Table of Contents

July 2025 was real warm if we generally speak about crypto market and crypto space: from pump tokens to atherium rush, a new all-time to pass the Landmark Genius Act from Bitcoin. Portfolio management and trading automation platform Finstel shared a market report of July 2025, which helps closure the most seminal events and outline the most important trends for asset managers.

Summary

- Finstel explains that the life of the first half of July has moved to the accumulation and risk mitigation by the end of the month.

- Institutional interest in Crypto is trembling. Serious April gathered in all BTC, corporate trees bought more than 40% in a week of July

- August may be a decisive month, carrying bitcoin to a level of $ 105,000 or $ 130,000, deduction in Fed and Solana’s seeker depends on the performance of STS

July price movement

Finstel’s experts emphasize the contradictions of the July market performance, “meets the surge standing” and reminds us that with a month, not only reaches a record-breaking value at the price of bitcoin, it also returned to several ideologies.

Bitcoin

In the first week, between tariff unwanted, the price of bitcoin was ups and down with $ 105,000 – $ 110,000. Finestl ETF cites the spikes buying on-chain as 9% increase in the week, when the BTC price crossed a mark of $ 120,000. As the price passed the peak value, it settled at $ 117,000, inspiring the asset managers to reduce the RISC. Overall, the benefit of July was 8%.

Ethereum

The figures of the atherium were superior. It demonstrated 17.03% monthly gains, reaching $ 3,800 and approximately $ 4,000. Finestel contributes to 29.4% stacking and rotation of ecosystem as a factor.

Altcin

The AltCoins market saw powerful volume spikes in this July, with 43% and second and thunder weeks in UPS, responsibility. The 8% cooling Fountain Week fell when the trading volume fell to $ 1.323 trillion, “with capital flowing in tokens such as XRP Post-Clearity Act.”

For altcoin market, July turns dynamic:

- Market cap rose 13.2%, reached $ 3.85 trillion

- Daily quantity increased by 56%, $ 161 billion

- At some point, bitcoin dominated by 60.6%

The fear and greed index was not moving away from the 70–75 range, “Altcoins were running 2% rotation in more active trading.”

| Metric | week 1 | Week 2 | Week 3 | Week 4 | Monthly | Finstel adjustment notes |

| Bitcoin (USD) | ~ $ 108k | $ 120k+ | $ 118k | $ 117k | +8% | Bid of mid -month; Trim 1% consolidation |

| Atherium (USD) | ~ $ 3k | $ 3.8k+ | ~ $ 3.8k | $ 3.8k | +17.3% | Promise 3% on ETF flow |

| Hat (trillion USD) | ~ $ 3.4 | $ 3.771 | $ 3.905 | $ 3.919 | +13.2% | Rotate 2% alt on peaks |

| Daily section (Arab USD) | ~ $ 98 | $ 139 | $ 161 | $ 161 | +56% | Scale for bots spikes |

| BTC Dominance (%) | High | -0.69 | -3.75 | +0.18 | Pure dip | 4% variety on falls |

Key of chain-chain signal

Within July, Bitcoin saw a change in an accumulation phase from active trading. Finstel explains that BTC touched 736,600 in Thunder Week, but in the fountain week, the video fell to 50%, settled at 367,000 BTC, which infections in a hand mode for infection.

While the peak of July was priced at $ 123,000, the support line was between $ 117,000 and $ 119,000. In the third week, the volume increased to 665,000 BTC. Despite the new record price, the profit declined, falling from 300,000 BTC to only 150,000 BTC. Institutional demand increased, which is a strong sign of faith. In July, institutions added 60,107 BTC.

In July, Bitcoin Minors earned $ 1.66 billion, while atherium stacking revenue hit 29.4%, “Royalized between 0.77–0.98 with DEFI exposure.”

Below, you can see the key on-chain signal mentioned by Finsel:

- Bulish: Gives potential suggestions for strong support at $ 117K for $ 130K.

- Recession: Distributor trends indicate that potential dips blow $ 115k, test $ 105k – $ 108k.

- Neutral: Stable velocity changes altcoins as a decline in the dominance of bitcoin.

