The price of Zora has increased by 4% in the last 24 hours, which is a modest operated in the broad cryptocurrency market.

Despite today’s value lift, technical and on-chain readings indicate that the distributor phase remains strongly in the game, still dominating the market with the recession Senate.

Zora’s bullish steam faded

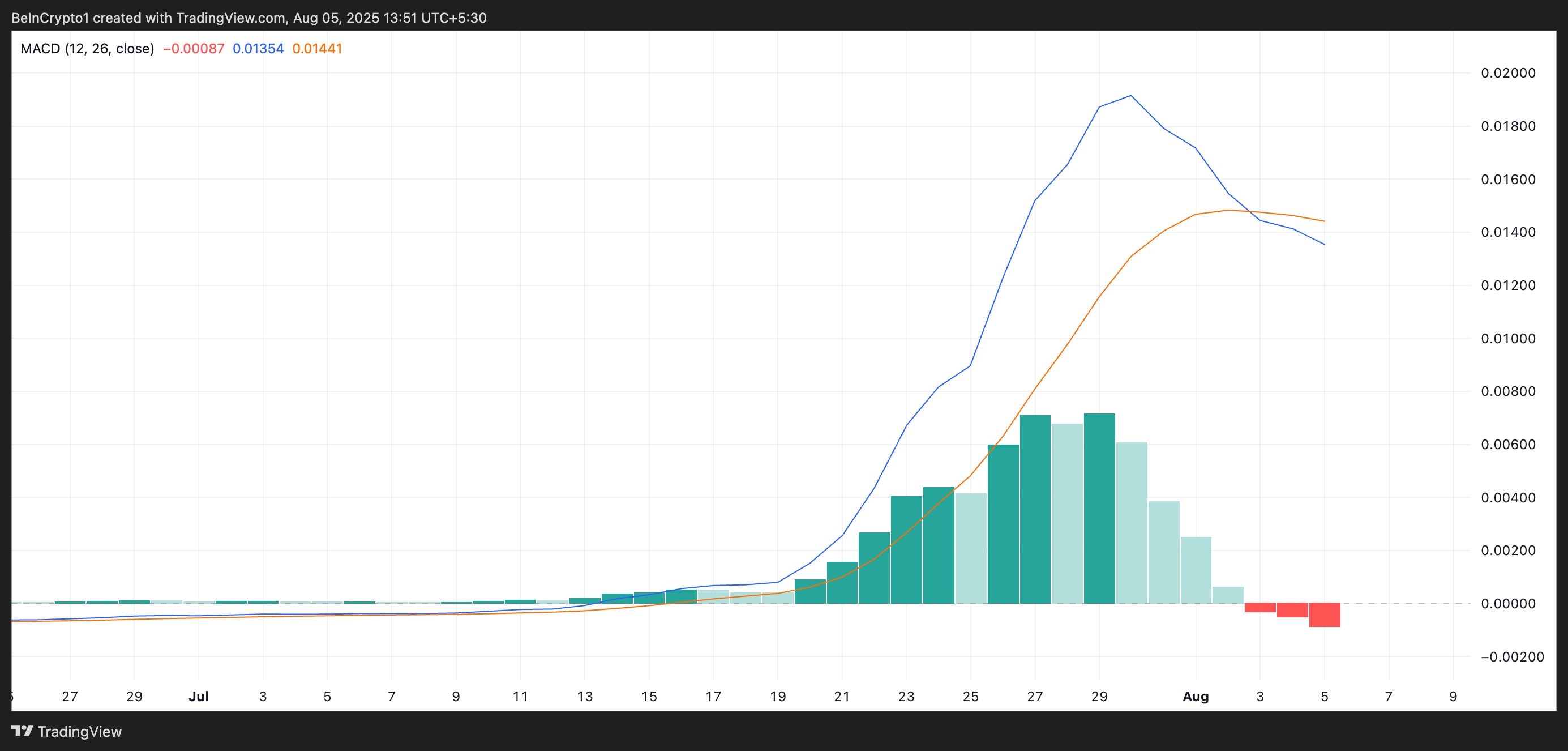

Reading from Zora/USD Day Daily Chart revealed the recent negative crossover in Zora’s Moving Convergence Division (MACD) indicator. This occurs when the MACD line (blue) breaks the signal line (orange), a sign of a classic recession that suggests the vanning speed.

