Table of Contents

Week Ahaad is a macro meinfield; We can occur on the projection of a crypto crisis. Between the Fed’s July meeting, earnings from technical giants, inflation prints and labor numbers, investors face piles to intimidate market signals.

Add business tension with the European Union, and Q3 can give a faster blow in any direction. What you should know here:

Everyone’s eye in Fed’s July meeting

“We are here to save the bull run.”

Do you think that those people are thinking this? Even if, do not make fireworks from the fed this week.

The consensus on polymercate indicates steam between 4.25% and 4.5% to the mice. Trump keeps insisting on cuts, but Powells stick to their guns and wait for more data. With 62% market-linening opportunity of September cut, it should be mandatory to look at Wednesday’s press conference and GDP release.

LMAO! A reporter asked Trump in the Federal Reserve: "As a real estate devil, what will you do with the project manager with over budget?"

Trump: "I will set him on fire!"

Powell super looks uncomfortable

pic.twitter.com/rowxkatq2e

– Nick Sorter (@nickSortor) July 24, 2025

On Thursday, the release of the Personal Consumption Expenditure (PCE) index will indicate what the Fed does further. PCE will provide clarity that tariff-related presses are crawling further in the economy.

Economists expect an increase of 0.3% month and month and 2.5% annual inflation. The core is estimated to increase 0.3% monthly and 2.7% annually, except for PCE, food and energy.

Discover: 9+ Best High-Risk, High-Bharads Crypto to buy in 2025

Business optimism grows before August 1 deadline

Meanwhile, July drops the report of Nonform payroll, which reads the most direct reading on the flexibility of the labor market amidst the trade unspecified. The consensus estimates that the project 102,000 new jobs and a unemployment rate lasts up to 4.2%.

“Initial unemployed claims have fallen for six strong weeks … but continuous claims suggest that it is taking people to receive again.” – Dow Jones Economist Briefing

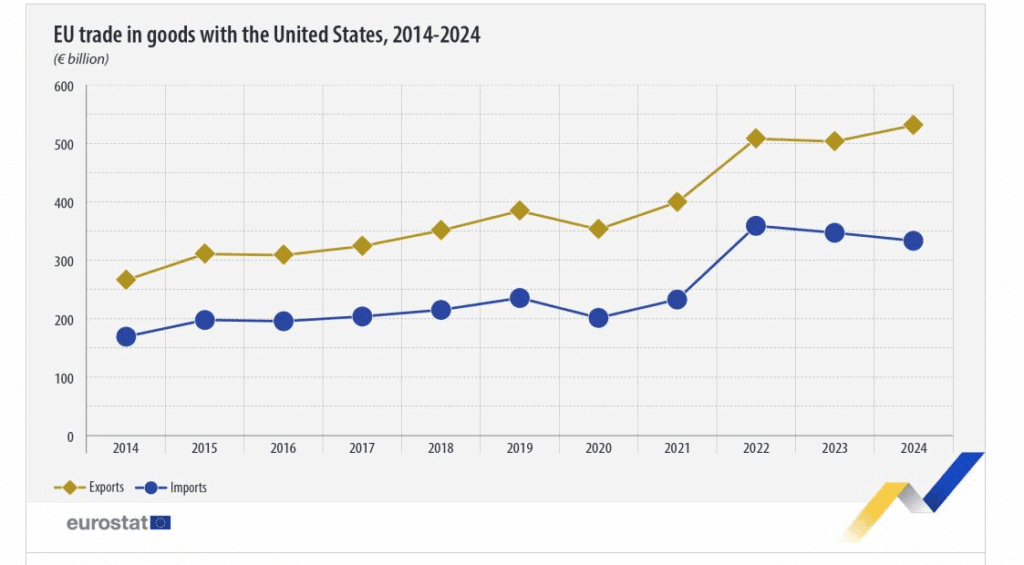

The market is optimisticly optimistic in this week’s US-EU trade deadline. With recent agreements with partial progress with Japan, Vietnam, Indonesia and China, the risk of major new tariffs has decreased.

The Trump administration is also preparing for new trade with Chinese authorities in Sweden, which further promotes the couple.

Apart from this, about 40% of S&P 500 is reporting this week’s earnings:

- Meta Platform (Mercury): Analysts expect EPS of $ 43.84 billion and $ 5.91 in revenue. Meditation is at AI expense.

- Microsoft (Wed): Forecasts call for EPS of $ 73.81 billion and $ 3.37 in revenue. AI will be the Azure Growth and Commentary Top Line app on services and infrastructure investment.

- Apple (thu): Analysts project $ 40 billion in iPhone sales as consumers run to defeat potential tariff effects. Expectations are silent for the second year.

- Starbucks (Tue): How is any of us considered to work without Starbucks? (Estimated revenue of $ 9.31 billion)

If Fed signals indicate perfection and trade clarity by 1 August, then like the risk property BTC ▲ 0.72% Can increase more.

For now, traders are entering the week’s possession with careful optimism. this it; Here it was

Explore: Tether CEO Paolo Ardoino expects for net positive from US election, says

Join 99bitCoins News Discord here for latest market updates

key takeaways

-

Week Ahaad is a macro meinfield; We can occur on the projection of a crypto crisis.

-

All eyes are on Powell this week as inflation is softened by the penis and labor matrix.

Post Marx Brace for Crypto Crisis: Fed, Earning and Trading Dialogue Tech Center for the first time on Bitcoin.