The price of bitcoin has increased continuously, climbing about 4% in the last seven days. This trend reflects the improvement and increasing optimism of the market in the market.

As the speed is formed, the key on-chain indicators indicate the possibility of a continuous Rali in the upcoming trading sessions.

Bitcoin miners hold tight

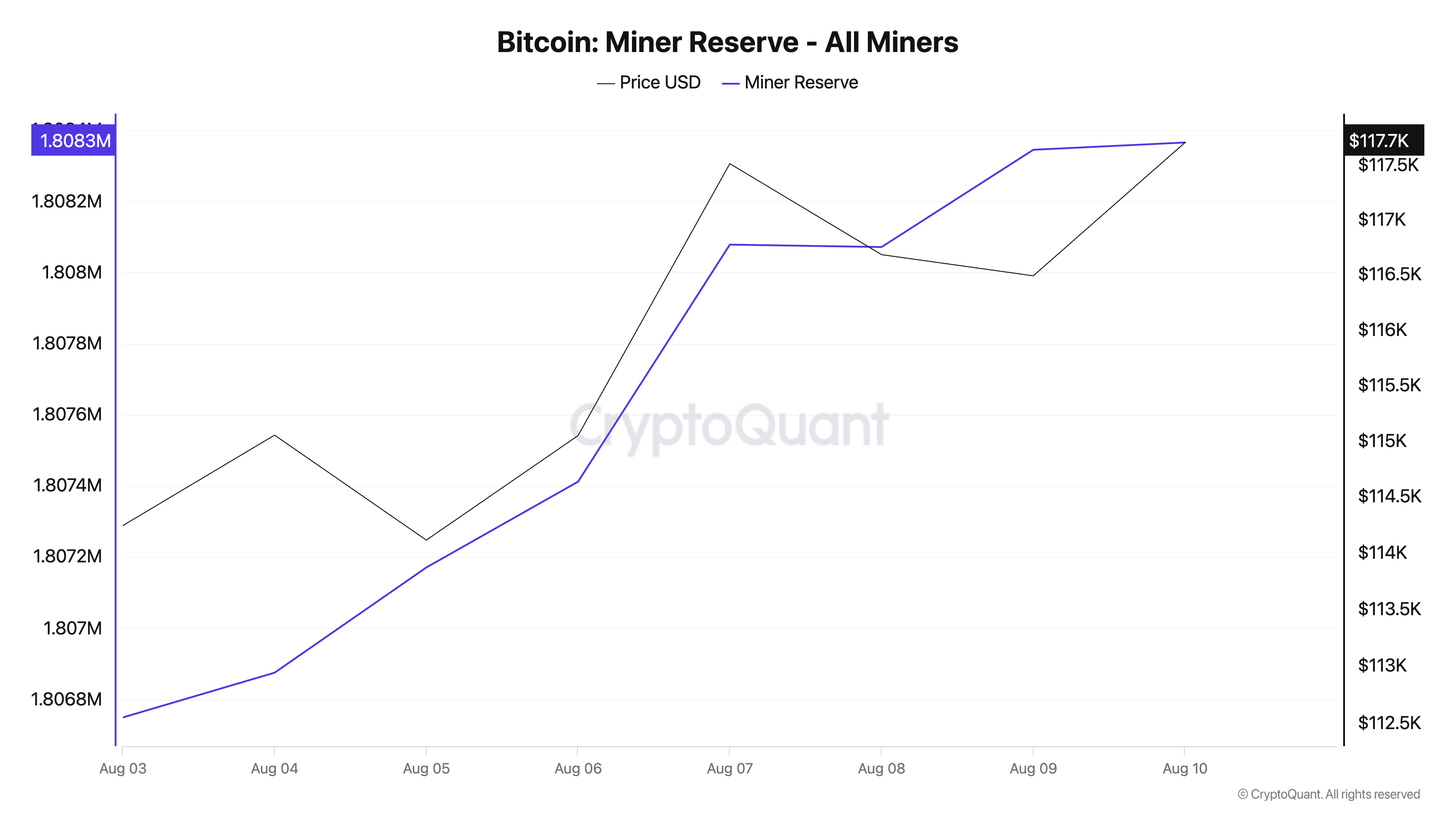

Bitcoin miners have resumed the accumulation of a week of 1.8 million BTC ($ 118,640.00) with a week of high week with a week of high week.

