The Cryptocurrency industry has been about to kill the new milestone in 2025, with futured Solna and XRP ETF (exchange-traded funds) between the latest to reach new achievements. For the latest market figures, SOL and XRP ETFs have reached $ 1 billion in total capital flows since their launch earners. This achievement comes behind rumors that the world’s largest asset manager, Blackrock, a spot can be seen to launch XRP-based exchange-tride funds.

Sol & XRP Futures ETF hit new milestone

In a post of August 9 on the X platform, Nate Gresi, president of the ETF store, requested that futures-based Solana and XRP ETFS have attracted more than $ 1 billion in the capital point launch. These crypto-linked investment products start trading in the United States about five months ago (for SOL ETF) and April (for XRP).

For reference, futures-based exchange-freed funds are a type of investment product that has a property detail. A financial instrument that is an investor to buy a property at a predetermined date on a predetermined date.

In March 2025, the shares of instability started the Solana Exchange-traded fund for the first time in the United States. The firm at the time rolled out two products: the volatile shares’ Solana Fund, which mimics the performance of the Solan futures, and offers 2x the only doli-tier exposure on it.

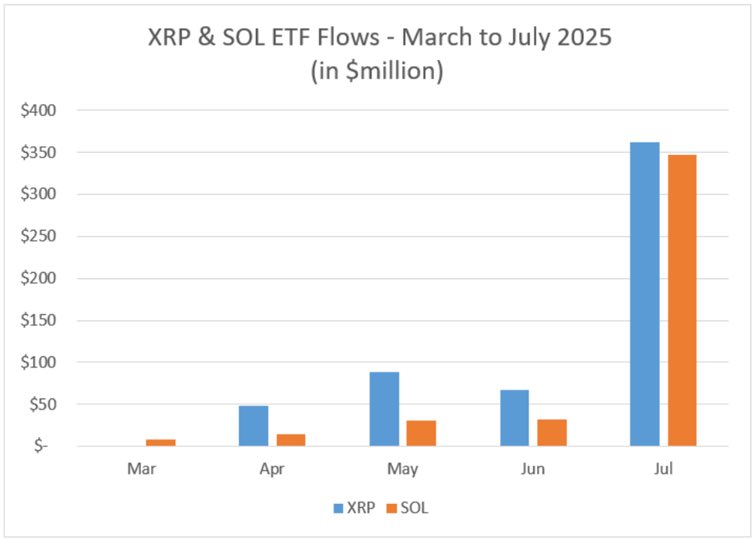

While Teucrium launched the first US-based XRP ETF (a 2x leased fund) in April, volatility shares offered the previously non—fered futures-based XRP exchange-fed-find-finded in May. As shown in the chart below, both Sol and XRP ETF posted only for minor monthly performances, which July – Wa ahey posted each each in capital flows approximately $ 350 million.

Source: @NateGeraci on X

Gresi stated that these figures include Rex -Spray’s Solan stacking exchange -traded funds, which claim up to $ 150 million in property under management. The account for the ETF specialist, it provides the display that the space will be a demand for Sol and XRP ETF.

Experts double on the application of Blackrock for Sol and XRP ETF

It is worth mentioning. As a report by a bitcoinist, Blackrock has indicated that it has no plans to join the race of Spot Solana and XRP ETF.

In a second post on X, Gresi reiterated her belief that Blackrock wants to expand its crypto ETF portfolio. “And I am being told that Blackrock doesn’t want a piece of this?” The ETF expert said, referring to the atribution by Enering by the future-based version of the XRP exchange-traded funds.

The price of XRP on the daily timeframe | Source: XRPUSDT chart on TradingView

Specially displayed image from pexels, chart from tradingview

Editorial process Focus on giving well, accurate and fair content for bitcoinists. We maintain strict sourcing standards, and each page undergoes hardworking review by our team of top technology experts and experienced editors. This process ensures the integration, relevance and value of our content for our readers.