Table of Contents

Mestro, a major bitcoin finance (Bitcoinfi) infrastructure provider, has been published a “State of Bitcoinfi” report, which brings further analysis on its financial applications, infrastructure and ongoing devils, which are running from a store of value to empower the business finance of (trades).

Maestro estimates that the volume increases as the enterprises continue to stack the BTC ($ 117,839.00) in their terris and the yield and more Idele coins are activated for the use of users.

Marwin Burtin, cum and founder and CEO CEO Marwin Burtin said, “We are looking at the convergence of tradefi and DEFI in a bitcoin – dedominated capital market.” “Financial apps on bitcoin are in place, exchanges from bitcoins, borrowings, and stabecoin are a stable reserve, a dynamic,

Stacking and lending

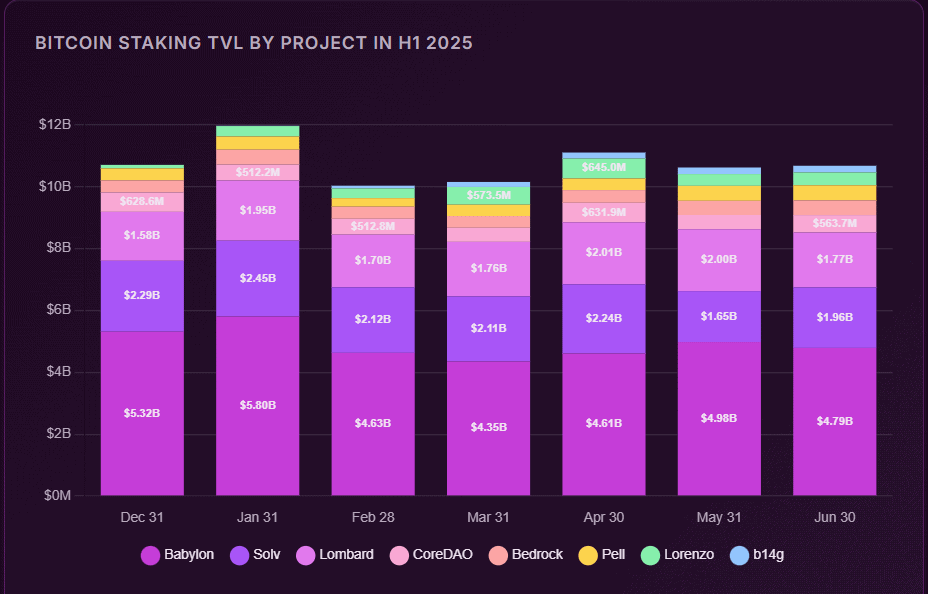

With more than 68,500 bitcoins in TVL ($ 7.39 billion), stking has become the most widely used application in Bitcoinfi. Re-staging is also increasing continuously, $ 3.32 BTC has been re-stake, meaning that the niche is now more than $ 10 billion through the produce-bearing protocol.

Babylon currently goes into the scale ($ 4.79B), but the frontier of Solv, Lombard, and Koradao liquid staging is carried forward for tokens (LST), resting strategies and dual-token safety models. Bitcoin-element lending is being spent by the liquidium with more than $ 500m in the volume.

Source: Mestro

Source: MestroAnother form of staking traction is dual stacking, which is intraged by Korado, with more than $ 615M BTC stacked. Inception includes their original core ($ 0.53) tokens and transactions fees block rewards, distributed to stackers and verifications.

There are some challenges, as many staging returns do not align with treasury rates, yield and living scattered agency with separate chains and protocols. It should be observed that BTC-safe network’s doubleity may continue to provide sustainable prizes.

Program layers

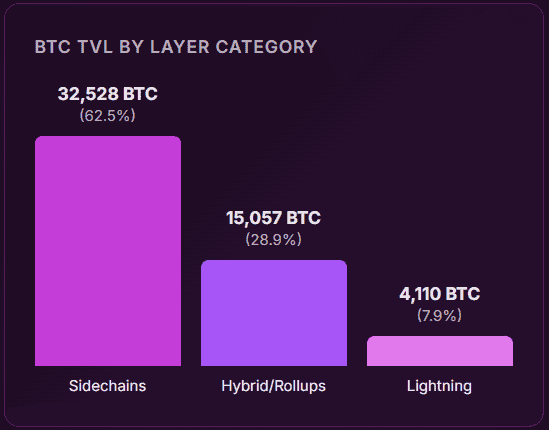

The total value lock (TVL) in bitcoin scaling and layer 2 (L2) layers has $ 5.52 billion (52,000 coove), which is motivated by the developer and user’s demand to permission for indigenous smart contacts, yield and asset, while taking into account the self-cosmetics, and the disposal is guaranteed.

