The price of injection was below.

Summary

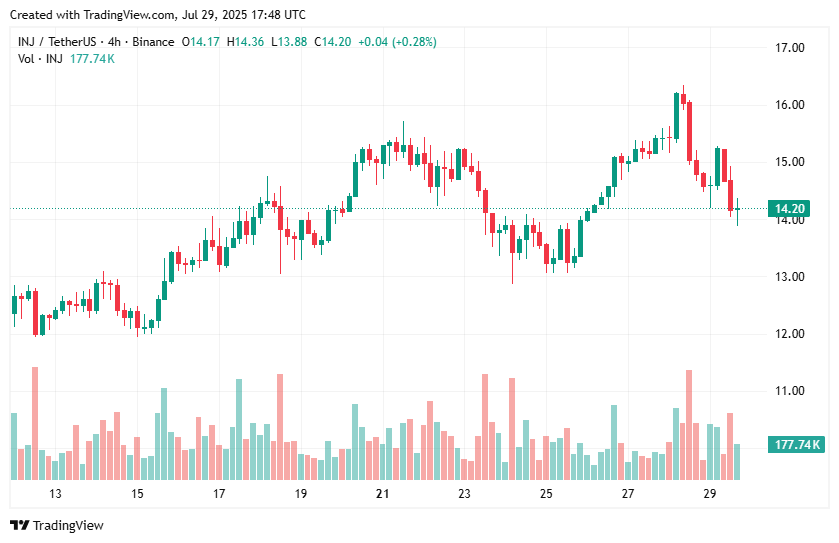

- On July 29, the injected price retrieving, falling nearly 5%, suffered an injury, as the injury touches the climb of $ 13.88.

- Altcoin extended in the news on Monday that CBOE filed the canary capital stacked injected ETF list.

- The institutional interest in injuries remains as the market eye, which is the regulatory approval for the crypto ETF, tilt for atherium and solana.

The injection (injury) price up to $ 16.35 with a climb of $ 14.48.

However, after leaving something upside down amidst broad market conflicts, the injury has increased the return. The coin touched the climb of $ 13.88.

Market data on Crypto.news showed the injective value around $ 14.31 on July 28, and shown the posside at the bottom as a negative side in the risk of further damage as top cryptocurrency.

Why not?

The advantage of the injected came when traders reacted to the news that CBOE, the biggest option, exchange exchange-traded funds.

The CBOE has filed to list the Canary $INJ Staked ETF in the U.S.

The @CBOE is the largest options exchange in the United States of America.

Injective's institutional adoption is accelerating like never before. pic.twitter.com/kWaDE1S1B0

— Injective 🥷 (@injective) July 29, 2025

The filing meant that the canary’s stacked injected ATF joined the other major Stake Crypto ETF Flings – Etharium (Ath) and Solan (Sol). It also indicates increasing interest in injective by institutional investors, which follows the registration of the Delaware Trust for these cannari injury ETFs.

As the market reacted to filing news, the price of injury increased. However, like many examples, ecosystem, buy rumors and sell-and-news scanner are always allowed to take advantage.

The injury is not below the obes, but the value is hovering near a major level and the fresh decline will be pushed. It supports $ 13.20.

Despite the decline, analysts have deployed in the price of injected protocols as indicating a bullying penant on high -time frimes.

Injective longs liquid

Data of Coinglass shows that a total of $ 982,000 has been used in the last 24 hours.

Of this, the vast majority are more than $ 895k bolts. This liquidation is killed for craving, with only $ 87k in shorts, also sees a decrease in open interest.

Coinglass data also indicates a decline of 10.4% in injective OI, currently in the year $ 167 million. Meanwhile, derivatives volume has fallen 16% to $ 413 million.