On-chain data shows that capital flows and solana in bitcoin have been given in the last one week, which has been flexible for the atherium.

The feeling cap shows deviation between the atherium and bitcoin

In a new post on X, the on-chain analytics firm Glasnode has changed the cap for some assets in the Cryptocurrency sector. The “feeling cap” refers to a capitalization model that calculates a giant coin value by assuming the ‘correct’ value of each token in the circle, the spot value he was involved in in the final transaction.

In short, the indicator that indicates is the total amount of capital which has been a complete storing by investors of cryptocurrency. Changes in its value, therefore, correspond to the flow or outflow of capital.

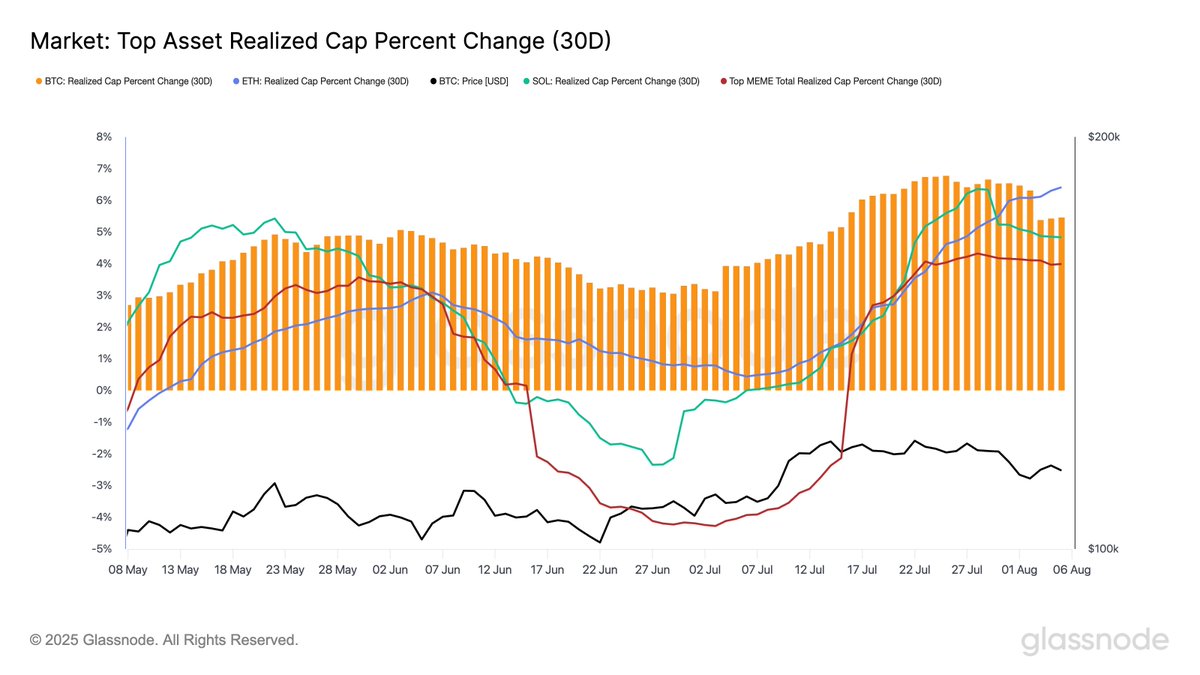

Below is the chart shared by Glasanode that reflects a 30-day percentage change in the realization cap for some different digital assets.

Looks like the trajectory of the metric hasn't been uniform across the sector in recent days | Source: Glassnode on X

From the graph, it appears that the monthly change in the realization cap is currently positive for bitcoin, atherium, solana and top memcoin. This shows that the capital has been washed away in the last 30 days.

Thought, which is true, BTC and Sol are showing a change in short words. A week ago, the cap channel realized for them was 6.66% and 6.34% respectively. But today, the value of the metric is 5.46% and 4.84%. Still notable positive, of course, but refers to a recession in life.

Interestingly, these two tokens have seen this trend, ETH has felt the cap with a percentage change from jumping from 5.32% to 6.41%. This may be an indication that capital is moving in token number two by market cap from other assets.

The top meme-based tokens have seen a flat trend in the indicator in the last week, according to the Elitics firm, there is another sign of “Cooling Risk Aptite”.

In some other news, both the largest and smallest of investors on bitcoin networks are recently accumulated at the same time, as Glasanod has posted in another X post.

