Two large atherium investors are seizing recent market reforms to extend their bets in property.

In the first fare days of August, the whale purse spent more than $ 400 million collectively on ETH ($ 3,470.92), indicating renewed confidence in the long -term value of the asset.

Chen activity increases as the atherium whale dip

One of the most notable transactions came from the wall tracked by Arakham Intelligence. Over a period of three days, Wallet acquired ETH worth about $ 300 million via Galaxy Digital’s over-the-counter trading desk.

The wallet currently has an unrealistic disadvantage of about 26 million dollars.

However, the sheer scale of the purchase and rapid speed speculative suggests a strategic, long -term accumulation rather than the short -term trade.

Another prominent player in this purchase race is Etharium-firm Sharplink.

To see, the company added 30,755 Eth in its balance sheet over a period of two days, spent $ 108.57 million, an aaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaa

Sharplink now holds 480,031 eth, its current stand is about $ 1.65 billion.

The acquisition came when Ethereum fell at a lower level of multi-weekly near $ 3,300. The account for data from Beincrypto, Eth is slightly recovered and is trading around $ 3,477 at the time of writing.

Industry experts said which activities are reflective of a broad, optimistic approach to the atherium.

In July, ETH moved beyond $ 3,900, operated by record institutional flows, mounting ETF exposure, and stabechoin-operated DEFI expansion.

Expert is arthritis that is not a small Rali, but a sign of the extended role of the atherium in global finance.

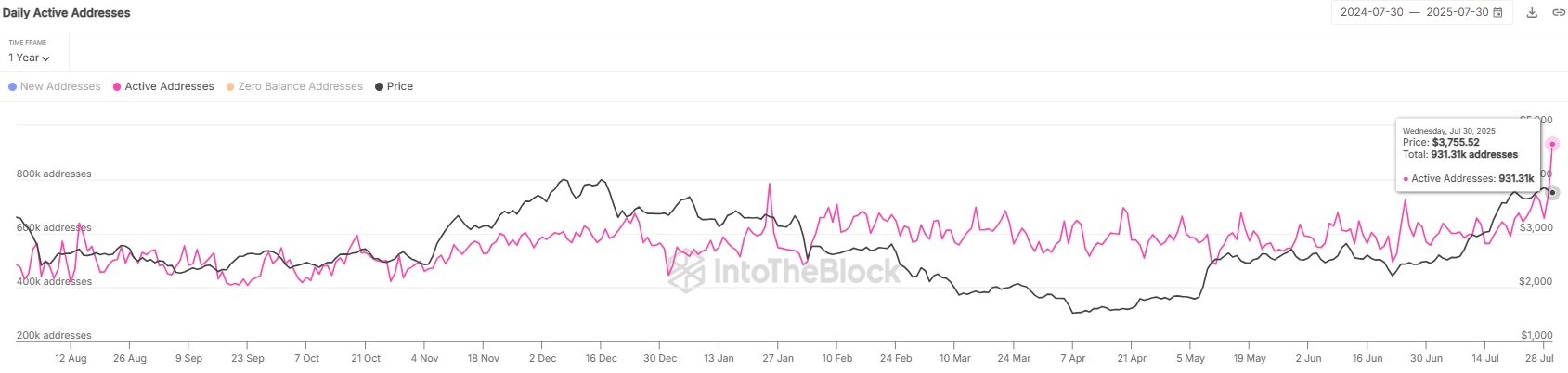

The increase in on-chant activity of the network supports this scene.

Sentora (East Intotheblock) recently stated that Ethereum registers 931,000 active addresses in a single day, its highest count in about two years. This upotic user grows in English and interesting in the entire network.

Ethereum active addresses. Source: Sentora (East intotheblock)

Ethereum active addresses. Source: Sentora (East intotheblock)Additionally, regulatory trends can further strengthen the attitude of the atherium as American officials are ready to lead the global finance in a blockchain-era.

Thomas Lee, a popular venture of Fundstrat Suggusted, said that if the favorite smart contract for the atherium wall street firms dominates as a contracting contract platform, its evaluation can increase considerably, the pottery can reach $ 60,000.

The post is quietly buying two major atherium dobbules) first on beincrypto.