The Crypto Bazaar has expected a minor correct, with several major coins looking for a decline of SMAL between a broad bull run.

This dip comes amidst significant activity, revealing the diveant strategies among the biggest players in the Crypto market.

Crypto Whale plays both sides: accumulation and sales

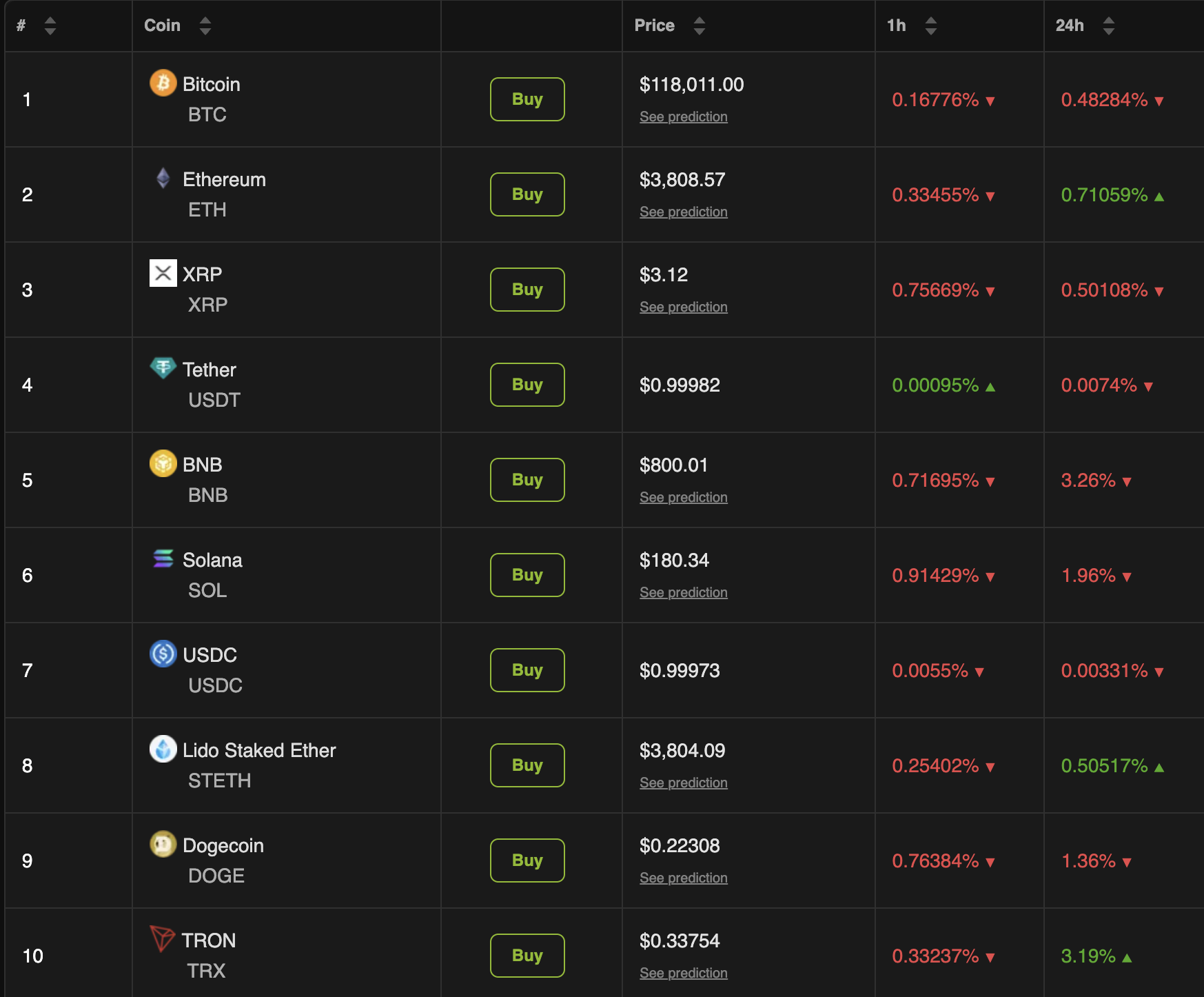

BEINCRYPTO market data showed that in the last 24 hours, the comprehensive crypto market has fallen by 3.83%. In addition, 7 of the top 10 cryptocurrency are in red.

Bitcoin (BTC ($ 118,334.00)), flagship crypto, drowned 0.48% in the previous day. Ethereum (Eth ($ 3,829.61)), Lido Stacked Ether (Stath ($ 3,826.88)), and Tron (TRX ($ 0.34)) increased the trend with the latest advantage of 3.19%.

Crypto market performance. Source: Beincrypto Market

Crypto market performance. Source: Beincrypto MarketMeanwhile, (micro) strategy has bought a dip. 21,021 BTC firm announced the acquisition of BTC, priced at around $ 2.46 billion. The average purchase price was $ 117,256 per coin.

The purchase is funded through an initial public offer of $ 2.5 billion, which is a permanent favorite stock (STRC) of convertible rate serials, which completes total holdings up to 628,791 BTC. The firm is now sitting on an unrealistic profit of $ 28.18.

The firm said, “With approximately $ 2.521 billion gross processes, it is the largest US IPO completed on GDP in 2025 to date and the largest American exchange -Listed is always stock offering since 2009.”

In addition, its BTC yield is 25%. The acquisition aligns with the company’s leverage equity and loan patterns, which is a strategy to increase its BTC reserves, which has posted it as a major institution.

In addition to the strategy, Lukanchen highlighted that the Encourage digital, a digital asset platform and infrastructure provider, have also increased their bitcoin exports.

“Encourage Digital has deposited 10,141 BTC ($ 1.19 billion) from several walllets in the last 9 hours,” Lukanchen posted.

In contrast, the activities of a preview passive investor indicated a greater profit-oriented approach. Lukanchen reported that after a 12 -year -old dormity, a bitcoin holder transferred 343 BTCs, priced at $ 40.52 million. Out of this, ‘Bitcoin OG’ deposited 130.77 BTC, which was $ 15.45 million to Crackon.

“This OG received 343 BTC (about $ 29,600) 12 years ago, when BTC was priced at $ 86.

This small transfer follows the largest bitcoin transacts ever in the history of cryptocurrency. Beincrypto reports that Galaxy Digital sold more than 80,000 bitcoins, which was over $ 9 billion on a long -term investor’s Bold.

The Etharium market has seen similarly contrary to whale behaviors. A new wallet (0x3DF3) accumulated a price of more than $ 45 million through Galaxy Digital at 12,000 ETH.

“Since July 9, a total of 9 fresh purse 640,646 Eth ($ 2.43 billion) has been deposited,” Lukanchen wrote.

However, it is offset by selling accumulation. An on-chain analyst stated that Galaxy Digital deposited 5,000 ETHs in the coinbase at a price of $ 19.28 million, and Cumberland also transferred about $ 40.79 million $ 40.79 million to 10,592 ETH.

In addition, Fidelity also followed the same path and sent 12,981 ETH valuable for the coinbase in the year $ 49.7 million.

Analyst Amber said, “The institutional address is suspected of being a hash capital, 12,000 ETHs were transferred to OKX a day before yesterday, and then withdrew from OKX to 46.16 million USDT ($ 1.00) from yesterday. ETH has been sold at a price of $ 3,847.”

Thus, the divents of the crypto whales -alasia versus liquidity -change different -risk hunger and attitude in the market.

The Post Crypto takes a 38% dip as a division of market whale – some buy billions, other cash outs first appeared on beincrypto.