On Tuesday, the Bitcoin Exchange-Trad Fund (ETF) launched four of its Fouth Consentant outflows, marking the longest streak of withdrawal since April.

This continuously reflects the recession in the spirit of the capital withdrawal market, which may reduce the price of BTC ($ 114,076.00) in near terrorism.

Bitcoin ETF is the top of $ 1 billion in 4 days as institutional bulls retreat

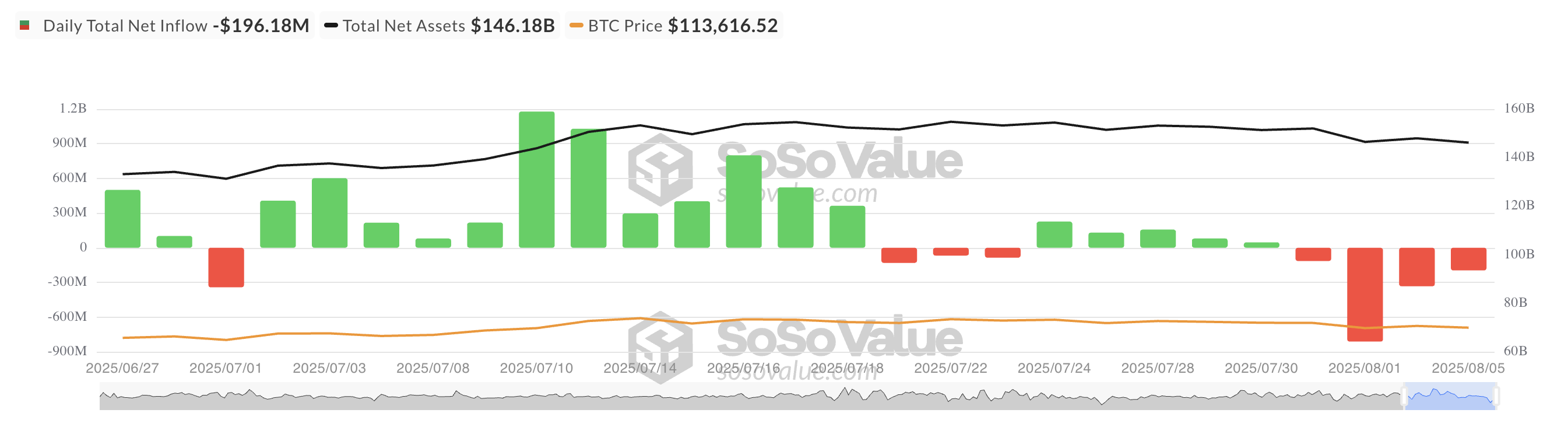

The four -day Suloff at ETFS indicates a weak inclusion among institutional investors who now look for their bitcoin exposure. According to Sosovalue, pure outflows from these funds have encouraged $ 1 billion in the last four days.

Tokens for TA and Market updates: Want more tokens insight in this way? Sign up for the daily crypto newsletter of editor Harsh Notaria here.

Total bitcoin spot ETF net inflow. Source: Sosowalu

Total bitcoin spot ETF net inflow. Source: SosowaluThis is an important developer as BTC’s recent Rali gave a large-scale fuel by the Act of these similar investors in a new all-time high of $ 122,054.

In July, Spot BTC ETF brought more than $ 6 billion in capital flow, helping the dryer to be higher. Their pullback now suggests a lack of institutional support, a change that weighs heavy weighs over the cryptocurrency of the price in the near period.

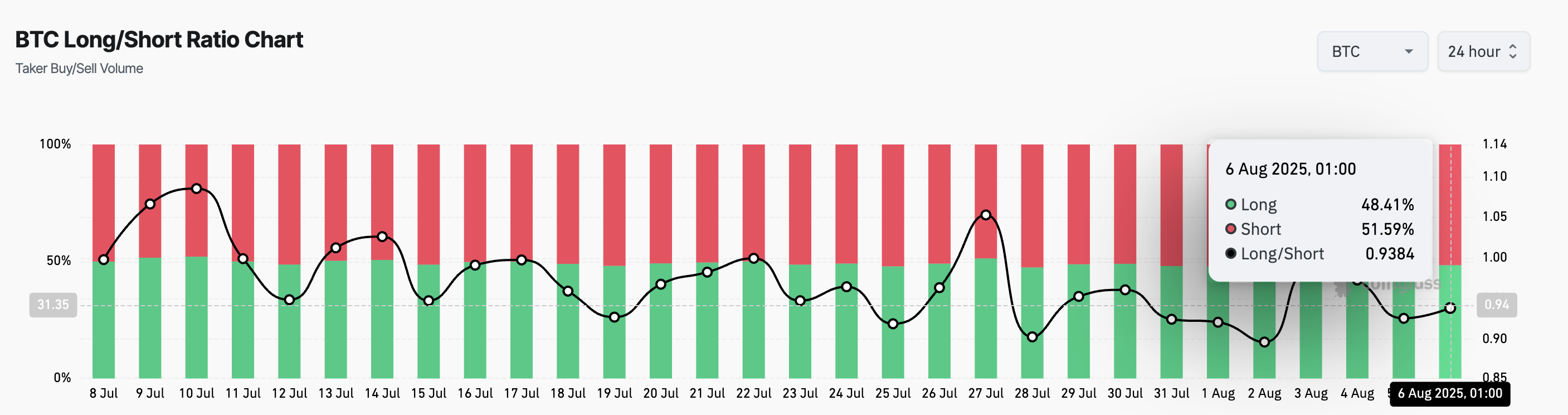

In addition, on-chant data also highlights the turn of the recession. It is reflected by a long/short ratio of the coin, which sits at 0.93 in the press time.

BTC long/short ratio. Source: Curring Class

BTC long/short ratio. Source: Curring ClassLong/short metric measures the ratio of long stakes for shorter people in the futures market of an asset. The ratio above one indicates a longer position than the less on. This indicates a rapid feeling, as most traders expect an increase in the value of the property.

On the other hand, with a leading coin, a long/short ratio below one means that more traders are hoping to grow at the price of the property to declare it.

BTC has a target of $ 111,000

The reading from the price phase of the Daily Chart Show BTC blows its permanent stop and reverse (SAR) indicator. Currently, dots that include indicators are at $ 118,086 above the price of BTC.

The permanent SAR indicator of a property and inverted. When these dots are under the price of a property, the market is looking at the speed of faster, and its value includes the couch to grow girls on buying Acients.

Conversely, when it remains above the price of an asset, it indicates a possible dowstrend amidst climbing under sales pressure. If this continues, the price of BTC can be $ 111,855.

BTC price analysis. Source: TardingView

BTC price analysis. Source: TardingViewHowever, if the new demand enters the market, it can push the king’s coin towards $ 116,952.

Bitcoin’s post Auds appeared on beincrypto for the first time as the top $ 1 billion as an increase of $ 111,000.