Jack Daisi’s block saw an increase in its XYZ stock in pre-market trading on Friday, after the report that the firm added more bitcoin (BTC ($ 116,530.00) in its stockpile in the second quarter (Q2).

Block corporate bitcoin is one of the flywheels receiving flywheels in the form of adoption glass.

Block enhances its holding with 108 bitcoins in Q2

The filing with US Securities (Securities and Exchange Commission) bought 108 BTC in Q2 Block Inc. At the current rate, with bitcoin trading for $ 116,554 as this writing, buy BTC alone is a price of $ 12.58 million.

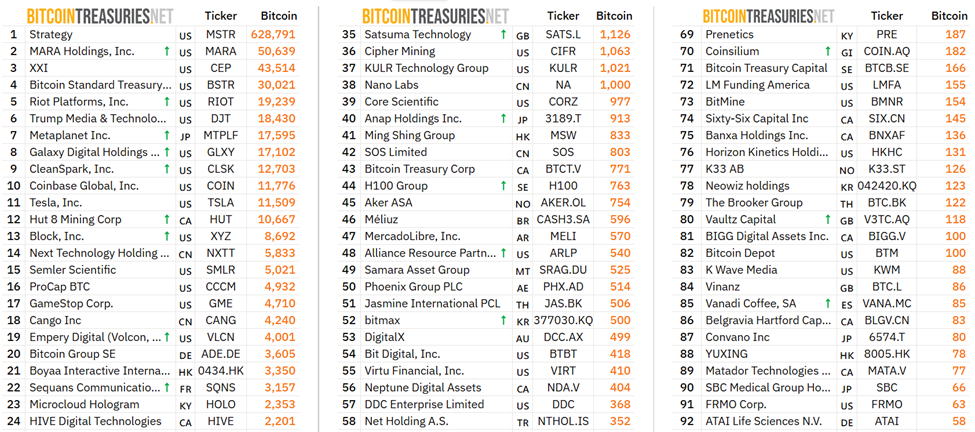

After purification, the block has 8,692 BTC tokens, which cost more than $ 1 billion. With this, Block Inc. is effectively the 13th largest public company with BTC.

Top 24 largest corporate BTC holder. Source: Bitcoin Treasure

Top 24 largest corporate BTC holder. Source: Bitcoin TreasureMove Position Block Inc. Along with firms pursuing the tendency of cycation between firms -twenty -one with a capital and microstty.

Recently, Bitcoin’s Pioneer Max Ciizer told Beincrypto that the corporations have copied the process of strategy to retreat BTC.

“To survive the corporations, they must imitate the process of strategy, they should ‘saylorize’ or die,” Keizer told Beincrypto.

For Max Ciizer, Corporations Coolp Drive Bitcoin adopting this strategy to $ 2.2 million per coin.

Meanwhile, Bitcoin Treasury Treasury Trends Regarding the firms adopting the Investor Enter Ecusains, the XYZ stock recorder of the block

Block stock (XYZ) pre-market trading. Source: Google Finance

Block stock (XYZ) pre-market trading. Source: Google FinanceQ2 returns of block except wall street forecasts

Beyond optimism around the bite-receiving blocks, the increase in XYZ stock price follows a positive Q2 income report in the east-market.

The report showed that the total revenue of the block has increased by $ 6.05 billion in Q2, with gross profit growing faster. More Cleoli, it rose from 8.2% to $ 2.54 billion, which was attributed to bitcoin-revenue from the cash app.

Blackberg reports that the block promoted its full-yarn profit Outlook after its Q2 income except for Wall Street’s predictions.

Based on the report, the block’s cache app lending products contributed to a strong growth in the strong growth in the lending products and the firm’s square merchant network.

Therefore, voting points to continue the confederation in the long -term value of the block’s fintech ecosystem and the long -term value of bitcoin.

Meanwhile, when the gross advantage of the block extended the year-on-year-year (YOY), its bitcoin holdings saw a revaluation loss of $ 212.17 million. Analysts have described it for a decline in the fair price of bitcoin.

This means that as the market price of bitcoin declined, the BTC holdings of the block became worth again.

The post block increases 10% pre-market because the expansion of Jack Dossei’s firm is the trend of Saylorization, which first appeared on the beincrypto.