Table of Contents

The price of bitcoin has not gone anywhere this week. Even after touching the high level of all time of $ 122,000, the price has been established. This is 3.1% below in the last 7 days, and only 5.8% for the previous month.

With the outflow of ETF, many traders expected deep improvement, marking the longest, the longest streaky SIN at the top of $ 1 billion. But the value that struggles to move the previous major level, many indications indicate that bitcoin can be set to be larger, if the time and when it is broken.

Short -term vendors are still bleeding, but slowing down

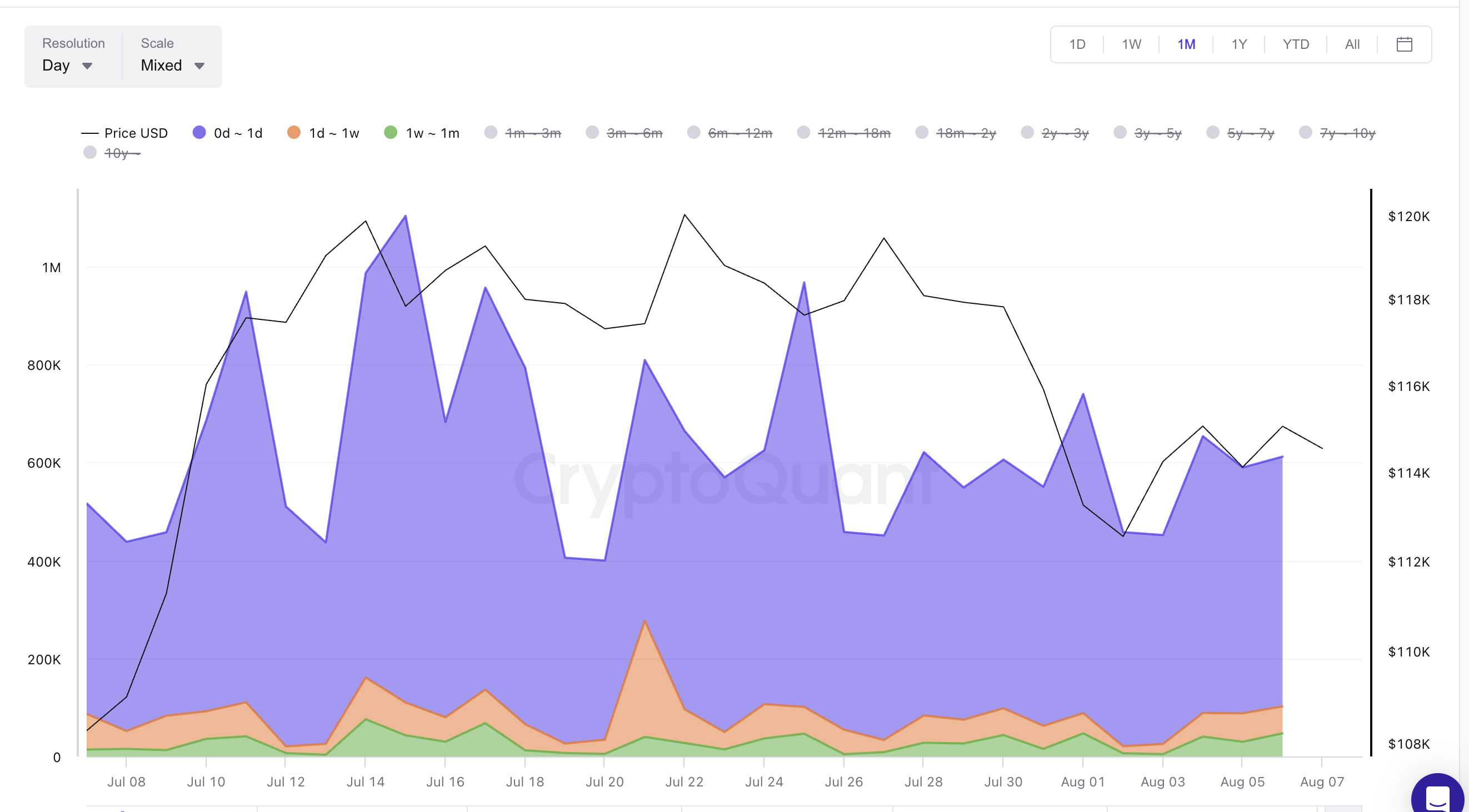

Every time the price of bitcoin has touched a $ 115,000 or any local top in the previous month, the short-tricum holders, who bought BTC ($ 115,024.00) in the last weeks, have studied sales. The output age bands spent clearly show this. On July 22, 28 July and even on 6 August, Bitcoin tried to push higher, but the BTC was raised to the top selling from the wallet for a month.

Bitcoin price and output age band spent: Cryptoctive

Bitcoin price and output age band spent: CryptoctiveThis shows that short-readers are booking quick benefits, which are topping the output metrics spent. But there is something after 25 July. This means that short -term traders can get out of BTC, or may be more confident in holding. If this continues, the bitcoin may eventually break through resistance.

The output age band metric track coins that they were conducted (or “spending”) were transferred on the basis of how long they were held. High movement from young coins (0–1 days, 1–17 days, 7–130 days) often indicates selling pressure.