The stack layer is a pioneer in development, more than doubled its TVL for Q2 and adding about 2000 BTC. Sidechans still hold most of the property in Bitcoinfi, but the architecture is dividing, looks promising with rollups and execution lovers.

Source: Mestro

Source: MestroThe heritage barrier of bitcoin is gradually peeling, as the base layer was for programability to Navar. While the Defi TVL in Ethereum is more than $ 116 billion, BTC-aligned infrastructure scaling layers are lagging behind in TVL in more than $ 5.5b. However, new cidchain, rollups, and various environments emerge, carry forward the biggest assets of the market cap per market cap, beyond their passive store-value role.

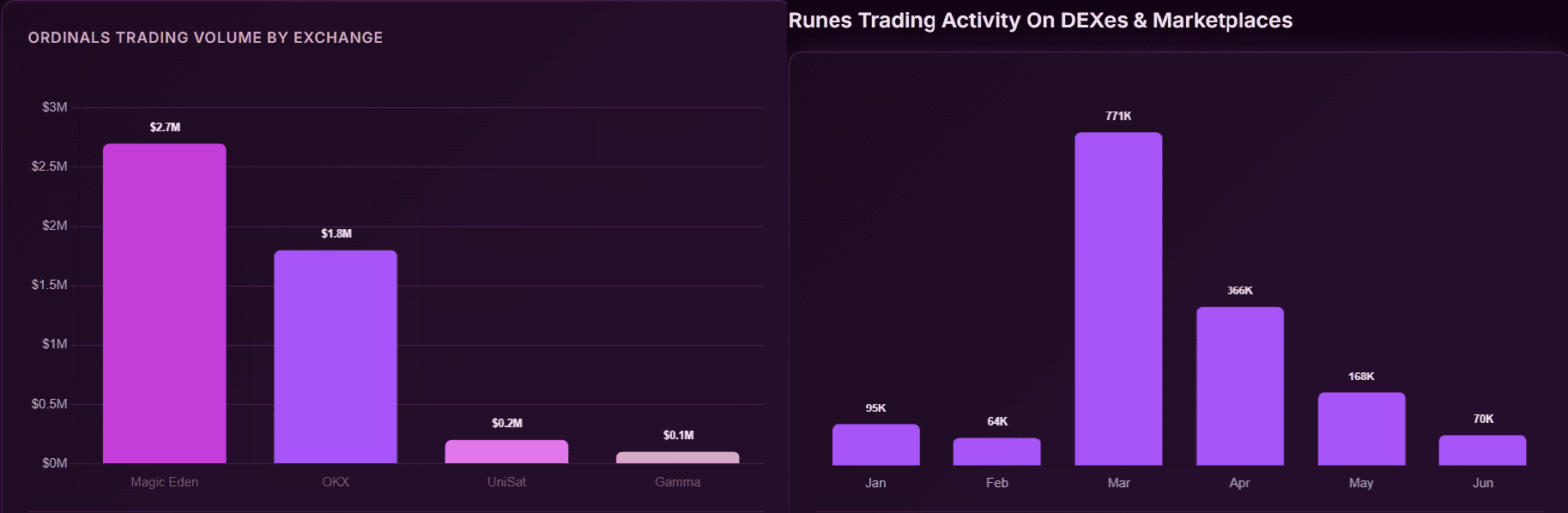

Metaprotocol

Runs, ordinal, and BRC-20 tokens were responsible for 40.6% of all bitcoin transactions in the first half of 2025, the BRC-20 volume reached $ 128 million.

After a pullback last year, Ordinals experienced a strong recovery, with 80 million inscriptions until mid -2010, 6,940 BTC (~ 681m) fees. Minding and trading volumes are rebounding at the end of 2024.

