The bitcoin network is expanding on an industrial scale, in which the flow of transactions for a trickle for an unprecedented high phenomenon with electric-flesh mining riveting energy consumption. Nevertheless, the network seems under stress as the growing and infrastructure collides with weak revenue and rare mempool, it is said that leaves earn slightly beyond the block subsidy.

Summary

- Bitcoin’s mining network year.

- The Gomining Institutional Report depicts an ecosystem where the deployment of hashrates and hardware continues to climb, but the fee is revenue and over -wide activity subdood, which leads to a melt between network scale and minor income.

- Observers say that this imbalance can occur for years, depending on a low block subsidy with operators that reduces half every four years, the last bitcoin is mined for some time around 2140.

Bitcoin (BTC) network is entering a phase of striking contradictions: its appetite for electricity is increasing, which is suppressed by the Economic Award for Miners Floor Transaction Activity. A new report by institutional institution seen by Crypto.news accelerates energy use, mute mining separately, and a landscape of an unusual cool on-chain environment, which enhances a Baouth how durable the current trajectory can be.

According to the report, the network has been the estimated energy consumption world of the network, which researchers described “an acting”. Drawing on data of coinmetrics labs, Gomining notes that use bitcoin mining power increased from 15.6 GW (GW) in January 2024 to 24.5 GW in January 2025. 33.1 GW, more than 100% increase in only 17 months.

The report said that most of the surgery is concentrated in the early part of 2025.

Industries Enlies quoted in the report that Altahuduel Mining Rigs are more efficient than ever, their spread is overshadowing these benefits. The report said, “The benefit of efficiency at the machine level is being offered rapidly by the hesting quantity of the hardware deployed,”

Stest declines since 2021

Quick energy use comes as a network of mining difference – how difficult it is to verify new blocks is an indicator – comparatively subdued. The first half of 2025 saw 13 difference adjustments, with a 109.78 trillion to 116.96 trillion by the end of June at the beginning of the MT. It only represents a year-on-year growth of 6.54%, with a monthly monthly clamp of 1.09%.

Report frames this recession against the rapid expansion of 2024, when Saudi rose 4.48% per month. In 2025, the cool relative was punctured from the moments of volutality: 6.81% upwards on 5 April and increased by 4.38% on May, but that peak quickly gave a SARP reversal way.

By the end of June, summer waves in North America forced some operators to limit activity, sent down the hasht by 147 EH/S. The report stated that the inter -7.48%of bitcoin’s difference since July 2021, the decline in the station, “reports in the report.

If the power draw of the network is climbing, the layer of its transaction tells the opposite story. On-chain activity 256,000 confirmed the transaction on 1 June.

That weakness has translated a low fee in history. Throughout the year, users have been absent to broadcast transactions at a bare minimum fee per virtual byte 1 Satoshi, regardless of priority. “During the H1, there were several occasions during the transaction – regardless of the level of priority – only 1 set/VB’s bare minimum fee,” the report said, “for the minimum fee of only 1 set/VB, height can do blockspace across the network.”

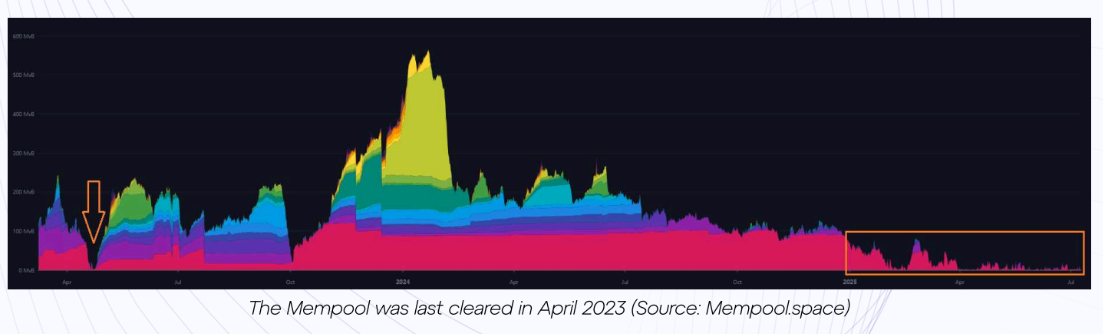

Ghostly mempool

The environment has produced a rare event: a first clear memool. Mempool – A waiting area for unconfirmed transactions – the beginning was first vacated twice in 2025 in two years. The final comparable phenomenon was in April 2023, when Ordinals and BRC -20 token activity had not yet performed block space for current criteria.

When the mempool is cleaned, the report notes, the miners briefly worked on the block subsidy “almost no transaction fee,”. It underlines one of the long -term economic questions of dynamic bitcoins. As the fixed subsidy does about half every four years – the disap eventually failed – the network would rely on the transaction fee to maintain miners. Low-fee environment, while users are welcome, operators may already struggle with energy costs.

For bitcoin miners, stress between rising electricity demand and thin revenue is getting harder. Excessive heat in major American mining areas has demanded the delicateness of theusht under environmental pressure. Meanwhile, from the beginning of 2024, the infrastructure on double the infrastructure of network energy consumption indicates that transaction activation or faster scaling compared to fee income.

Industry supervisors suggest that the contradiction may remain. The mining firms continue to deploy energy-erosion fleet to secure the network and capture the block rewards, but their long-term economics are designed to facilitate block space, and the speed of the halwings program programmed by bitcoin, which is expected to continue almost every four years when the final BTC is expected to continue every four years.