Solana (Sol ($ 163.25)) posted some of its string on-chain matrix in the last several weeks. However, the major holders are not clinging around to celebrate.

On the one hand, Solana is a delivering record and on the other, Harders of bleeding. Is this a health rotation or smart money cover cover?

Solana on-chain grows, but he is quietly selling Sol

In July, for Solanflur, the network hit a new all -time high in a monthly non -ordered transactions. True Transaction visited 1,318 per second (TPS), which is the highest ever.

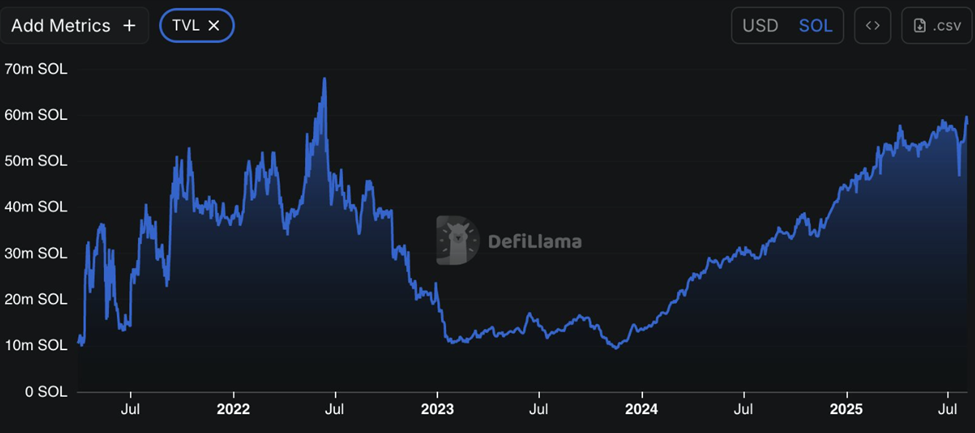

At the same time, the Defylama data suggests that Salana’s TVL (total value lock) in the original soul words is now the highest in three years. This indicates to increase viscosity between users and DEFI protocols.

Solana TVL in native soul words. Source: Defilama

Solana TVL in native soul words. Source: DefilamaDespite this, behind the curtain, big holders or whales are destabilizing millions of people in Sol and sending them to the Benance Exchange.

Lukanchen flagged off the Galaxy Digital at a price of $ 250,000, and transferred it to the bank on Wednesday, August 6.

Another whale, tracked by onchain lens, soul worth $ 4.9 million after two months of inaction.

After four years of staking, the same address has quietly exceeded $ 30 million in Sol in recent months. The whale still has a large part of $ 179 million in the staked soul, but the cell press is growing.

