In August 2025, the mining distribution of bitcoins increased by all time of 127.6 trillion.

However, despite the increased technical challenge, mineral profitability is quietly climbing, a rare dynamic analysts say Bitcoin (BTC ($ 114,336.00) is a new phase familiar in the market cycle.

Bitcoin mining difficulty hit record high

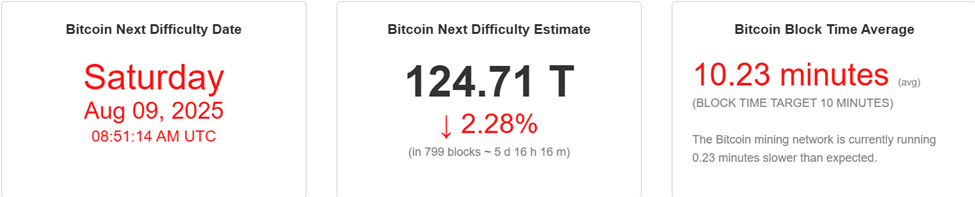

The next mining expected on August 9 is processed to reduce the metric to approximately 124.71 trillion.

Bitcoin mining difficulty. Source: Coinwarz

Bitcoin mining difficulty. Source: CoinwarzThe purpose of this adjustment is to bring back the average block time below 10 minutes and 23 seconds to a target of 10 minutes.

These periodic renovation are fundamental for bitcoins. They continue to release and maintain network stability despite the flow in the hash rate.

The discrepancy, how, is that high bitcoin mining differences have not translated into the margin squeezed for miners.

Quite opposite, network data showing network data has reached after a later peak of $ 52.63 million per exhalation.

Bitcoin Minor Revenue. Source: Yccharts.com

Bitcoin Minor Revenue. Source: Yccharts.comYCart.com analysts indicated, “Bitcoin Minors Revenue is at a current level of 52.63 meters per day, tomorrow 56.35 meters below 56.35 meters and 25.64 meters ago.”

This is a strange sign, looking at the rising energy cost and a competitive competitive mining playground.

In a recent post, Bitcoin Mining Analytics firm, Blockware Intentaliz highlighted this deviation.

“The bull case for bitcoin mining? Growing,” the firm said in a rented post.

Growing Benefits Margin Signal Bulish Shift

Historically, such a dynamic, where the price of bitcoin grows faster than the mining difference, has rapidly taken the early stages of market cycles. Similar patterns were seen in 2016 and again in mid -2020, which were before the major price rallies.

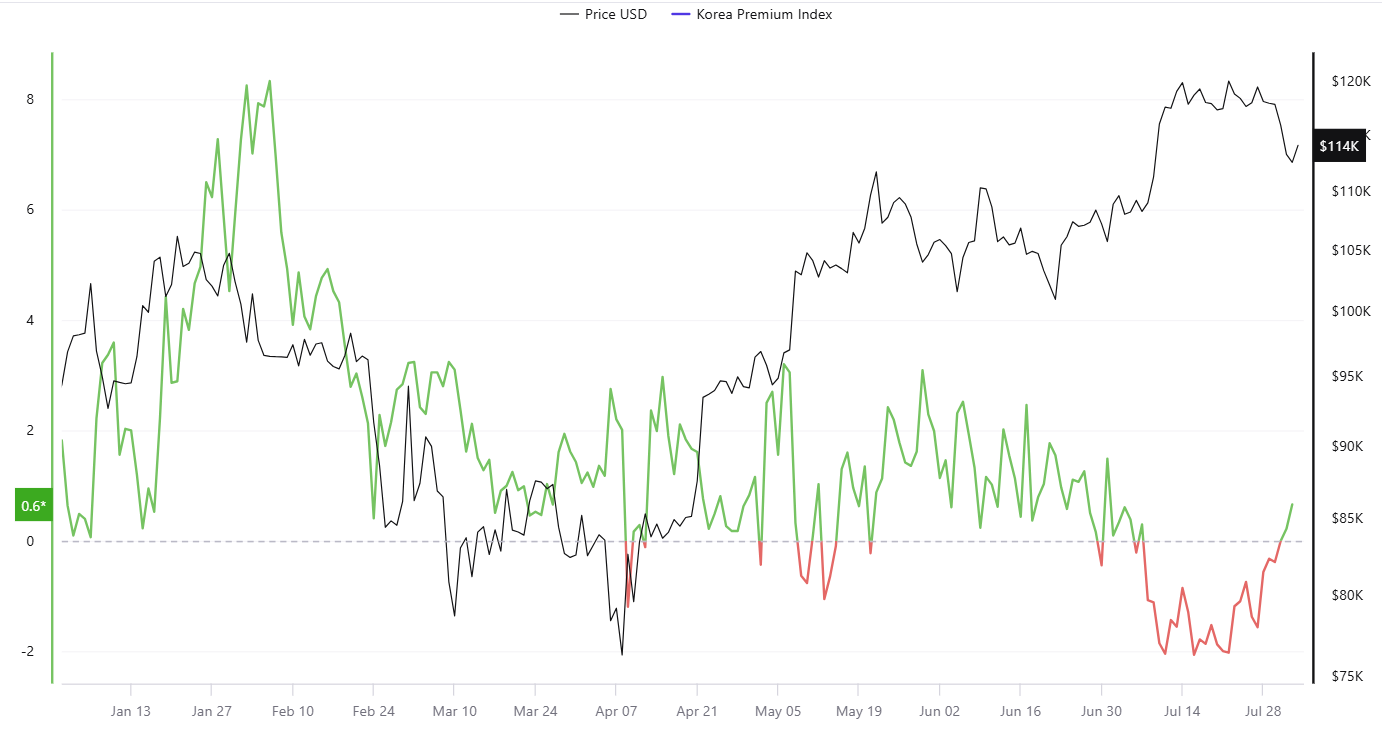

Increasing profitability also reflects the dynamics of deep demand, with data +0.6%showing the current kimchi premium in South Korea. No, it indicates a strong regional appetite for BTC.

Korean Kimchi Premium. Source: Cryptoctive

Korean Kimchi Premium. Source: CryptoctiveKimchi premium represents the price difference between local exchanges and global spot markets.

Such asic paired with the deployment of ASIC machines and growing instant mining investments, suggests that the mining area is both healthy and optimistic about the medium evolution of bitcoin.

Beyond the minor margin, there is a lack of bitcoin. More than 94% of the total 21 million BTCs were already mined, the stock-to-lo of the pioneer crypto is now at around 120, which is looking at gold.

This long -term scattering botcoins keep the bitcoin as a hedge against inflation and monetary disintegration, even under the form of short -term value action.

Nevertheless, the broad market is to be explained in the network of reforms. After the heights of July, the bitcoin returned to the levels, flew $ 115,000, indicated on-chain technical health and a temporary decouling between the investor provincial.

Bitcoin (BTC) Price Performance. Source: Beincrypto

Bitcoin (BTC) Price Performance. Source: BeincryptoThe specialty of analysts is, meanwhile, the miners appeared to be growing in front of the rest of the market.

The combination of growing separate, growing margin and strong regional demand marks a twist point in mining economics and broad cycles of bitcoin. If history is sung, the increasing strength of the network may soon resonate in the price.

The post bitcoin mining is more difficult than ever – so why are the miners smiling? First appeared on the beincrypto.