Want more tokens insight by this way? Sign up for the daily crypto newsletter of editor Harsh Notaria here.

Bitcoin Minor Reserve. Source: Cryptoctive

Bitcoin Minor Reserve. Source: CryptoctiveBitcoin Tracks the number of coins conducted in the buttics of Minor Reserve Miners. It represents the reserves of coins that have to look at the miners. When this fall occurs, the miners are extracting coins from their wallet, usually to sell, the growing recession against BTC confirms the Senate.

Conversely, when it climbs, miners are holding their mining coins more, which usually reflects praise of future price and confidence in a rapid approach.

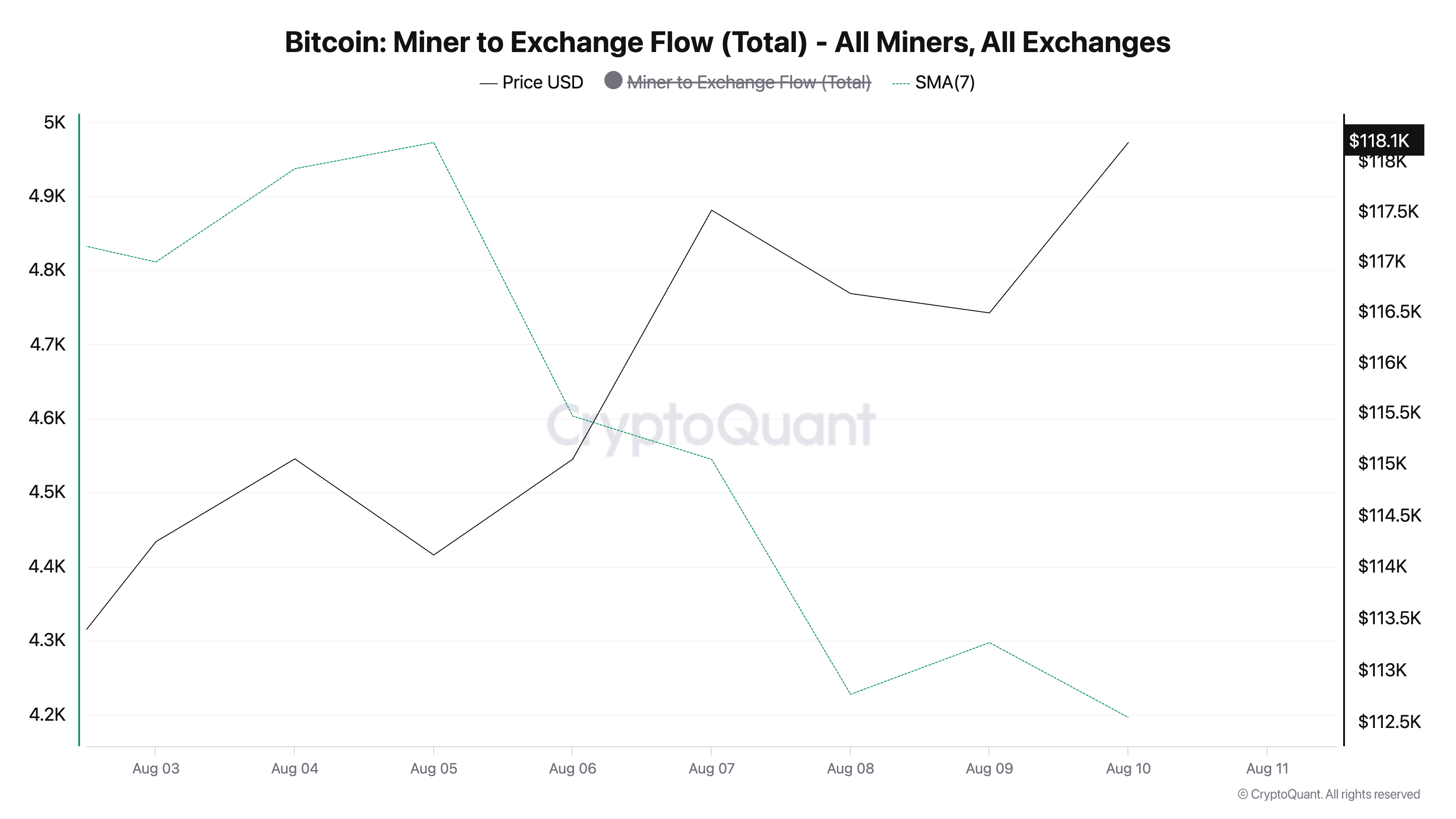

In addition, the decline in BTC’s Minor-to-Accesses blows miners on the network in the last seven days.

