Table of Contents

The price of Solana is breaking. Despite increasing 12% in July, tokens have now improved at a rate of more than 7.5% in the last 24 hours, exiting those benefits.

The sharp drop has pulled Solana below a significant support level, which broke from a recession pattern that seemed on the daily chart. Traders are now surprised: was it just a temporary shakeout, or was there a sign that bears are tightening their grip?

Active addresses collapse as demand

The daily active addresses on Solan reached 4.1 million on July 21, followed by the price of Sol ($ 169.50) to the previous $ 200. This indicated that a strong network activity supported Rali.

But the speed faded quickly. Within two sessions, the active addresses fell to 23.7%, and the suit was followed in the price of Solana, which fell to $ 176. So far, the country sits about 3.2 million, marking a continuous decline.

Solana Price and Network Activity: Satrishti

Solana Price and Network Activity: SatrishtiThis matters because active addresses measure the demand for the actual network. Without increasing participation, they struggle to catch rallies. The activity in the form of the latest breakdown (later revealed in the post) under the ascending veg continued to fall, showing that Solan’s Bullish push lacked support for avoiding Lavel.

Shorts dominate the liquidation map, recession confirm bias

The derivative market shows that traders are making heavy recession. It discovers Alice with a dip in network activity, which weakens the inter -price structure.

The open short position is now $ 1.69 billion, while the Longs trail is only $ 244 million. Generally, a high short ratio may indicate a funding rate playing or setup for a squeeze. But for a long time for a long time, this funding is not a game of wars; The market is really slant.

Solana 7-day liquidation map: Coinglass

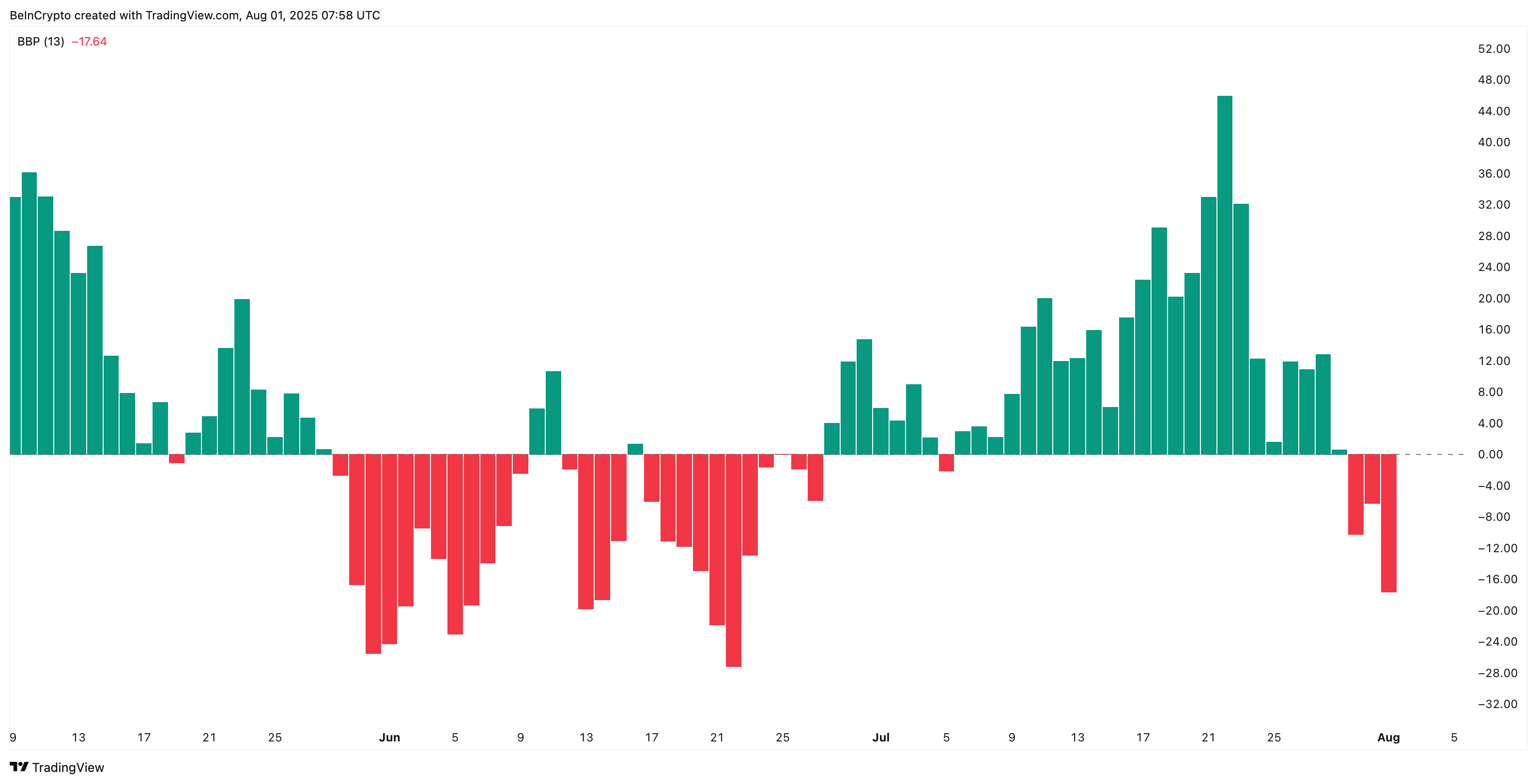

Solana 7-day liquidation map: CoinglassAt the same time, the Bull-Beare Power Index has been negative for three consecutive sessions, its longest red streak since June. This indicates that the sellers are strongly under control, sometimes reduce price action despite recovery efforts.

Solana Beer took control: Tradingview

Solana Beer took control: TradingviewIf, however, the solana bounces rapidly and gains speed of $ 175 – $ 180 (later described in the piece), then these heavy shorts for a small squeeze form coples copes bikum fuel, a bear mesh. For now, think, the press is clearly tilted downwards, and does not look like a mesh setup.

Tokens for TA and Market updates: Want more tokens insight in this way? Sign up for the daily crypto newsletter of editor Harsh Notaria here.

Solana Prices Action Focus puts $ 166

Technically, the price of Solana is broken from its ascending veg on this day, sputtering a pattern that supported July. The immediate support level to view is $ 166, which is aligned with $ 206 high to 0.5 fibonacci retracement zone. Losing this ISA can open a deep slide towards $ 156 or $ 143.

Solana Price Analysis: Trading Coves

Solana Price Analysis: Trading CovesTo invite this recession landscape, Solana needs three things in quick succession:

- User activity should indicate strong demand.

- The price must be rectified to $ 175 – $ 180, forcing the shorts to disappear.

- A daily pass inside the broken wedge restores the faster the structure.

Only if all these situations align this setup morph into a classic bear mesh, then the flipping statement in favor of the bulls. Till then, the price of Solana is heavy, with further risk of more damage.

The post solana value breaks, loses the major level – can it be a “bear” mesh? First appeared on the beincrypto.