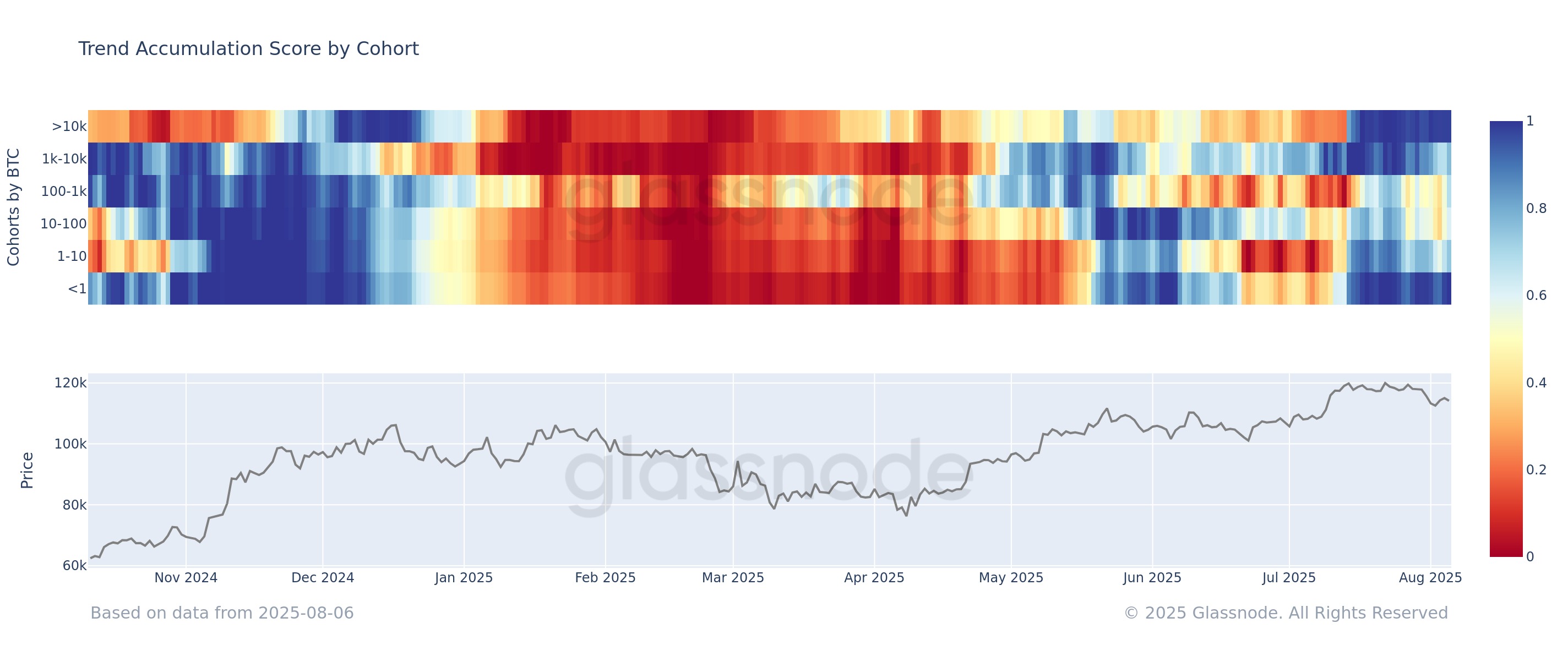

The trend in the BTC Accumulation Trend Score for the different cohorts | Source: Glassnode on X

In the chart, the data of the “accumulation trend score” is shown, which tells us what bitcoins are depositing or distributed to investors. The value of close to 1 implies the major purchase, while a value is suggested to sell a value for 0.

As is clear from the graph, the value of the metric is below 1 BTC and is very close to 1 for 10,000 BTC investors. “It suggests a recent initial dip of improvement,” the Elletics firm said. He said, Glasanod also captioned that the signal was lagging behind, the investor behavior has become smooth at the 15-day window.

BTC Price

At the time of writing, bitcoin

The price of the coin seems to have been up and down over the last few days | Source: BTCUSDT on TradingView

Dall-e, Glassnode.com specially displayed image, chart from tardingview.com

Editorial process Focus on giving well, accurate and fair content for bitcoinists. We maintain strict sourcing standards, and each page undergoes hardworking review by our team of top technology experts and experienced editors. This process ensures the integration, relevance and value of our content for our readers.