The UK-Listed The Hoosier Web Company increased the capital of £ 8.1 million soon after BTC crossed over 2,050. Can BTC accumulation increase stock prices?

Summary

- Stock of UK-Listed the Smarter Web Company has increased by 208% in the last month after BTC acquisition.

- The company has recently planned 225 BTC, which increases its total holdings to 2,050 BTC. Echo a wide tendency of companies updating their BTC holdings in an attempt to promote stock prices.

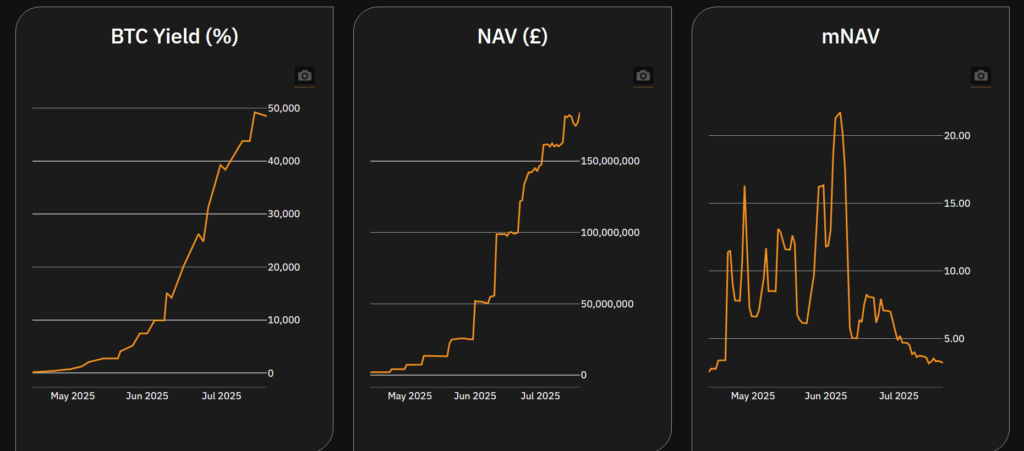

- As of August 4, the company holds a total of 2,050 BTCs in its reserves, meaning that the shared price is trading at £ 230.75. Account for the company’s official website, the Smarter Web Company has a market net asset value of 3.22 below the high level of about 20 in June.

For a recent press release, a total offering of £ 8.1 million ($ 10.75 million) for the company Woldage Capital. The funding round for the smart web company offered shares worth £ 2.05 per stock. A new issue for trading is expected to be available on August 7, 2025.

Data of Google finance shows that the stock is growing up to 208.094% in the last months as it has to bought more BTC (BTC) and compete with its crypto reserves. In early July, its holding was 543.52 BTC and reached 2,050 BTC by the end of the month. It translated four times BTC Holdings into 200% shares jump on the stock market.

The same thing happened in June when the SWC stock reached its peak price at £ 500. June was the month when the company managed to reach 500 BTC for SINNEX for the first time, it has been set in April 2025 to set its BTC Treasury Stock Pilling Strategy.

Effect of BTC Stock Pilling on Stock Price

On 28 April 2025, the Hoshiyar Web Company unveiled its “10 Aneyyar Plan” and bitcoin treasury strategy. The company first organized BTC internal. However, it first marked that the firm announced its commitment to stock BTC and announce its purchase to the public.

Unknowingly, a BTC company change was not immediately recognized as a positive indication among investors in the market. On 28 April, its share was still stuck at a lower level from £ 3.125, its market cap was still £ 5.1 million. At that time, the first BTC procurement made by the company is still at 2.3 BTC in the store.

It was not that in early June, the market cap of the smart web company multiplied from just £ 5 million to £ 150 million in just two months. In fact, its share price increased; Its previous at least £ 500 high rates that have barely reached £ 0.05. This marked more than 1,000% jump for its stock price two months after the declaration of BTC strategy.

As of August 4, the company holds a total of 2,050 BTCs in its reserves, meaning that the shared price is trading at £ 230.75. Account, Smarter Web Company’s market for the company’s official website is 3.22. This means that investors are paying £ 3.22 in stock value for each £ 1 of the treasury value held in bitcoins and cash.

Michael Sirer’s strategy, the company that has quoted many people as an inspiration of dozens of BTC-centric companies, has a 1.65 MNAV, meaning that the share price is trading at 1.65 ratio compared to its bitcoin reserve.

How does DOS Smarter Web Company compare with other BTC-centered companies?

The smart web company is not a separate case. In the last few days, many companies have announced the formation of BTC Treasury Strategy. This is usually followed by the issue of recent announcements about BTC procurement and its total updates on almost daily-to-weekly basis.

On June 30, battling with the Spanish coffee series, Vanadi Coffee saw a 242% increase in its stock after approval of his new strategy to get more BTC on his blunt sheet. Today, its stock got its price a little boost, after its recent announcement of 7 BTC purchases, which increased its holdings to 85 BTC.

In comparison to the choice of microstrate that crossed the 628,791 BTC, the news of 7 BTC Porius was sufficient to be free from 0.73, holding a small BTC trove.

On the other hand, the same thing has come to Valeram; Another publicly listed UK company that has estimated the bitcoin treasury on 1 August compared to the previous trading day. At that time, its stock is currently trading at 0.033 euros.

Today, the price of its share is reminiscent of 0.03 euros. However, this can change because the company has not included any BTC purchasing activity.

For data from bitcoin Treasury, there are 287 institutions with bitcoins, including institutes and state governments. In the last 30 days, this number has increased by 22 institutions, which reflects the continuous growth of firms that hurd the BTC into their burn sheet.