Parataxis holdings are merging with the Silverbox Corp IV in a particular objective acquisition with a Nyse-Edcoin Treasury Company manufactured $ 640 million.

Summary

- Parataxis and Silverbox Corp are maging to create a bitcoin treasury targeting markets of IV US and South Korea.

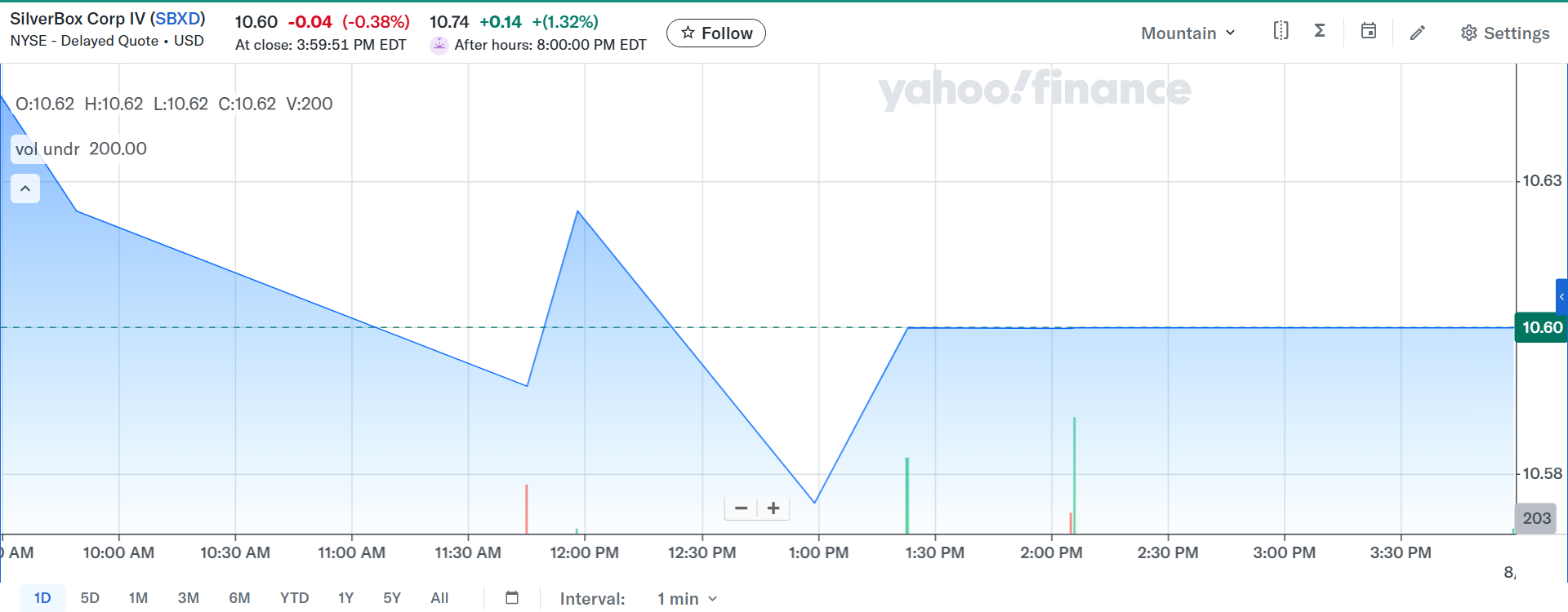

- The news of the merger increased the stock of Silverbox by 1.32% in the previous day.

In a rent press release, the two companies announced that the deal could provide “$ 640 million gross processes” to fund a bitcoin (BTC) Treasury strategy listed on the New York Stock Exchange “. The deal worthy $ 31 million of equity as much as it will be used for immediate purification bitcoin.

The firm also stated that the merger would include a share objective agreement that would allow to release up to $ 400 million in the equity line of credit.

The news of the merger managed to increase the price of Silverbox Corp’s stock, leading to increased market sales by 1.32%. For Yahoo Finance, the share price for SBXD now now sits at $ 10.74 on 7 August. How the stock was achieved in the previous month, since the early gathering of last month.

The SPAC agreement will enable parataxis to publicly list the Silverbox Corp IV to publicly list the NYSE under the ticker symbol PRTX, which agrees to the US market.

In turn, it also allows Silverbox to reach the South Korean market as the digital investment firm has just received a new name and focused on its operation on setting up the BTC reserve in Korea.

Parataxis plans to create a bitcoin treasury in South Korea

For a press release, the merger of both companies will result in BTC Treasury Company which will especially target the US and South Korean markets. Back in June 2025, Parataxis bought South Korean biotechnology company Bridge Bioteraputics Inc., converted it to Parataxis Korea with the objective of making the first bitcoin treasury platform count.

So far, many South Korean companies are not interested in following metapland and strategy blueprints. However, the current President is trading digital assets in the region due to recurrence of Li J-Mung. After Lee won the presidential election, he allowed the spot bitcoin ETF to legalize this year.

Has any loan been taken in the deal?

The Cast for Form 10-K filing in the Securities Exchange Commission Date 2024, Silverbox Corp IV does not have any dues on SPAC.

However, by June 2024, the company reported $ 109,000 in the obligations of current loan and capital lease, not all responsible for the unpaid sponsor promise. It was later confirmed that the loan was repaid until the first quarter of 2025, as there was no current debut or capital lease responsibility on the company’s blons sheet.

For parataxis, there is no indication that the company has any long -term rimm loan, bank loan, or public bond responsibility listed in press release or summary. The only sign of loan is the equity line of history in a press release of $ 400 million.

Thought, it is worth noting that an Eloc is not a traditional loan. It acts as a credit feature, which gives parataxis flexibility to find operations and to extend BTC holdings.