key takeaways

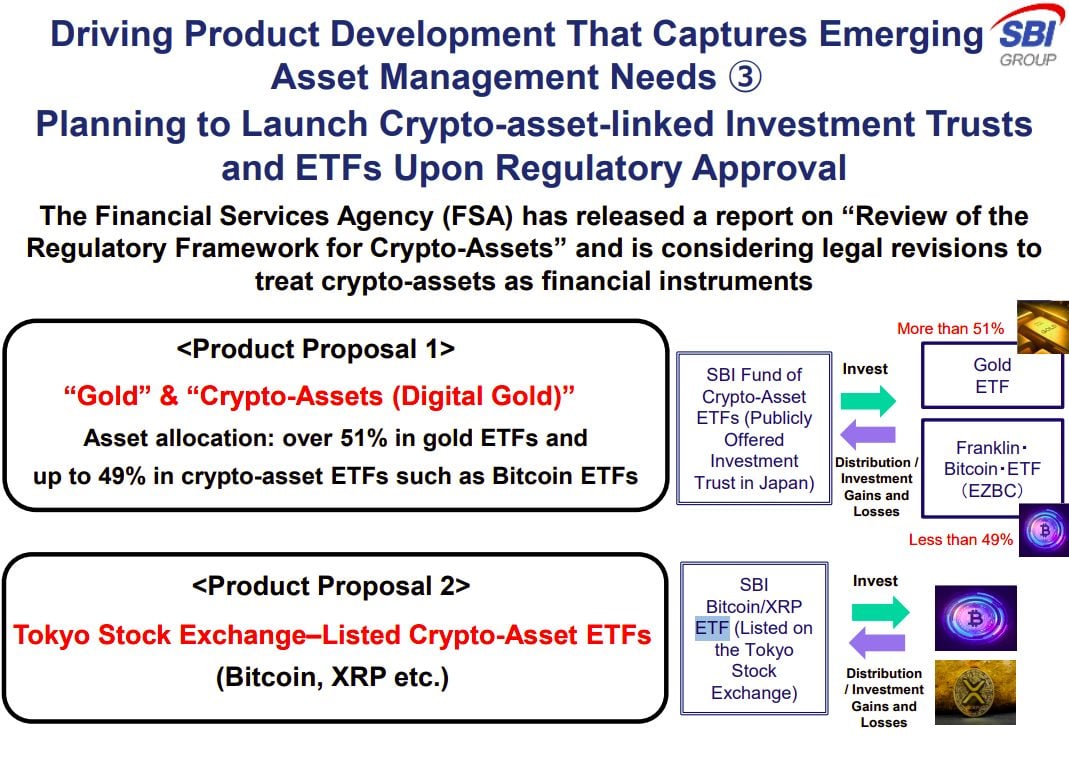

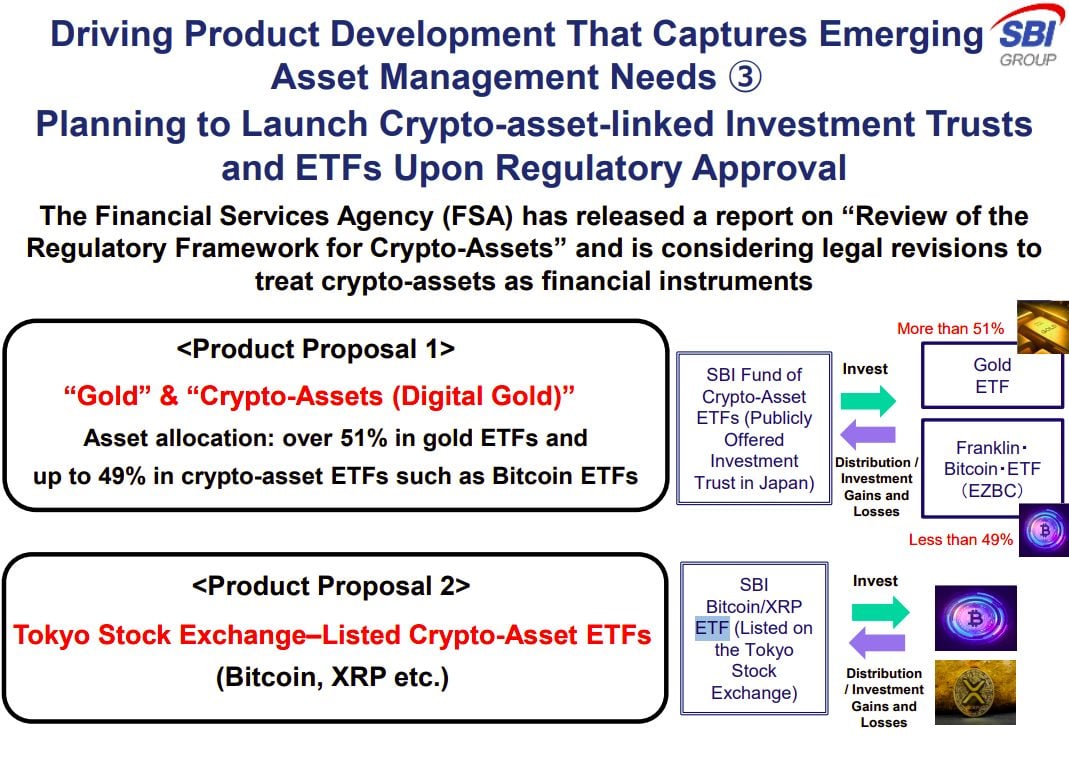

- SBI holdings experts focus on Japan’s first crypto ETF, focusing on XRP, bitcoin and a mixed ‘Digital Gold’ ETF.

- Crypto ETF will provide both XRP and Bitcoin to investors with strict directors through traditional financial instruments.

Share this article

Japan’s financial groups with active operations in SBI holdings, banking, securities, asset management, and Bitcoin and XRP Exchange-Free Fund (ETFS) plans to introduce Tokyo Stock Exchange are subject to upcoming regulatory changes.

In its latest Finnish result presentation, SBI has outlined two proposals designed to catch Gaurav for Digital Asset Management and currently availed potential legal revolutions under the review of Japan’s Financial Services Agency (FSA).

The first is a hybrid investment reliable combination Gold ETF, with Crypto-asset ETFs such as Franklin’s Bitcoin ETF (EZBC) to 49% Crypto.

The second is a crypto ETF that is proposed to list on the Tokyo Stock Exchange. SBI Bitcoin/XRP ETF is quoted as an example, indicating readiness to launch pending regulatory approval. These ETFs will trade like any listed security, targeting wide retail and institutional access.

Earlier this year, the FSA released a discussion letter on revising the Crypto regulator Fremywork, which proposes to revive the Crypto Associates as a financial instrument, if the inventor blasts innovation when the inventor conservation regulatory gap closes.

The proposal will benefit the path of gloto ETF’s globalization and regulation, which means that these products can be introduced in Japan under comparison of strict regulatory oversight for traditional securities.

The count of SBI’s move increases institutional adoption of XRP and other digital assets in Japan’s regulated investment market. Japan has maintained a relatively structured approach to crypto regulation compared to other major economies.

SBI Holdings has shown interest in crypto assets and blockchain technology through various business enterprises and parties.

In April 2024, Franklin Templeton and SBI Holdings entered a partnership in Japan to form a new crypto ETF management company. The parties have signed a memorandum to provide more access to investment vehicles including Crypto-Band ETFs to young investors.

Share this article