Tokens for TA and Market updates: Want more tokens insight in this way? Sign up for the daily crypto newsletter of editor Harsh Notaria here.

Zora McD. Source: TardingView

Zora McD. Source: TardingViewThe MACD indicator of a property identifies trends and speeds in its value movement. It helps in selling potential purchases or selling signals through crossovers between MACD and signal lines.

When the MACD line is about the signal line, it indicates the speed of speed, suggests that the price of the property may continue to increase.

On the other hand, when the MACD line sots are below the signal line and fall towards the zero mark – as currently with Zora – it indicates rapidly museum and a photo shift recession control.

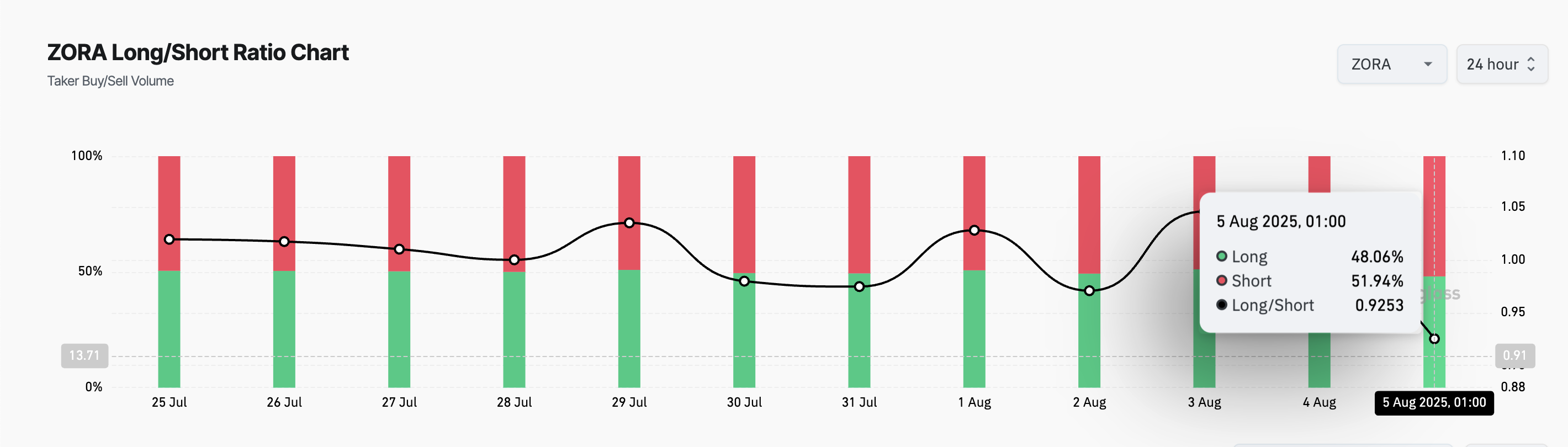

In addition, the Senini is no different between Zora’s futures. It is reflected by its long/short ratio, which sits at a 14-day low of 0.92.

Jora tall/short ratio. Source: Curring Class

Jora tall/short ratio. Source: Curring ClassLong/short metric measures the ratio of long stakes for shorter people in the futures market of an asset. The ratio above one indicates a longer position than the less on. This indicates a rapid feeling, as most traders expect an increase in the value of the property.

On the other hand, a long/short ratio below 1 means that more traders are betting at the cost of property to announce that it is expected to grow.

Therefore, the current long/shorter ratio of Zora suggests that most traders are growing rapidly for improvement rather than pushing at new heights.

Jora stall in resistance – traders braced for fast moves

At the time time, Jora trades at $ 0.06799, which relaxes just below the resistance formed on $ 0.06802. If the bear may witness a bridge towards the support floor on the support floor, if the bear falls on its control and shopping.

Zora value analysis. Source: TardingView

Zora value analysis. Source: TardingViewHowever, if accumulation violates GROCS and Zora $ 0.6802, this acquisition increases its profit to $ 0.08431.

The post flanks value increases, but the recession indicators indicate in a mesh for late buyers, first appeared on the beincrypto.