key takeaways

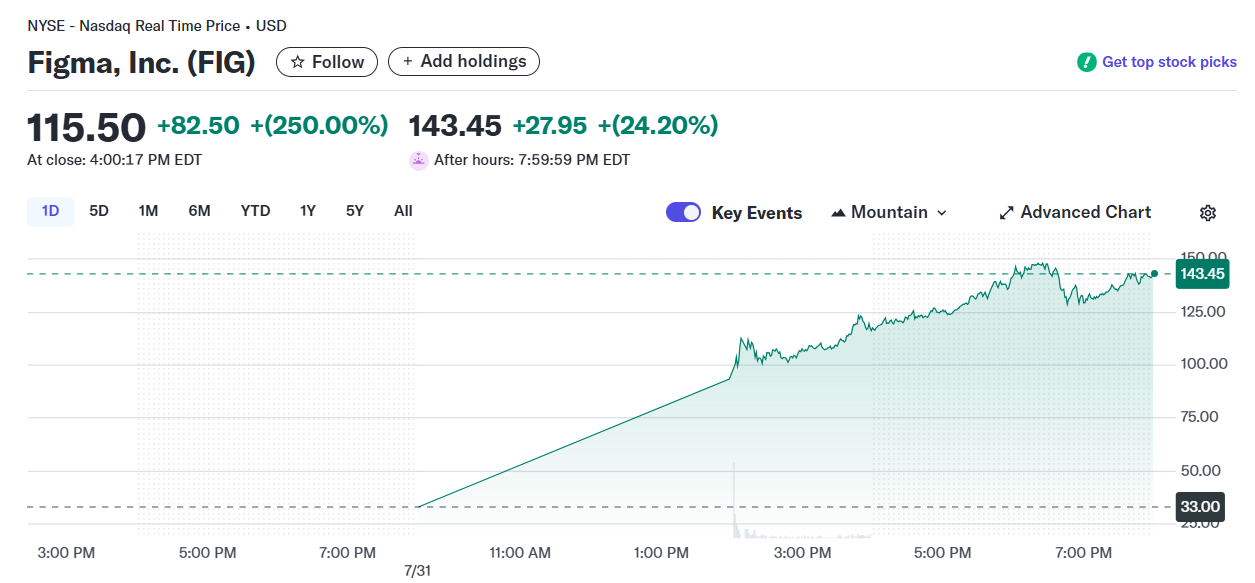

- Fig stock jumped 250% on its first day, closed at $ 115.

- The IPO of figs is part of a wave of public listing amidst the new market activation under Trump administration.

Share this article

Figma, collaborative design platform, 250% Sow in its NYSE debut on Thursday, pricing its IPO at $ 33. In stock hours trading, another 24% climbed $ 143, Yahoo Finance Data Show.

The company, which holds $ 70 million in Bitcoin ETF, reached an enterprise price of about $ 66 billion in the market, except in Adobe’s unsuccessful 2022 takeover attempt, which was blocked by European regulators.

Stockmktnewz, Kathy Wood’s Arch Investment bought 60,000 shares on its debut day.

Kathy Wood and Arc Invest bought 60,000 Figema $ Fig Now pic.twitter.com/zi0cckmc1

– Ivan (@Stockmktnewz) August 1, 2025

The Figma was included in other companies in 2025 amid revival in IPO activity under Trump Administration.

Before figs, the Crypto-country firm Circle Internet Group, the second largest Stabelcoin, the company behind the USDC also sparked a splash on NYSE, with shares (CRCL) as $ 123 as high as they were in the first week. Circle closed today at $ 183, 3%below.

In his second IPO filing, Figma stated that it maintains $ 30 million in USDC Stabelin for future bitcoin purchases. The company’s bitcoin exposure showed the trend of companies involving Crypto’s assets in its treasury strategies.

Share this article