After months of underperformance, the atherium starts starting institutional interest.

Summary

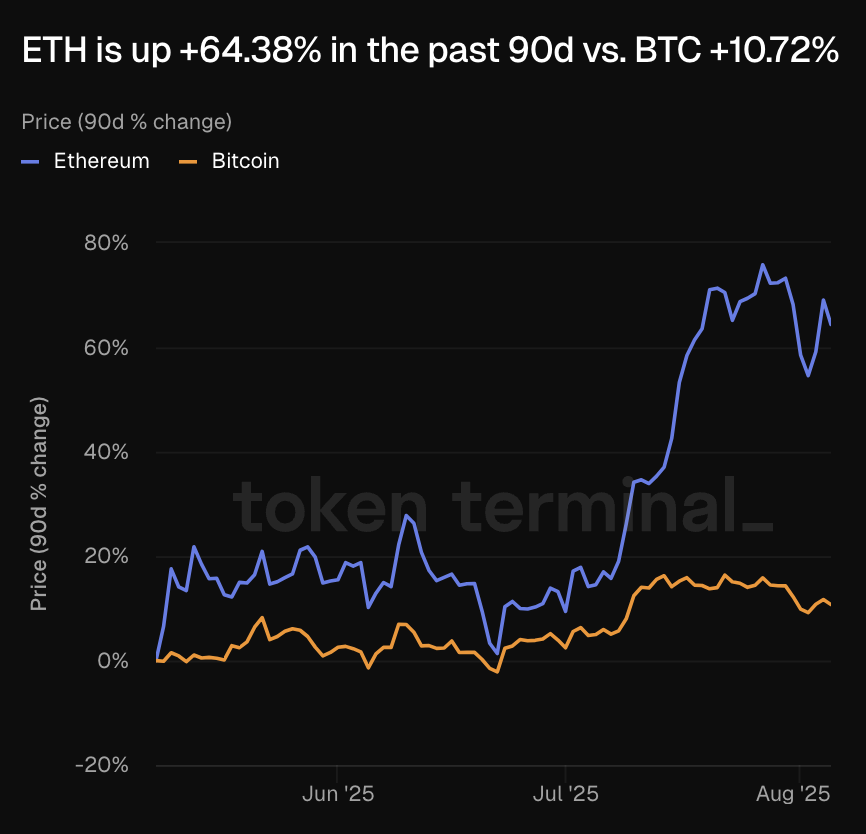

- In the last 90 days, Etherium improves bitcoin

- Institutional interests were the main driver of the rise of atherium

- Bitmine recently became the biggest ethy holder

When it comes to a crypto tree, the institutes are not a longcon (BTC). Etharium (Ath) rose 64.38% to $ 1,808 to $ 3,684 in the last 90 days. Given the same period, bitcoin grew just 10.72%to $ 94,748 to $ 115,375.

The growing institutional interest was behind the bounce of the atherium, the chief analyst of Mexak Research, Sean Young told Crypto.NUS. He highlighted investment in Major Treasury Beas, as well as other altcoins.

“The total Eth 2024 conducted by the listed firms has increased by about ten times. Bitcoin-Cowel Treasury Era,” Sean Young, Mexc.

For example, on August 4, the atherium holdings of Bitmine reached $ 2.9 billion, which became the largest corporate holder of the property. What is more, the firm carried out a very aggression strategy, collected these holdings in just five weeks.

This suggests a comprehensive trend where major financial institutions are starting to diversify their crypto portfolio beyond bitcoin. In this environment, the atherium is a clear option as the second-big crypto property.

Athherium is cured by recession on digital oil story

It came after a slow performance period, roughly filled with questions about the tokenomics of the atherium. For example, in 2024, atherium was 53% than the 113% profit of bitcoin. No, on -chain volume fall, roughly caused by layer -2 network, caused noticeable inflation, put pressure on the price of Ath.

Nevertheless, the story around Etreum began to change in June, “Digital Oil” designation was gaining popularity. That is, investors were interested in the role of Ethereum in the largest Defee Ecosystem.