Tokens for TA and Market updates: Want more tokens insight in this way? Sign up for the daily crypto newsletter of editor Harsh Notaria here.

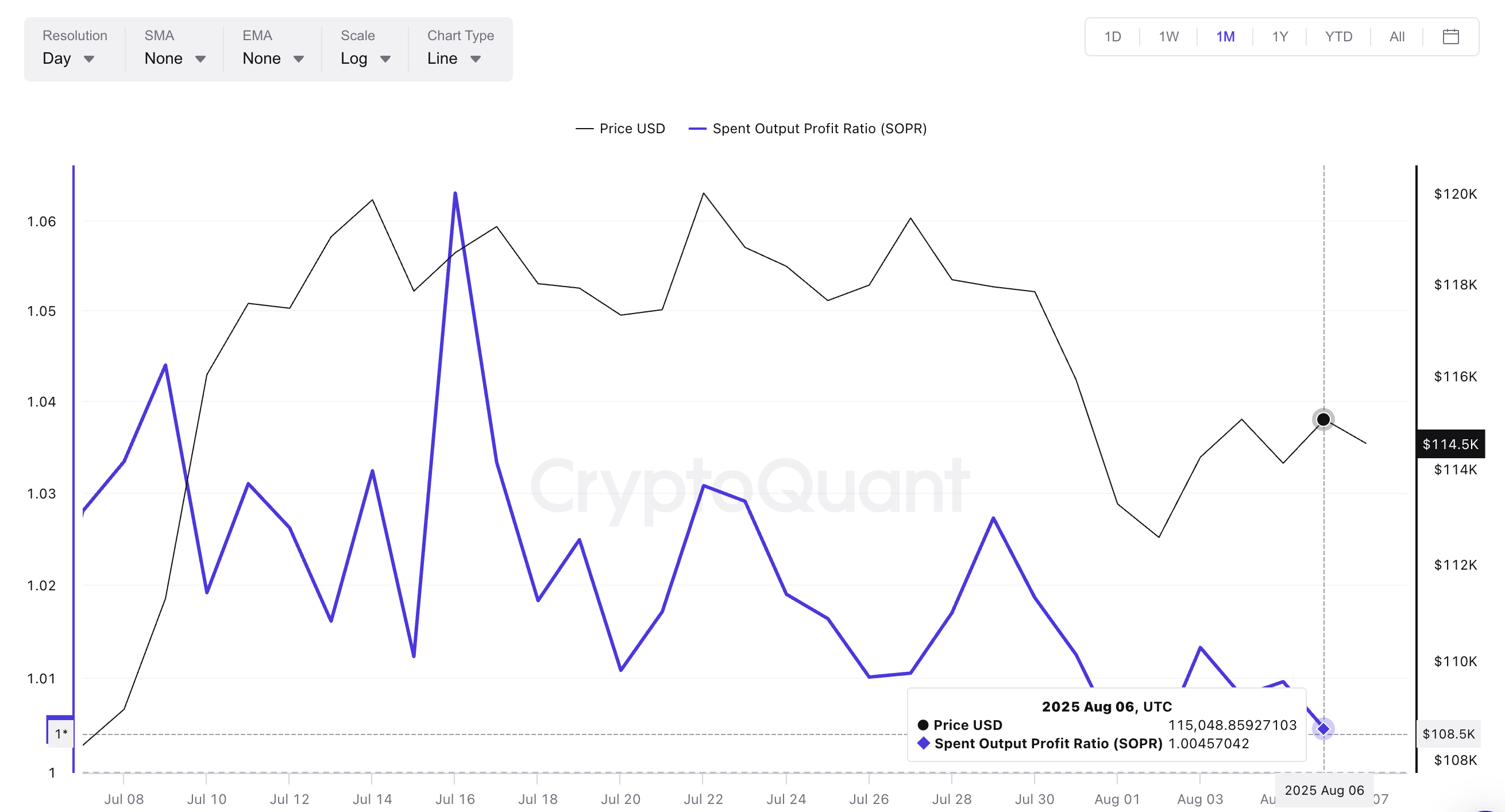

Lower signal from sopr?

The output profit ratio (SOP) spent output profit ratio (SOP) wheel BTC holders are selling at a profit or loss. When people stop at the top profits, and when they sell in a loss, often near bottoms.

Bitcoin Price and SOP: Cryptoctive

Bitcoin Price and SOP: CryptoctiveWe have seen this pattern playing many times recently:

- July 16: SOPR hit 1.06, the price tops around $ 118k.

- July 25: Sopr dropped from 1.016 to 1.01, but the price of bitcoin actually increased, showing deviations.

- August 5: Sopr dropped again, while the price increased to $ 114,000.

This means that low vendors are in profit, and some are similar to the exit in losses. When it occurs with a steady or rising price, it often indicates the bottom of a market.