So, what does it give? Solana’s spotlight revolves out of whale hyperlicid theft

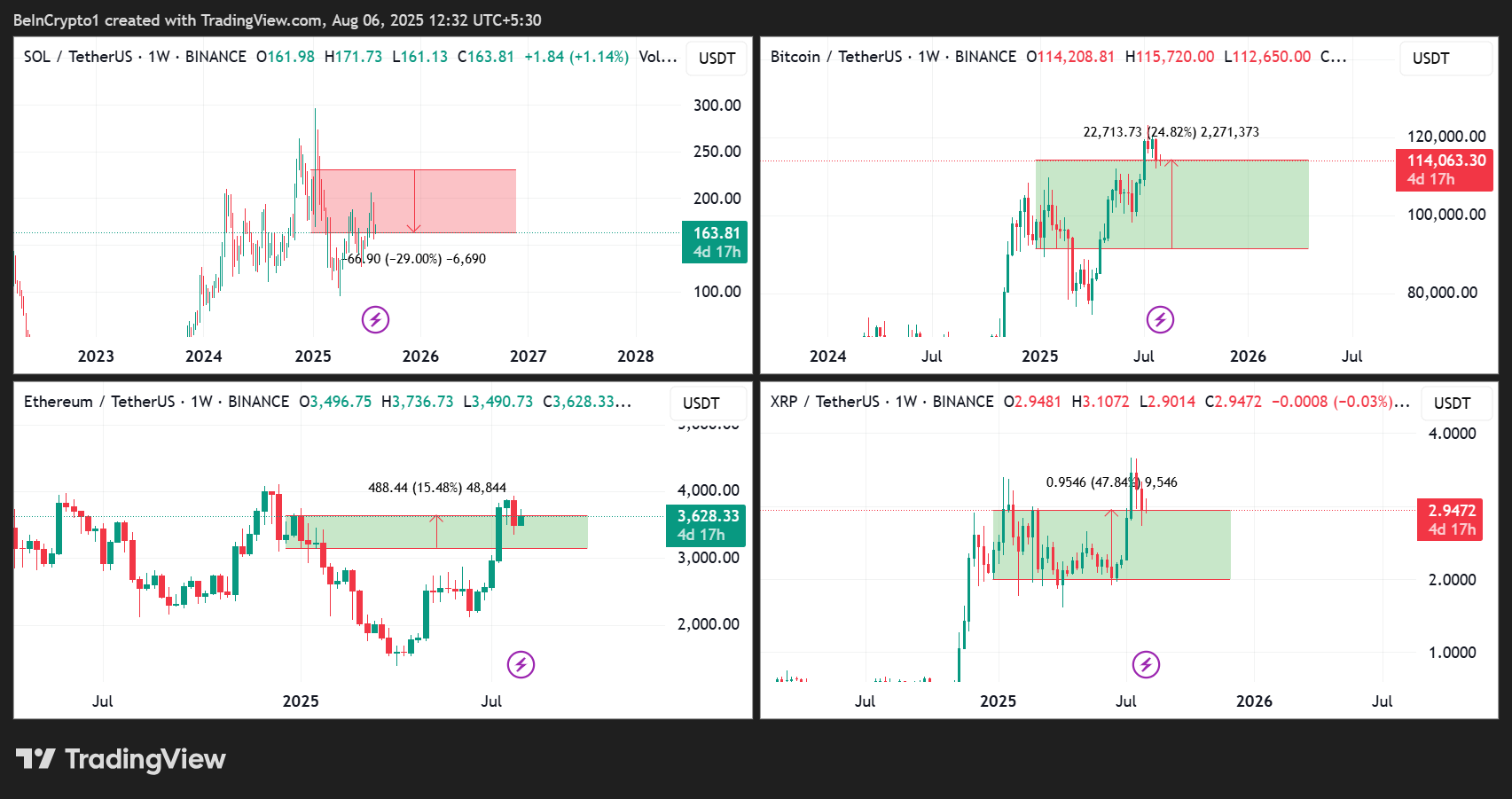

Despite the impressive action, the price action of the sol has been reduced. Year-by-Tarikh (YTD), the solan value is 30%below, which is BTC ($ 113,955.00) 26%, Eth ($ 3,623.66) 15%, and XRP ($ 2.93) 48%.

USDT ($ 1.00), BTC/USDT, Eth/USDT, and XRP/USDT Price Performing “Class =” WP-Image-727706 “SRCSET = SRCSET = SRCSET = “https://beincrypto.com/wp- Content/uploads/2025/08/XRPUSDT_2025-2025-2025-2025-08-06_10-10-14.png 1705w, 1705w, 1705w, https://beincrypto.com/wp- Content/uploads/2025/08/XRPUSDT_2025-2025-2025-2025-2025-06_10-10-14-360×190.png 360w, 360w, 360w, 360w, 360w, 360w, 360w, 360w, 360w, 360w, 360w, 360w, 360w, 360w, https://beincrypto.com/wp- Content/uploads/2025/08/xrpusdt_2025-2025-2025-2025-08-08-06_10-10-10-14-8502-14-850×449.png 850W, 850W, 850W, https://beincrypto.com/wp- Content/uploads/2025/08/XRPUSDT_2025-2025-2025-2025-2025-2025-06_10-10-14-768×406.png 768W, 768W, 768W, 768W, 768W, 768W, 768W, 768W, 768W, 768W, 768W https://beincrypto.com/wp- Content/uploads/2025/08/XRPUSDT_2025-2025-2025-2025-08-06_106_10-14-14-14-14-14-14-14-14-14-14-1536×812.png 1536w, 1536w, https://beyncrypto.com/wp- Content/uploads/2025/08/XRPUSDT_2025-08-08-08-08-08-08-06_10 -10-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-15

USDT ($ 1.00), BTC/USDT, Eth/USDT, and XRP/USDT Price Performing “Class =” WP-Image-727706 “SRCSET = SRCSET = SRCSET = “https://beincrypto.com/wp- Content/uploads/2025/08/XRPUSDT_2025-2025-2025-2025-08-06_10-10-14.png 1705w, 1705w, 1705w, https://beincrypto.com/wp- Content/uploads/2025/08/XRPUSDT_2025-2025-2025-2025-2025-06_10-10-14-360×190.png 360w, 360w, 360w, 360w, 360w, 360w, 360w, 360w, 360w, 360w, 360w, 360w, 360w, 360w, https://beincrypto.com/wp- Content/uploads/2025/08/xrpusdt_2025-2025-2025-2025-08-08-06_10-10-10-14-8502-14-850×449.png 850W, 850W, 850W, https://beincrypto.com/wp- Content/uploads/2025/08/XRPUSDT_2025-2025-2025-2025-2025-2025-06_10-10-14-768×406.png 768W, 768W, 768W, 768W, 768W, 768W, 768W, 768W, 768W, 768W, 768W https://beincrypto.com/wp- Content/uploads/2025/08/XRPUSDT_2025-2025-2025-2025-08-06_106_10-14-14-14-14-14-14-14-14-14-14-1536×812.png 1536w, 1536w, https://beyncrypto.com/wp- Content/uploads/2025/08/XRPUSDT_2025-08-08-08-08-08-08-06_10 -10-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-14-15The biggest drakes on Solan’s story are hyperlicid dex. Following a significant period as an undisputed hub for on-chain trading, Solan has lost the ground for the peritual product of hyperlicid, which is among the power users.