Cast for cryptoctive, this metric, which measures the total amount of coins sent from the purse in the mine to 10% during that period.

Bitcoin Minor to exchange flows. Source: Cryptoctive

Bitcoin Minor to exchange flows. Source: CryptoctiveWhen the mining-to-access flow of BTC falls, they retreat from selling miners and keep their coins away from the exchange. This reduced the signs of increasing confidence in the price of BTC and can help strengthen its Rali.

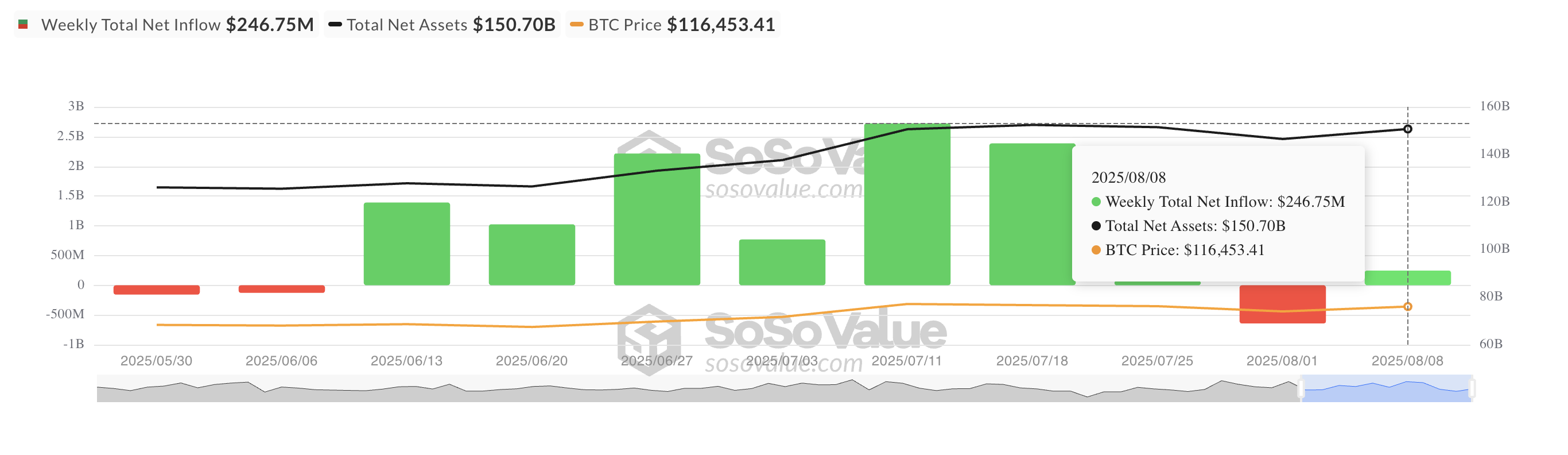

In addition, last week, the weekly spots were invited to Bitcoin ETF, reversing the negative outflow recorded in the last week. Between 4 and 8 August, according to Sosovalu, there were total $ 247 million in capital flows in these funds.

Total bitcoin spot ETF net inflow. Source: Sosowalu

Total bitcoin spot ETF net inflow. Source: SosowaluThe shift renewed the institutional purchase interest and change in market bias towards BTC. Institutional investors believed that the coin would expand its profit and was investing its director risk through ETFs.

Can BTC push the previous $ 118,851 to $ 120,000?

This combination of fresh institutional demand and mineral confederation strengthens the case for the withdrawal of near-period of BTC that exceeds $ 120,000. However, to know this, King Coin will first have to break above resistance at $ 118,851.

Bitcoin price analysis. Source: TardingView

Bitcoin price analysis. Source: TardingViewOn the other hand, if the accumulation stalls, the coin can resume its decline and fall to $ 115,892.

Post how can Bitcoin Mine Drive a New Drive