Despite rejection, bitcoin price pattern is still sharp

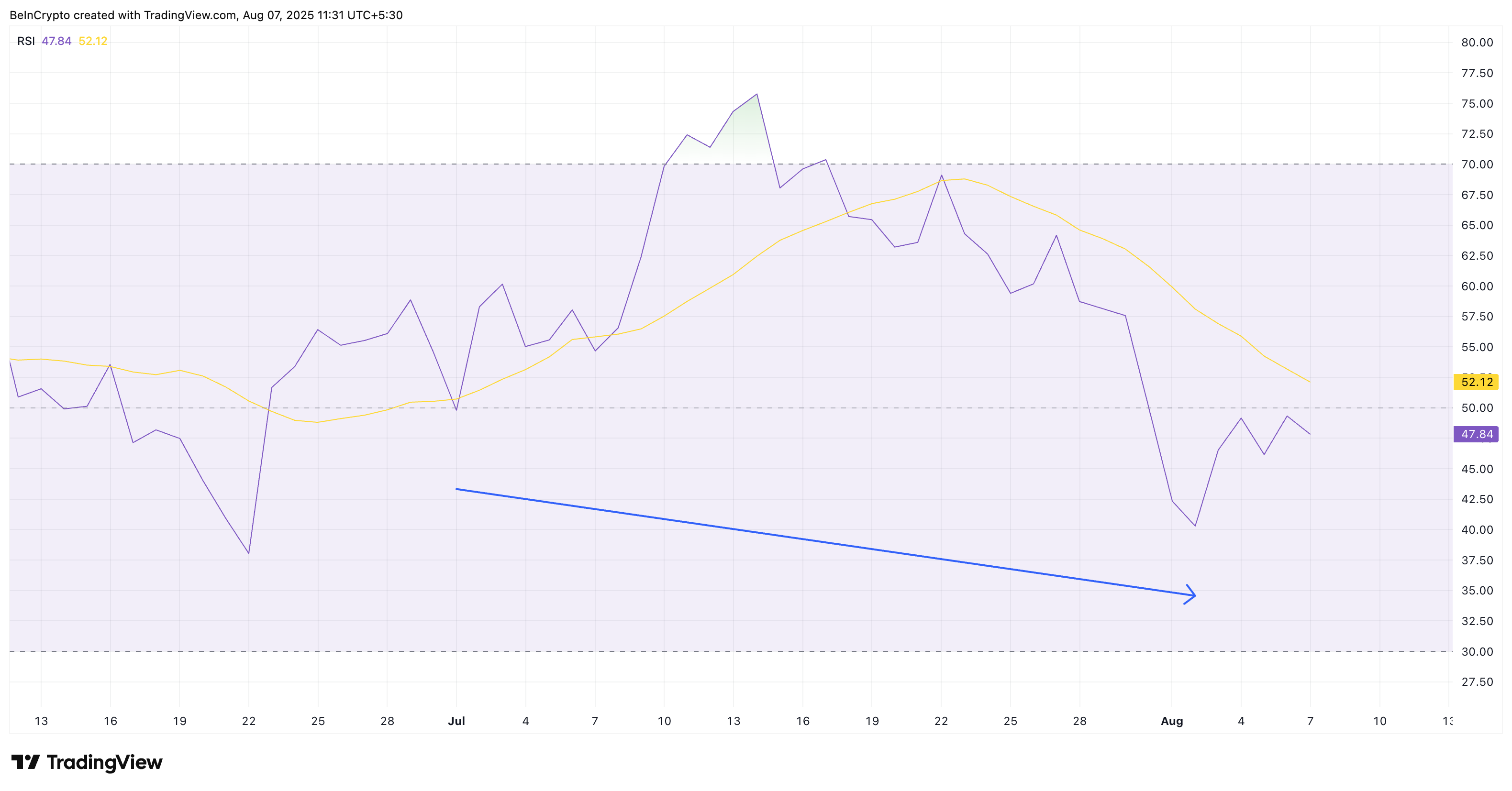

Even think about the price of bitcoin that $ 115,000 fails to break the brace zone, an important indication that the trend can still be rapid: the relative power index (RSI).

Bitcoin RSI: Tradingview

Bitcoin RSI: TradingviewBetween 2 July and 2 August, Bitcoin formed a higher low, indicating that each most content was not a darker before dip -peculiar classic signal in price. However, given the same period, RSI hit less. It is known as a hidden rapid deviation, indicating that the speed is quietly constructing, even though the price has not increased significantly yet.

The relative power index (RSI) measures the strength of the rectures to spot the possible tendency changes.

Therefore, which price chart is stuck, the RSI is quietly indicating that the buyers are still under control, and have strong legs of a brokeout couple. It also indicates that the underlying trend remains rapidly.

Now pair it with a real chart pattern. Bitcoin is moving inside a rapid penette pattern. The major resistance is $ 115,000. This line bitcoin cannot just break. But the price is creating high climbing consolidating under that level.

Bitcoin Price Analysis: Tradingview

Bitcoin Price Analysis: TradingviewIf bitcoin can be above $ 117,000 and then above $ 118,000, the breakout may confirm. LES below $ 114,000 and under $ 112,000. A breakdown can pull BTC up to $ 107,000, but right now, all signals indicate short -term power construction.

Post calm before boom? Why the week of bitcoin can end the week, the first appeared on the beincrypto in a sharp trick.