“Hyperlicid was able to occupy the speed of solana … because it offers a simple, highly functional product,” Matthew Sigel said, the head of digital assets research in Viak.

Meanwhile, Tech Roadmap of Solana hit unrest. To replace high -performance clients, firades, throwput and Reliance, failed to take over time.

Its internal drama, developer department and public disputes have denied confidence. For Sigal, why ambiguity can occur, why walk out, even chain data flash faster.

Nevertheless, not every big wallet is coming out. Analyst Ted highlighted a large -scale procurement of $ 12 million on Benance, which was restored for Kamino Finance, buying some whales dip.

Meanwhile, Solana still claims unmatched speed, and the ecosystem matches the coins of the meme. However, institutions and serous capital require stability and confidence, two things Solana’s engineering roadmap is not completely safe.

“Solana should focus not only around its ability, but also about its long -term stability,” Sigel said.

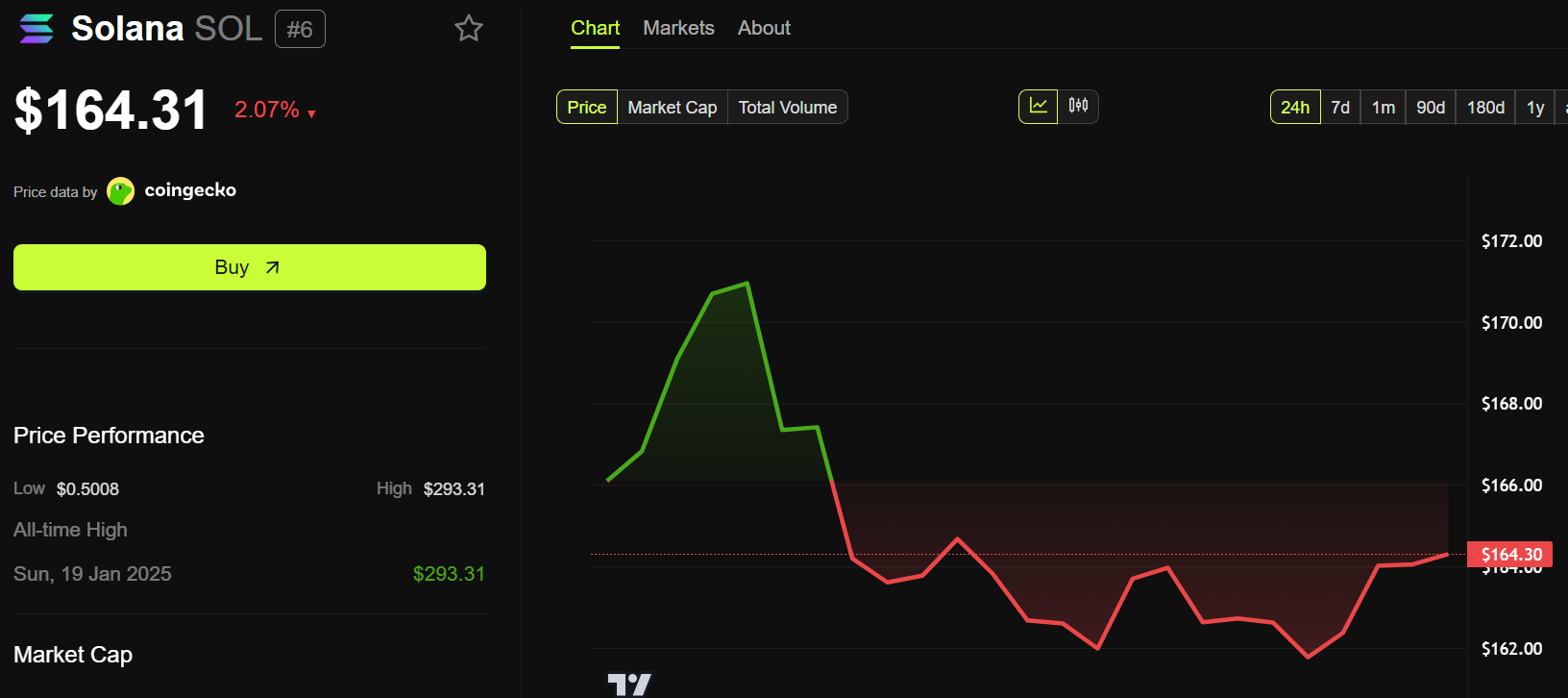

Solana (Sol) Price Performance. Source: Beincrypto

Solana (Sol) Price Performance. Source: BeincryptoAs this writing, Solana was trading for $ 164.31, more than 2% in the last 24 hours.

Post for Solan Activity appeared on Beincrypto for the first time to proceed in $ 70 million in Sol till the all-time high-a-reasons.

Breaking: Monthly non-separated transactions on @Solana hit a new all-time high in July. True TPS also averaged 1,318, the highest recorded. pic.twitter.com/MPQNEXDCGY

Breaking: Monthly non-separated transactions on @Solana hit a new all-time high in July. True TPS also averaged 1,318, the highest recorded. pic.twitter.com/MPQNEXDCGY