Bitcoin ETF and Crypto Treasury Companies influence

Crypto ETF flow, as well as emerging and rival Crypto Treasury companies, had an impact action in the crypto markets. In July, Bitcoin attracted by ETF to Finstale of $ 12.8 billion, $ 6 billion, $ 6 billion in bitcoin and $ 5.43 billion flowed into the atherium. Blackrock gained $ 84 billion, with 75% new funds captured. The outflow of Fountain Week was only $ 72 million.

Corporate Crypto Trezaries promoted their race in the fountain week of July, depositing 60,107 BTCs only over the weekend -40% of all bitcoins purchase by Bitcin Treasury Sen. The Q2 revenue of the strategy from 628,791 BTC holdings was $ 10 billion.

Regulation and gross factor

Finestel experts consider the Clarity Act and the Genius Act as catalysts for Crypto market activity in July. These acts helped define

Other rapid regulation changes mentioned by FinestL include licenses for Hong Kong’s crypto platforms, which is a campus of tasks aimed at streaming the development of the Crypto region in the US, “These changes are expected to interact with Defi Flow and Liquidity, as is seen with the rising part of Atheram,”

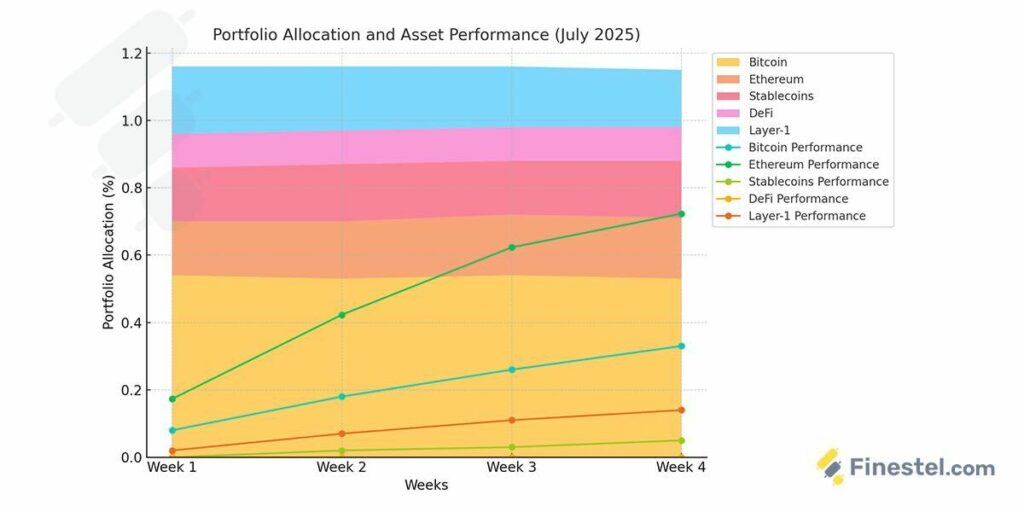

Pruning allocation

Reacting to the changes in the market, the asset managers at Finstel made the related adjustment to the portfolio.

Below you can see recurrence of changes

- BTC + Eth: 54% (Sorting 1% due to Volatibility)

- Stablecoins: 16% (1% as a hedge)

- Defi: 10% (1% for compliance-based yield)

- Layer -1: 20% (cooled as 2% winding below)

What do you expect next?

Finestel provided possibilities for the performance of the August market, not that the month could test a level of $ 117,000 with bitcoin. From this mark, it can slide down to $ 105,000 – $ 108,000 range or hit $ 130,000 if positive factors become more impressive.

Experts underlined major events to keep an eye on. They include the launch of Solan’s seeker Ships, which can promote layer -1 rotation and rate cuts by the Federal Reserve. Rate cuts can trigger liquidity flow, increasing the crypto market.

The other possibilities mentioned in the FinestL report are likely to have a $ 4,000 mark and the capacity of the capacity for the excellent performance of RWAS.

For unfairness, Finestel experts advised portfolio managers to adjust to BTC + Eth to 53%, so that stabilcoins’ stake is up to 17%, and Defi can be increased by 10%. Finally, they remind traders that automation equipment can help reduce risCs and increase profit.

Disclosure: This article is not DOS representative investment advice. Materials and materials are painted on this page, only for education.