The Etharium rallred the earner of $ 3,700 on August. Inteensified as 5 and insurental accumulation. Can it return above $ 3,800 by the end of the week?

Summary

- Despite the recent instability, the atherium is up to 148% of its year-by-year.

- New Whale Wallsts has scooped over $ 3 billion in two days.

- Macro unwanted and ETF outfits continue to move upside down to ETH.

Cast for data from Crypto.news Ethereum (Eth), Altcoin, a leading by market cap, rose 5.7% to an intraday of $ 3,730 in GR on Tuesday. 5, before settling back at $ 3,650 at press time. It currently costs 148% Itar-to-date low.

The recent bounce came only a few weeks after breaking above a mark of $ 4,000, but was rejected near $ 3,900 due to macro headwind, which had eaten a remarkable risk value in institutional risk hunger and closed in its ecosystem.

Eth is looking at renewed whale accumulation and institutional flow

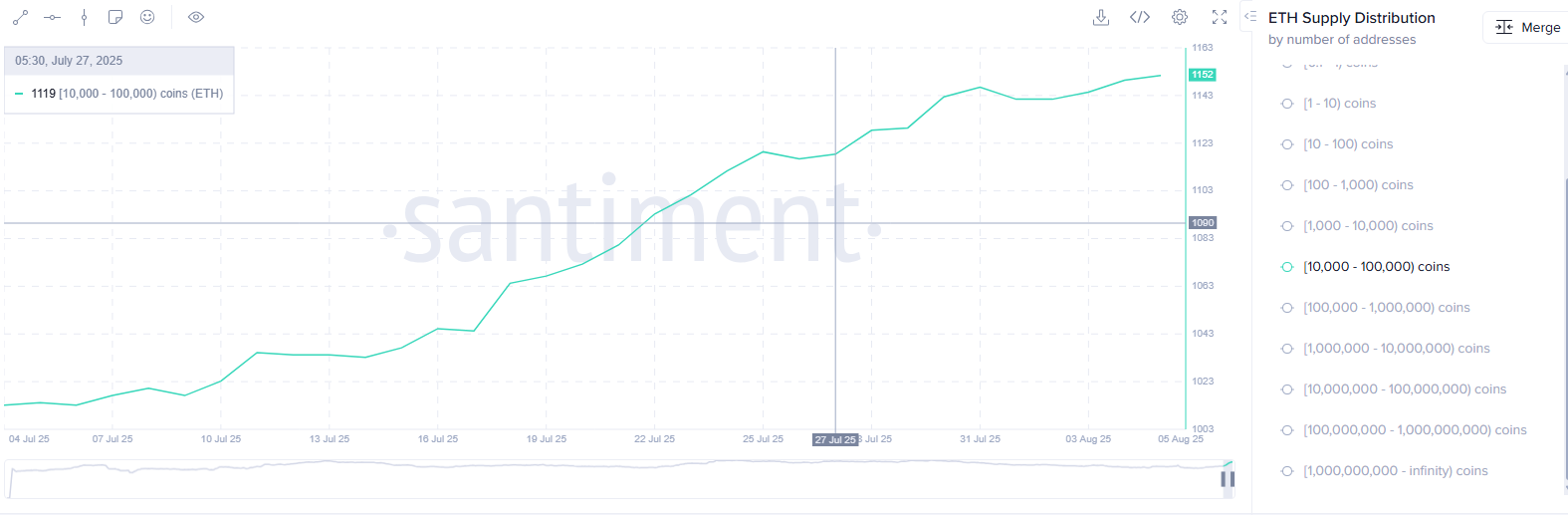

This week, the rebel and large institutions of the Etharium appear to be tied close to fresh accumulation. Casabint for data from Santlective, the number of purses having more than 10,000 eighths is not on the past, indicating that large holders are placed for potase upide.

Meanwhile, on August. 4, two newly created addresses acquire around 40,000 ETHs, which is about $ 142 million according to viewing data. The tendency to buy on August intensified. 5, when three additional wallets accumulated one and 63,837 ETHs, which was about 236 million dollars.

Overall, the Luke -Chen reports that 14 fresh whalelets collectively accumulate over 856,000, which cost about $ 3.16 billion in about two days.

This scale of accumulation, especially from new wallets, often indicates growing determination from high-net-welfare individuals or institutional actors. These buyers are usually taken to long -term positions and are deposited before the expected price application. Their activity is also seen by retail traders, who often interpret such mothers as a rapid signal.

In addition to purchasing whales, instanceal interest in Ethereum is also gaining momentum. Treasury and structured products focused on ETH have increased noticeable increase.

One of the most prominent devils is the Grwth of the strategic atherium reserve (SER), which tracks institutional ethereum holdings in major wealth, treasury, asset managers.

Just six weeks ago, the total assets of SER under management were blue $ 3 billion. The film is now exceeding $ 10.8 billion, and 2.45% of the total support of reserved ETH, above just 1% in June.

Contributing to this boom, the top holders, a nasdac-knit firming firm and top holders within the SER, added a price of about $ 66.63 million in the reserve 18,680 ETH in the reserve on August. 4.

What’s next for Eth?

Despite the signature, where accumulation and renewed institutional procurement, the atherium still lacks $ 3,800 – $ 3,900 above the resistance area decisively lacks the speed required.

