The United States (US) Federal Reserve (Fed) will announce its interstit rate decision and Posted policy details after the July policy meeting on Wednesday.

The market participants widely estimate that the US Central Bank will abandon the unchanged policy settings for the fifth consolation meeting, which will deliver the interest rate to the previous dick in the range of 4.25% -4.50% by 25 basis points (BPS).

No rate cut from feds?

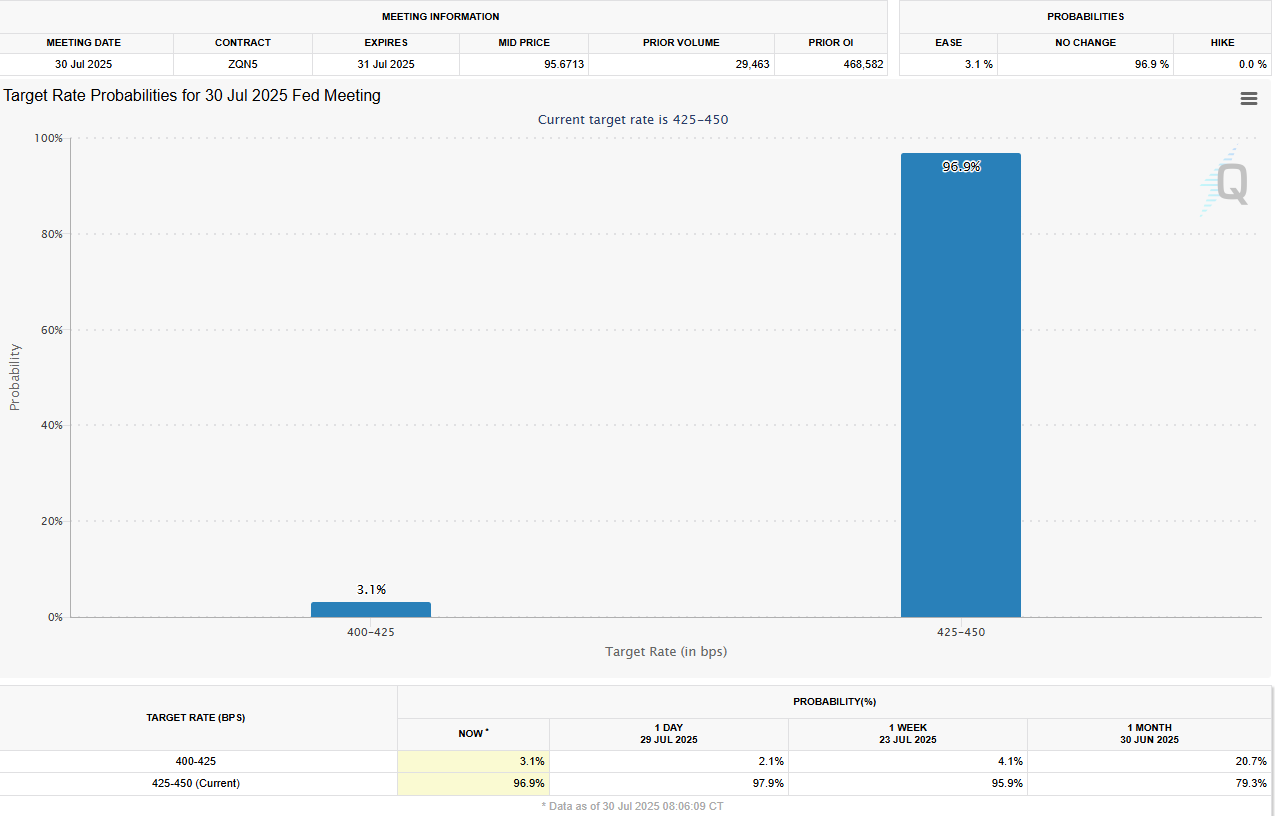

The CME Fedwatch tool suggests that investors actually see no changes to the rate cut in July, which pricates about 64% of the 25 BPS recurrence in September. The status of this market shows that the US dollar faces two-way risk in the incident.

The revised summary of the Economic Projects (SEP) published in June revealed that the estimates of the policy makers cut the rate of 50 bps in 2025, followed by both 2026 and 2027.

Expectations of interest rate. Source: CME Fedwatch

Expectations of interest rate. Source: CME FedwatchSeven out of 19 Fed officials did not cut any in 2025, one cut in two, eight estimated two, and this year made two forecast three cuts.

Following the June meeting, Fed Governor Christopher Waller in his public presence gave voice to his support to cut the July rate, arguing that he should not wait that the Labor Market is in trouble before the policy.

Similarly, Fed Governor Michelle Boman said that he is open to cut rates as soon as July as July as the flow remains.

Meanwhile, President Donald Trump increased his attack in July to put pressure on the US central bank to cut interest rates.

Addressing the report with the British Prime Minister Kir Stmper on Monday, Trump reiterated that the American economy can do if the fed is cut.

In TD Securities, Anilsts said, “FOMC is again widely expected to keep his policy stance unchanged next week, with committee mice at 4.25%-4.50 with mice.” “We expect flexibility around the next step of the committee in September, their patients expect to repeat the data-free policy stance. Waller, like this meeting.”

When will the Fed announce its interval rate and how will it affect EUR/USD?

The Fed is scheduled to announce its intersti rate decision and publish the statement of monetary policy on 18:00 GMT on Wednesday. After this, Powell of Powell of Fed Chair Zerome Powell will be started from 18:30 GMT.

Powell in the cast opened the door to cut a rate in September, which is commonly used under renewed sales pressure with an immediate response, citing low inequality after dealing with some prominent partners such as the European Union and Japan.

The major analysts of the European session in FXStreet, Eernngezer, provide a small technical approach to EUR/USD.

“Nearly technical approach points to the construction of the speed of the recession. (SMA) for the first time for sin in late February.”

In contrast, USD may collect strength against its rival situations.

In this scenario, investors can avoid pricing in the rate of cut in September and wait for new inflation and employment data.

“On the negative side, 1.1440 (23.6% retracement level of February-July) 1.1340 (100-day SMA) and 1.1200 (Fibonacci 38.2% retracement) as the next support level.

The Post Federal Reserve set up the interest rates to leave the interest rates, which were unchanged unchanged amid eccentric uncertainty.