Table of Contents

The price of XRP ($ 3.05) has come to a standstill, and the stagnation is looking suspicious. In the last seven days, the price has decreased by 4.7%, although it is about 400% year-over. Despite those massive annual benefits, XRP is trading in a tight band under a $ 3 mark. So why has Rali contract?

On-chain data may be answered. For exchanges, a sharp spike is classified in whale flows. And like January, the side that presses more can decide whether the wheat XRP price breaks or breaks.

It is back to exchanges, and it is a mantra of troubles

One of the most obvious signs of whale behavior is how much XRP is being sent to exchanges. On 7 August, the 30-day simple moving average (SMA) of the Whale-to-Access Flow rose to 9,298 according to the Cryptoctive. This is the second tallest spike this year, only behind January 18, when the same metric hit a peak and XRP hit $ 3.27 to $ 1.70 in the next four months.

Price of XRP and Exchange SMA (30): Cryptoctive

Price of XRP and Exchange SMA (30): CryptoctiveThe pattern looks familiar: the whale spike flows, and the price stall or reversal. It is unable to push the psychological barrier to $ 3. History suggests that inflow price rallies, when small buyers cannot keep.

The WHO-S-Relations Flow measures how many tokens are sending large holders (whales) to centralized exchanges. The increase in this metric usually indicates potential sales pressure. We use 30-days, which identify clear trends to reduce noise and over time.

Tokens for TA and Market updates: Want more tokens insight in this way? Sign up for the daily crypto newsletter of editor Harsh Notaria here.

Retail buyers keep accumulating, but can they exclude the selling wall?

Not everyone is a slowdown. While whales send XRP to exchanges, short-ram holders have invested their posts continuously in the last month. These wallets, which type from 1 week to 3 months, buy dips continuously.

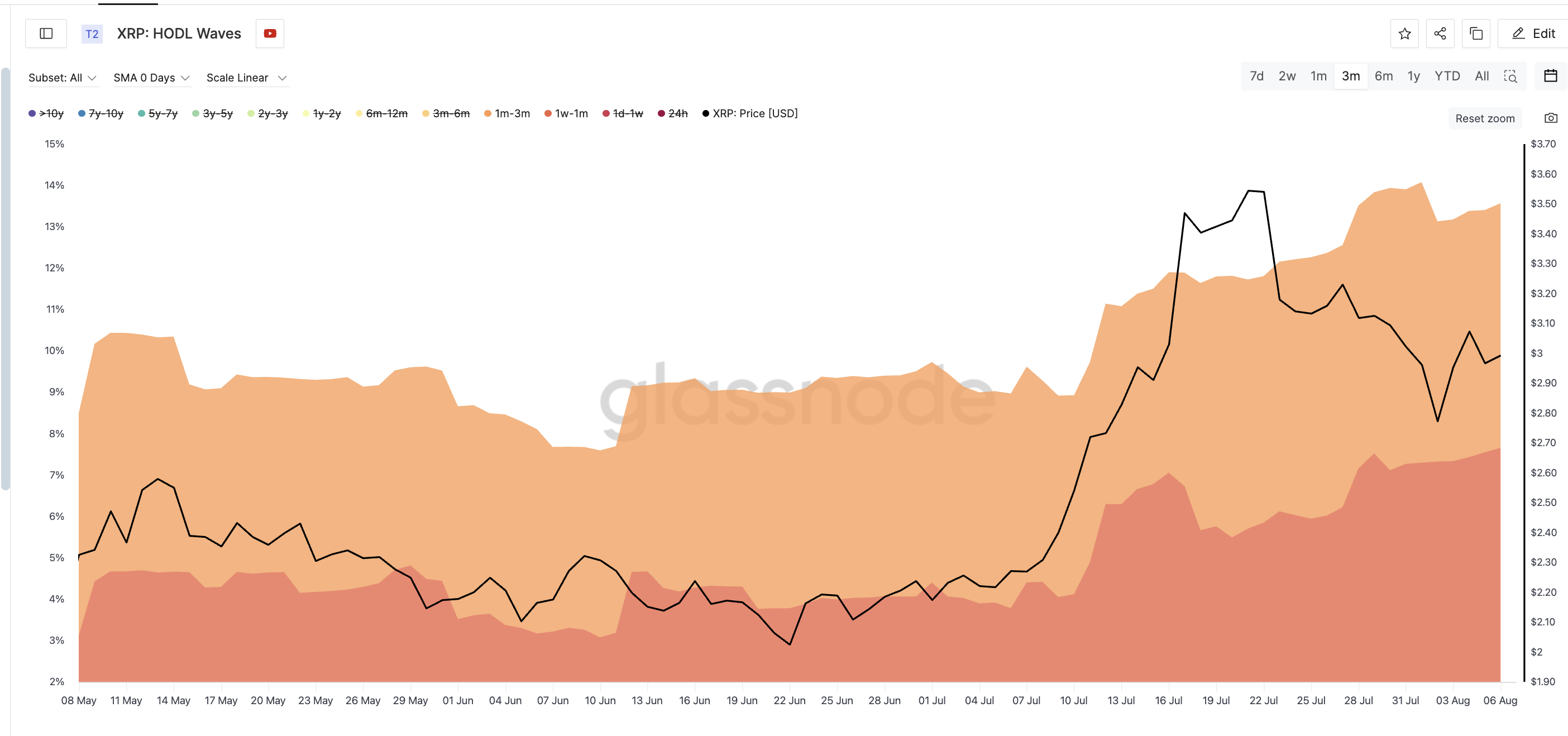

XRP Price and Hodl Waves: Cryptoctive

XRP Price and Hodl Waves: CryptoctiveOn July 10, when XRP was trading at $ 2.54:

- 1W – 1M holders held 4.117% of the supply

- 1m – 3m holders held 4.81%

By 6 August, those numbers climbed:

- 7.657% for 1W – 1m

- 5.912% for 1m – 3m

It is a meaningful utteric in accumulation, it reflects XRP’s similar behavior before $ 3.65 from July. If the retail keeps buying at this speed, this Arab makes a price floor and eventually stops sealing the whale.

Hodl waves suggest how long coins have been held in wallet, allowing us to explain whether short -term or long -term holders are taking market action. Here, we focused on 1W-1M and 1M-3m band to track recent accumulation.

The price of XRP stuck in a limit, but not for a long time

The price is testing the support at $ 2.94, with several shutdowns of several daily. This is the major close-term area to see. If XRP manages to keep above this level and purchase the Pressor Build, we can see a step towards $ 3.08 and possibly $ 3.29, where the next resistance is the lace.

XRP Price Analysis: Tradingview

XRP Price Analysis: TradingviewBut if the flow of whales increases and the market sees more sales pressure, then there is a possibility of a decline towards $ 2.72. It marks low fare trading honors at the bottom end and a possible breakdown zone.

For now, the XRP range-bound remains, but whale unloading and holding short-term buyers, it won in that manner for craving. The next Mot will prefer the disclosure that reality controls this market.

Post tug-off-win near $ 3: Can XRP buyers dominate the whale wall? First appeared on the beincrypto.