Table of Contents

Metaplanet, a Tokyo-based publicly trading company (TSE: 3350), has greatly expanded its bitcin (BTC ($ 114,886.00) by purchasing an aduration 463 BTC for about 55 million dollars.

This strategic investment was exclusive at the announcement price of around $ 119,500 per BTC. This underlines the firm’s comment to strengthen the shareholder value through sufficient cryptocurrency accumulation.

Treasure with bitcoin

After this recent acquisition, Metaplanet now holds 17,595 BTC at an announcement price of approximately $ 102,800 per coin. The company’s total investment in bitcoins is around $ 1.8 billion, which is the status of Metaplanet among Japan’s largest and world’s seventh largest corporate bitcoin holders.

Metaplanet dashboard

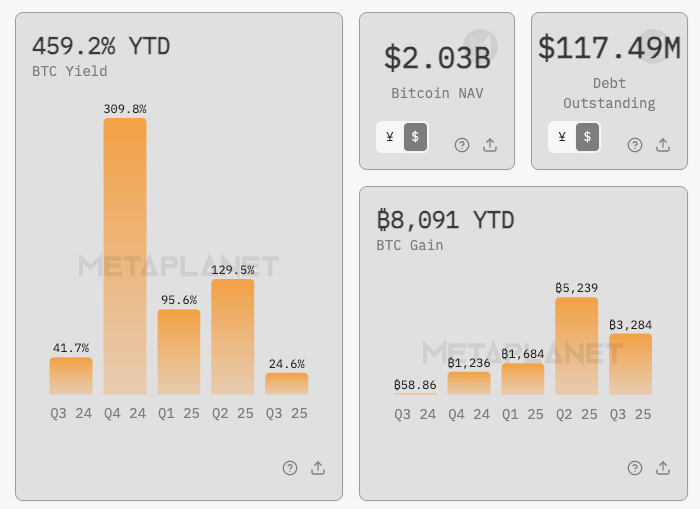

Metaplanet dashboardMetaplanet uses bitcoin yield (BTC yield) as a major performance indicator (KPI) to create the success of its treasury strategy. The BTC yield measures a percentage change in bitcoin holdings relative to the outstanding shares perfectly on the specific reporting period. Between July 1 and August 4, 2025, Metaplanet reports a BTC yield of 24.6%, which reflects aggressive accumulation.

The firm also tracks BTC Gain and BTC dollar gains metrics. The BTC gains determines the complete growth of the company’s bitcoin holdings, exclusive effects from issuing new shares. The BTC dollar profit represents the market value of BTC profit which is translated into US dollars. This provides investors a clear insight into Metaplanet’s Treasury Management Performance.

For Q2 2025 (1 April to 30 June), Metaplanet reported a BTC yield of 129.4%, which stored BTC profit of 5,237 BTC, translated to about $ 604 million. These figures highlight Metaplanet’s strong finance strategy in leverage cryptocurrency investment to increase their corporate trichor.

Navigating inflation and currency risk

Metaplanet’s aggressive bitcoin acquisitions aligned with growing concerns over inflation and individual yen depreciation. For the industry, the company’s cryptocurrency strategy serves as a Protective Heids Monetary Inflation.

“Japanese companies are facing individual depreciation, making bitcoin an atrible hard asset hedge,” BTC provides better long-term risk-dominated returns, especially in markets where real yield is negative. ,

Metaplanet’s bitcoin-centered treasury management comes amidst an increase in global inflation, not in major economies such as the United States and Japan. With the Yen’s constant depreciation experience, the Japanese corporations see rapid bitcoins as a viable long -term safard against low power power.

The company’s comprehensive BTC holdings contribute significantly to its corporate price. They oversee traditional undertakings such as hotels and media. These heritage businesses are currently only a limited revenue basis.

Although the hotel section remains stable, its profit is modest relative to the scale of contact cryptocurrency investment. Duuring Q1 2025, Metaplanet reported a revenue of about $ 6 million, 943.9% year-to-nine investment, which is mainly responsible for the sale of bitcoin and benefits from related activities.

Metaplanet has a demonstration of volatility in shares that actually actually expedite the flattens of bitcoin. This indicates the amplified exposure and sensitivity to the crypto market change. Volatility is associated with debt financing, issuing new shares, and future holdings expected by market premium.

Bitcoin-focused strategy re-define corporate value

The firm suggests that this KPI functioning accurately reflects treasury performance, eliminating the implications of equity weakening. The management emphasizes that BTC yields, BTC gains, and BTC dollar benefits are valuable treasury performance metrics. These indicators help to assess effectiveness independently of traditional revenue or profitability benchmarks.

Metaplanet’s released bitcoin accumulation reflects confidence in the long-TRM capacity of BTC. The company sees it as a tool for attractive returns between strong inflation conservation and global unaccounted. Investors closely monitor $ 101,000 per BTC price level, which also marks the threshold of Metaplanet. This level is seen as a financial “Danger Zone”, where possible damage may occur.

The Post Japan’s Bitcoin Mohra: Metaplanet adds 463 BTC, holdings now appeared on the total $ 1.8 billion before beincto.