Tedhar released his verification report for Q2 2025, showing a dramatic decrease in the purchase of American Treasury Bond. The firm spent $ 7 billion in the previous quarter as compared to $ 65 billion in Q1.

Although the company is buying bitcoins and gold and making corporate investments, all its “cash counterparts”, such as Bond Recluishing Agreement and non-UCS Treasury, have barely fallen roses or lump sum. This can complicate the compilation of the talented Act.

Why does Tithi not want us?

Tether, the world’s largest Stabelcoin issuer, has recently been investing something very diverse. For a response report, interest from the firm’s American Treasury Bond allowed it to invest in more than 120 companies.

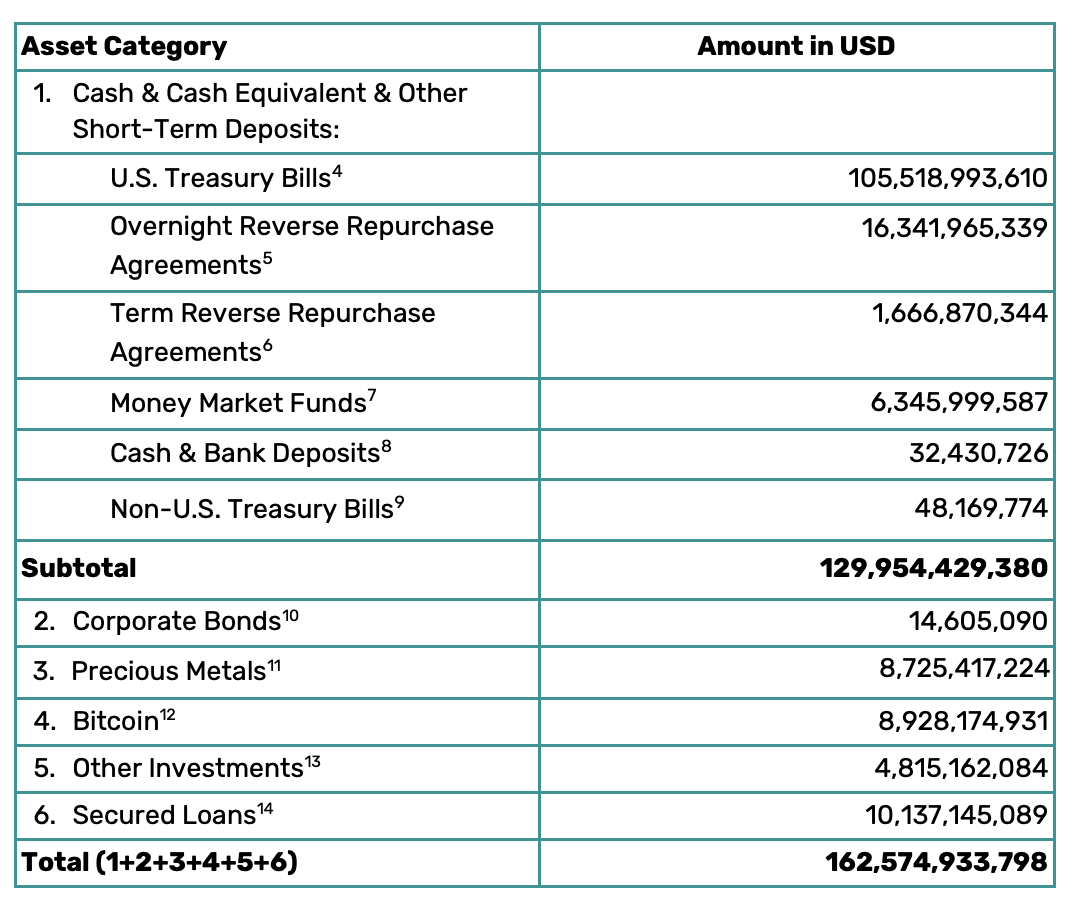

Today, Tedhar released its Q2 2025 Attation Report, which confirms a slight increase in Treasury Holdings.

For the report, Tether is currently $ 105.5 billion in the US Treasury and one and $ 24.4 billion in indirect exposure. This includes Oweni reverse report agreement and reports of non-US trees, which can refer to the Bonds of the European Union for Mike.

There is a simple reason so Tether is buying so many treasury bonds: StableCoin rules. The Genius Act said that the Stabelcoin issue has an asset reserve in the treasury, which can cause problems for the firm.

Nevertheless, Tithitar worked hard to pass this law, so it is likely

However, here is an interesting piece of data. Since the asbestos first made effective, Tedhar bought the astronomical amount of Treasury Bonds.

In Q4 2024, it bought $ 33 billion, and Q1 2025 added $ 65 billion.

Today’s report shows an investment of less than $ 7 billion in Treasury Holdings through all of Hawl, Q2.

Stores of tithi by property. Source: Tether

Stores of tithi by property. Source: TetherTather’s non-American Treasury Holdings decreased by about $ 17 billion, and all other “cash counterparts”

Certainly, the firm is buying Gold, Bitcoin and these Discipper corporate investments, but its huge appetite for the treasury has been discontinued. Tather’s holdings are growing, but its strategy is changing.

It is not clear what to make all this. For the post of CEO Paolo Erdoino, Tithther has released more than $ 50 billion USDT ($ 1.00) tokens compared to the same American Treasury. Can there not be problems for the Future Talent Act compliance?

Ultimately, it is difficult to say that potential bond market issues caused this change in strategy. This cancer, when.

Post Teether drips your American market ambition for USDT? First appeared on the beincrypto.

(@Paoloardoino) July 31, 2025

(@Paoloardoino) July 31, 2025