While fresh capital has re -sent the market through the new wallet and treasury alox, these flows have to be translated into a broad shift in the market.

Last week, Ethereum-focused ETFs saw a total number of $ 129 million, which indicates that mainstream investors are still hesitant, and macroconomic unwanted, trade war risks to concern for American labor market, risk weighing on risk property.

Without a clear story or short-end catalyst, the current Rali remains unsafe to reversed.

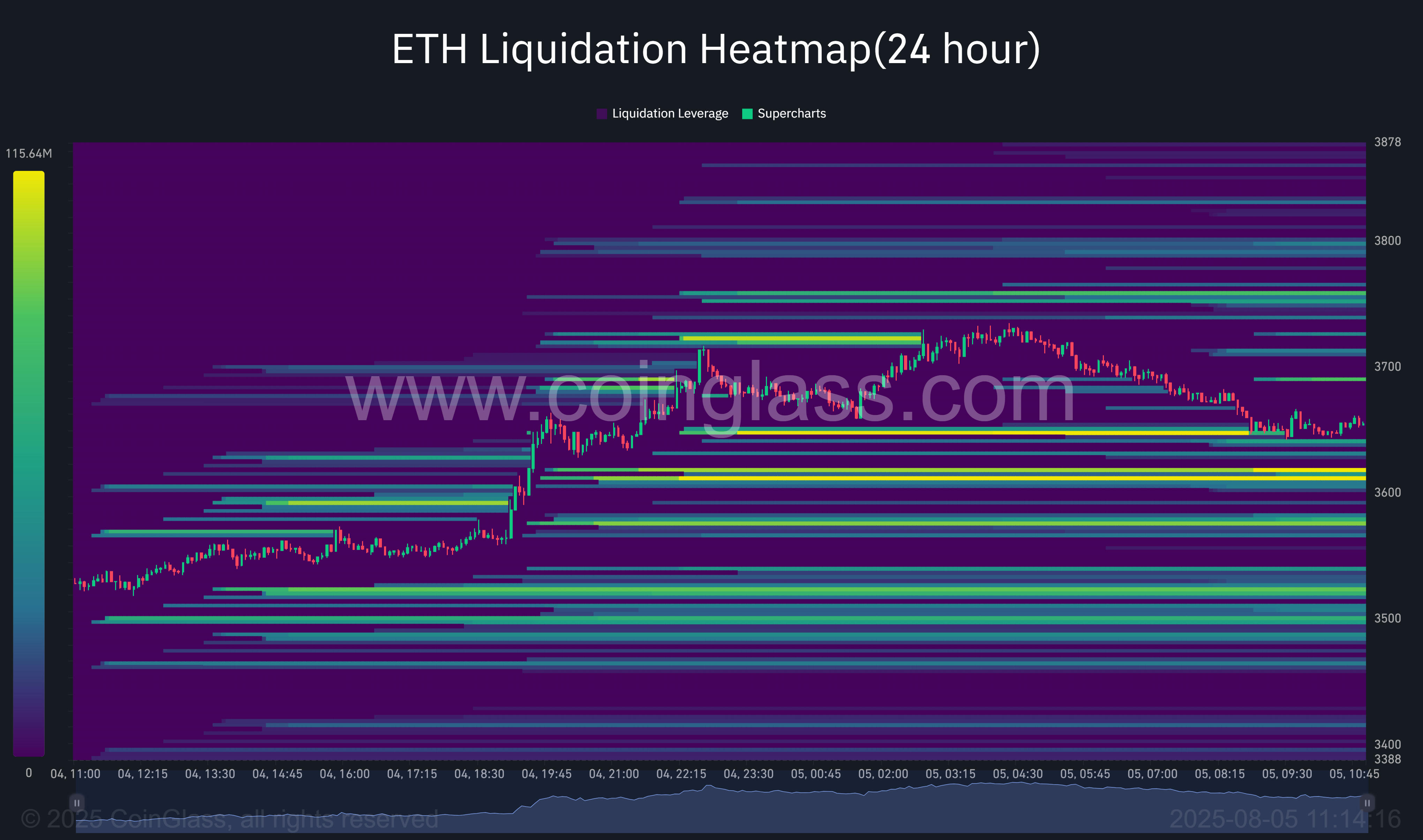

Data of coinglass shows that Ethereum is trading close to a dense cluster of long liquidity levels between $ 3,620 and $ 3,660. This area, published by a high-intensive band on a 24-hour hem, represents a large concentration,

This setup introduces a short -term negative race. If Ethereum fails to keep above a mark of $ 3,650, a film trigger cascading liquidation in the $ 3,660 Pocket Council.

Sucnario is probably likely to sell Calsure, where additional long positions are unsafe, pushing eths close to the secondary liquidity pool near $ 3,580 or even $ 3,540. These levels act as liquidity magnets, which means the value can move towards “harvest”, which can first “harvest” open positions.

Conversely, if bulls manage to postpone the current support area and spark a short-term rebound, the atherium may target short liquidity near $ 3,730- $ 3,780.

Nevertheless, some market water is expected to be recovered by $ 4,000, which is rapidly supported by technology.

Disclosure: This material is provided by a third party. Neither crypto.news nor the author of this article naturally supports any product on this page. Users should make their reservation before taking any action related to the company.