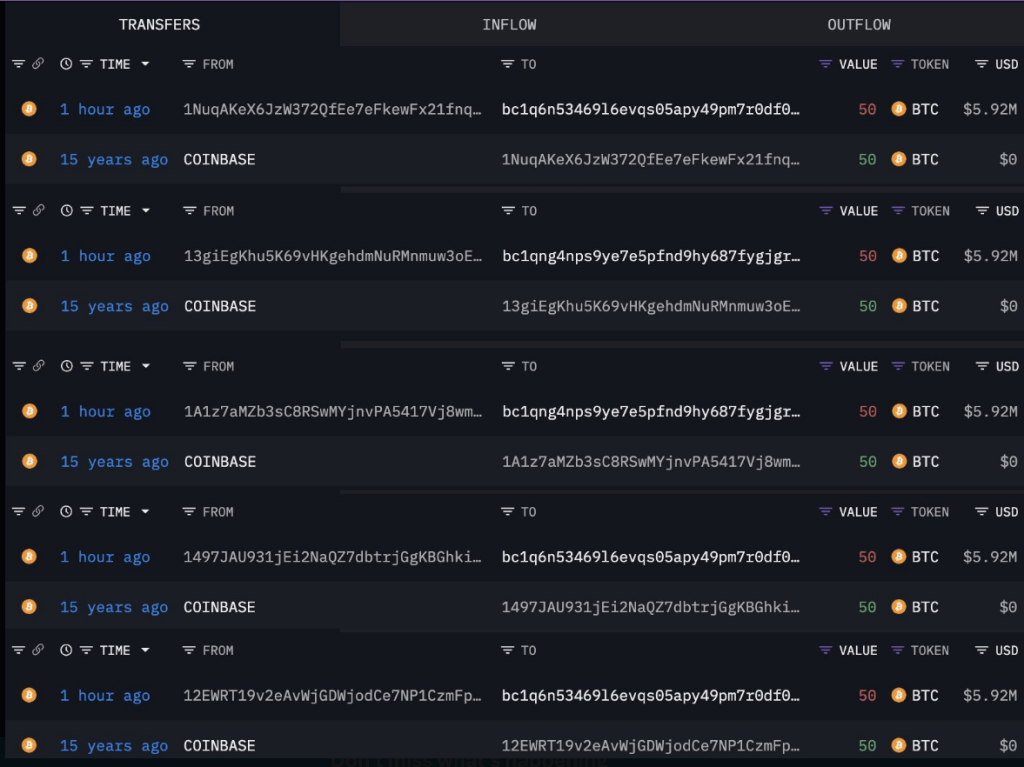

Five long -15 -150 bitcoin wallets returned to life on 31 July, furthering a total of 250 BTC ($ 113,663.00), which is money on 26 April 2010, which is duying the early tests of bitcoin. The traders saw and stopped the innings, wondering if a large-scale self-inoff was working after a silence of more than 15 years.

Early coins stir

For on-chain supervisors, these coins came from active walllets before the famous “Patoshi pattern” finished. The pattern, often connected to the manufacturer of bitcoin, slowed around May 2010.

About 250 BTC made a splash in today’s headlines. Yet the circulating supply of bitcoin tops 19 million coins. So far, the funds have shown on public exchanges. This means that any real effect on prices can be reduced -coins suddenly to get out in the snow.

5 Minor Wallets woke up after being over 15 years and transferred 250 $ BTC ($ 29.6m) before one -AAR.

These minor wallets earned BTC every $ 50 from mining on 26 April 2010.

Batu: 1nuqakex6jzw372Qfee7efx21FNQD3 12wrt19v2evWWWWWWWWWJDWJDWJODCE7NP1CZMFPHT … pic.twitter.com/vgtae6mxy

– Lukanchain July 31, 2025

Traders and analysts have started monitoring the addresses remembering BTC. If they begin to make a wallet exchange or funnel in the over-the-counter desk, nervousness can spread.

But wallet reshuffle without selling is common among early miners who want to strengthen their safety or upgrade.

Clues indicate away from Satoshi

Based on the reports, with which the alert, it does not match the nonsus patterns tied to about 1.12 million BTCs in the motions, once mined by “Satoshi Nakamoto” by “Satoshi Nakamoto” by “Satoshi Nakamoto”.

Mining speed and nonsus range experts are not associated with the manufacturer of bitcoin. This makes it more such as these funds belong to other early adoptors.

Custon Crypto Rules

Meanwhile, reports have revealed that Japan’s Financial Services Agency (FSA) has created monitoring of Crypto-asset exchanges in a more powerful unit.

Its purpose is to tighten the rules, guard against impropstal checks and money-laundering. This change brings the crypto platform under the same investigation as banks and brokerage.

Coins running since 2010 have always raised eyebrows. Nevertheless, 250 BTC bitcoin has a drop in the ocean. And with a clue pointing away from Satoshi, the market can close it until the funds hits exchanges.

Japan’s new rules suggest that the regulators still do not stand – they are making sure that crypto firms are barely found.

Meta specially displayed image, chart from tradingview