Source: Mestro

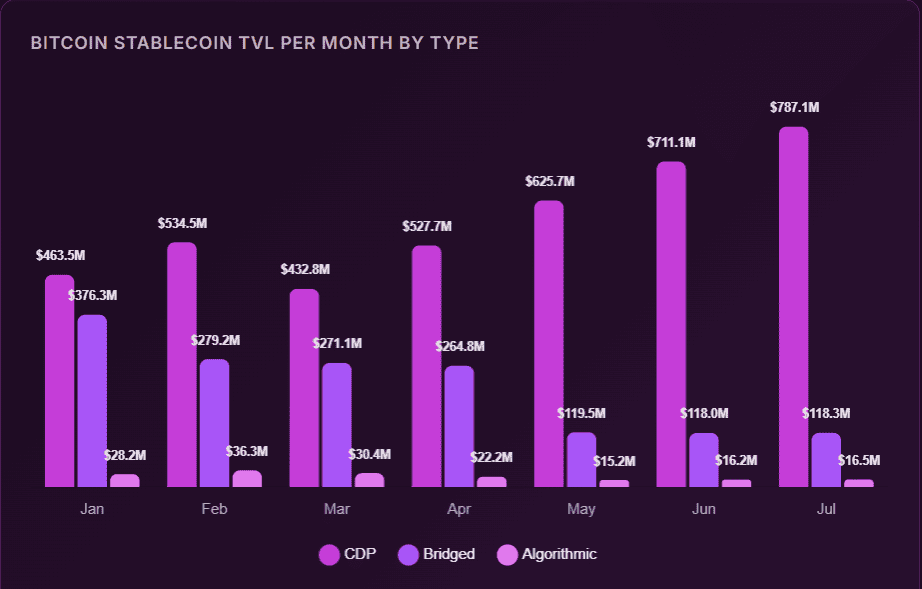

Source: MestroStabelcoins

In TVL, with $ 860 million (more than 42% quarter-fourth-fourth), this asset class has come to comprehensive with bitcoin ecosyim, thanks to the L2S maturing and the increasing demand for indigenous primation.

CDP-based (collateral debt status) Stabelines, such as the USDA ($ 559m) of Avlon, have seen early traction in Bitcoinfi. The high-produce stabechoids, such as a 25% APE offer of the hermetica, indicates the demand for capital-generating assets.

Source: Mestro

Source: MestroSome Hurd Ramain, with fragmented liquidity (inability to eliminate a transaction with one or more participants due to lack of clear arrangement) being one of them, because it limits the depth of the market in chains and L2S.

Oracle designs remain an issue for CDP (collateral debt positions), and composite tradeoffs show stiffness between performance and decentralization.

Enterprise funding

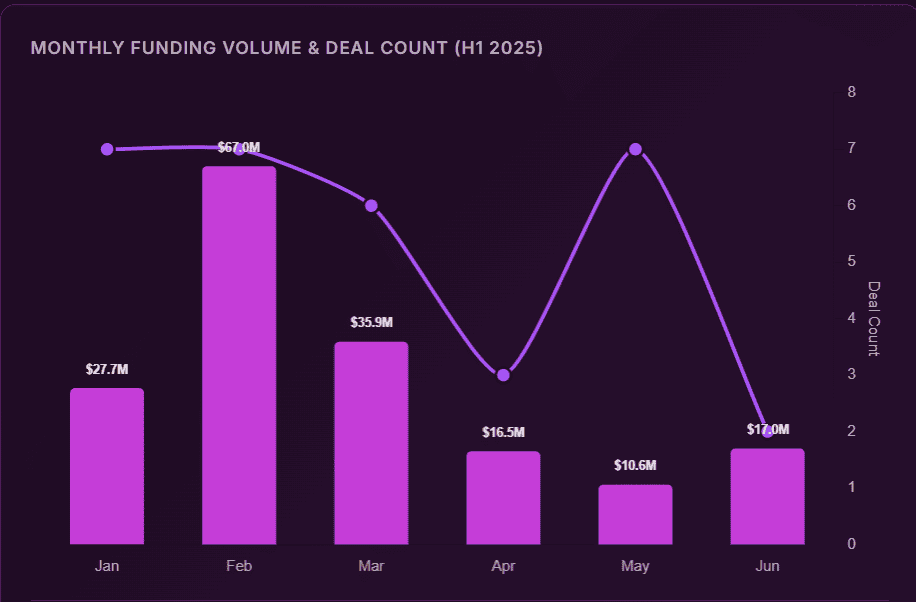

Following the period of decline in interest, Bitcoinfi Funding has reached $ 175 million in the same half of the year in 32 rounds, 20 out of 32 deals were targeted in Defy, Apps, and custody.

Capital is being projected and transferred to products, which now has a infrastructure on the back seat.

Source: Mestro

Source: MestroThe beginning of the year -Holongs to accept the niche as a popular border in the Cryptocurrency universe, among others, among others. These remarkable deals indicate a powerful halvanship of the infrastructure department and application-layer traction, with investors interest from both traditional and crypto-root parts.

In The Post the State of Bitcoinfi Q2 2025: Research first appeared on Cryptopotato.