Mara Holdings reported strong earnings for the second quarter with a significant increase in revenue and bitcoin treasury.

Summary

- Mara Holdings benefited from BTC ATTH

- Firm’s net income was $ 808.2 million

- Mara Holdings only trails strategy in corporate BTC holdings

Recently, Bitcoin (BTC) market Rali had a strong impact on Treasury and Mining firms. On Tuesday, July 29, Mara Holdings, East Marthan Digital Holdings reported a strong income for the second quarter of 2025. Appreciation.

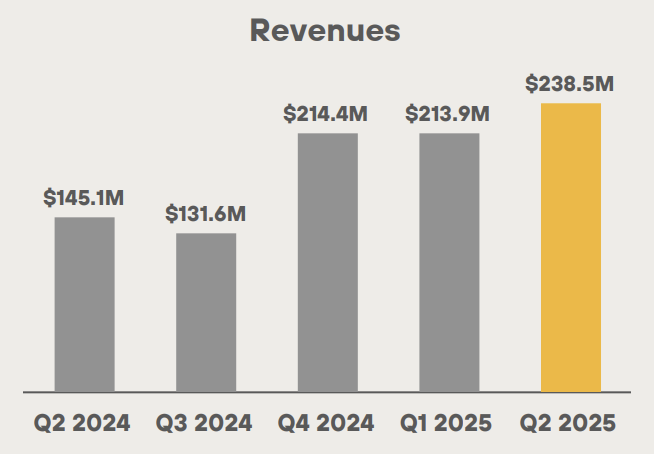

Mara Holdings reported a total revenue of $ 238 million, a 64% year-year growth, the highest from its bitcoin mining operation. This growth was largely inspired by the high price of bitcoin, currently trading near its all -time high. Average BTC prices in Q2, which increased 50% yoy, contributed to mining revenue.

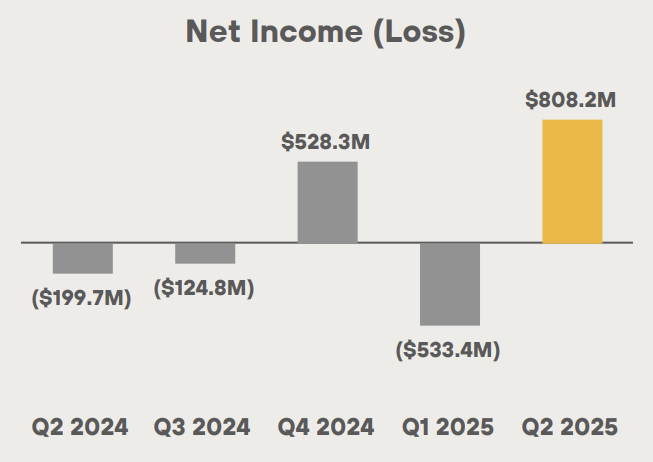

The company reported a more strong net income at $ 808.2 million, compared to a loss of $ 199.7 million in Q2 of 2024. Due to untrue benefits on bitcoin holdings.

Mara holdings continue to deposit BTC

The company’s bitcoin holdings also increased by 170%, which is now a total of 49,951 BTC. Shortly after the quarter-end, BTC Holdings of Mara crossed 50,000 BTC. This makes it the second large BTC Treasury firm, only the followed strategy.

Unlike most bitcoin miners, Mara Holdings do not sell BTC IT mines. Instaded, the firm avails its BTC as a strategic reserve asset to extend its price long periods. The company also uses stock offerings to get additional bitcoin reserves.

Since regulatory changes in the US, bitcoin is a popular treasury property. More and more companies are taking advantage of their bitcoin reserves to enable investors to come into contact with the largest crypto property.