On-chain data suggests that Atherium Daily Active Address Matric has recently shot. Here this couple means for cryptocurrency.

Atherium daily active addresses near the highest level in 2 years

Casabint for data from institutional Defi Solutions Pravarthi Sentora, Ethereum Blockchain has recently seen activity light. “Daily Active Address” is an on-chain indicator that keeps track of total number of total addresses that are participating in any kind of transfer action every day.

When the value of this metric increases, it means that a large number of users are making films on the network. Such a tendency implies that business interest in cryptocurrency may increase.

On the other hand, indicator observation suggests a drop that investor activity is going down on blockchain. Such a trend may be a possible sign that the attraction is getting away from the property.

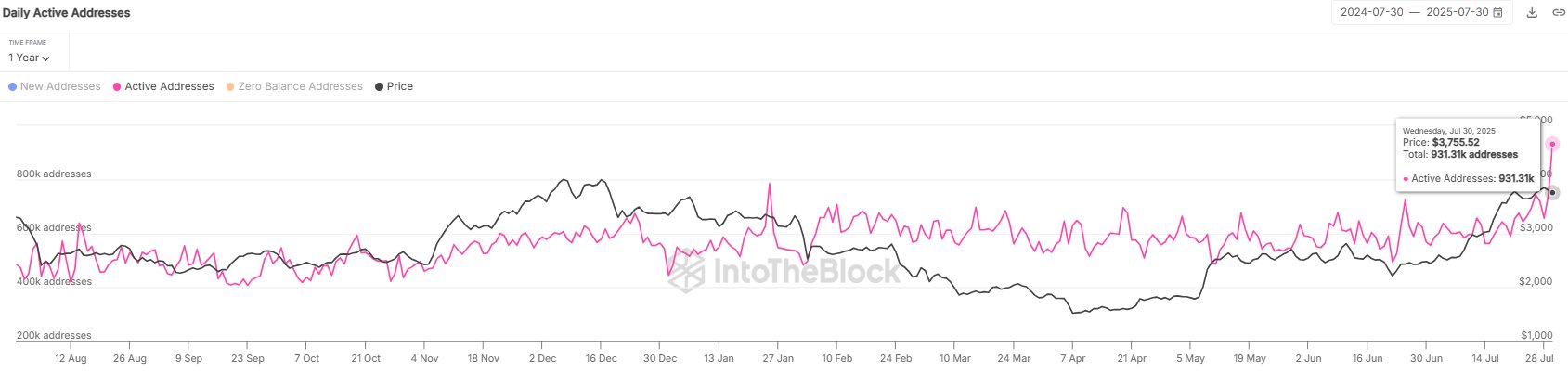

Now, here is a chart that shows the day in the daily active address for the atherium in the last one year:

The value of the metric appears to have shot up in recent days | Source: Sentora on X

As displayed in the above graph, the atherium daily active address saw the deviation over its recent consolidation level of 600,000 with the latest rally, reflecting the value broth interest in the asset.

Interestingly, the trend has accelerated in the last fees, in which the indicator records a sharp spike. This rapid growth has reduced its value to 931,310, which is the highest daily level in about two years.

Historically, high transactions from users have been a precursor to activity Valtiness. Any price action exiting the trading can go on the path, because there is no information about what to buy or send in the daily active address, that the inventors are making motors.

This appearance wants Spike may have led the instability this time at the atherium daily active address, as the price is posted by the cryptocurrency of the price.

In some other news, StableCoin USDT has revealed the scene to its 30-day moving average (MA) Transfer Volume Recverver.

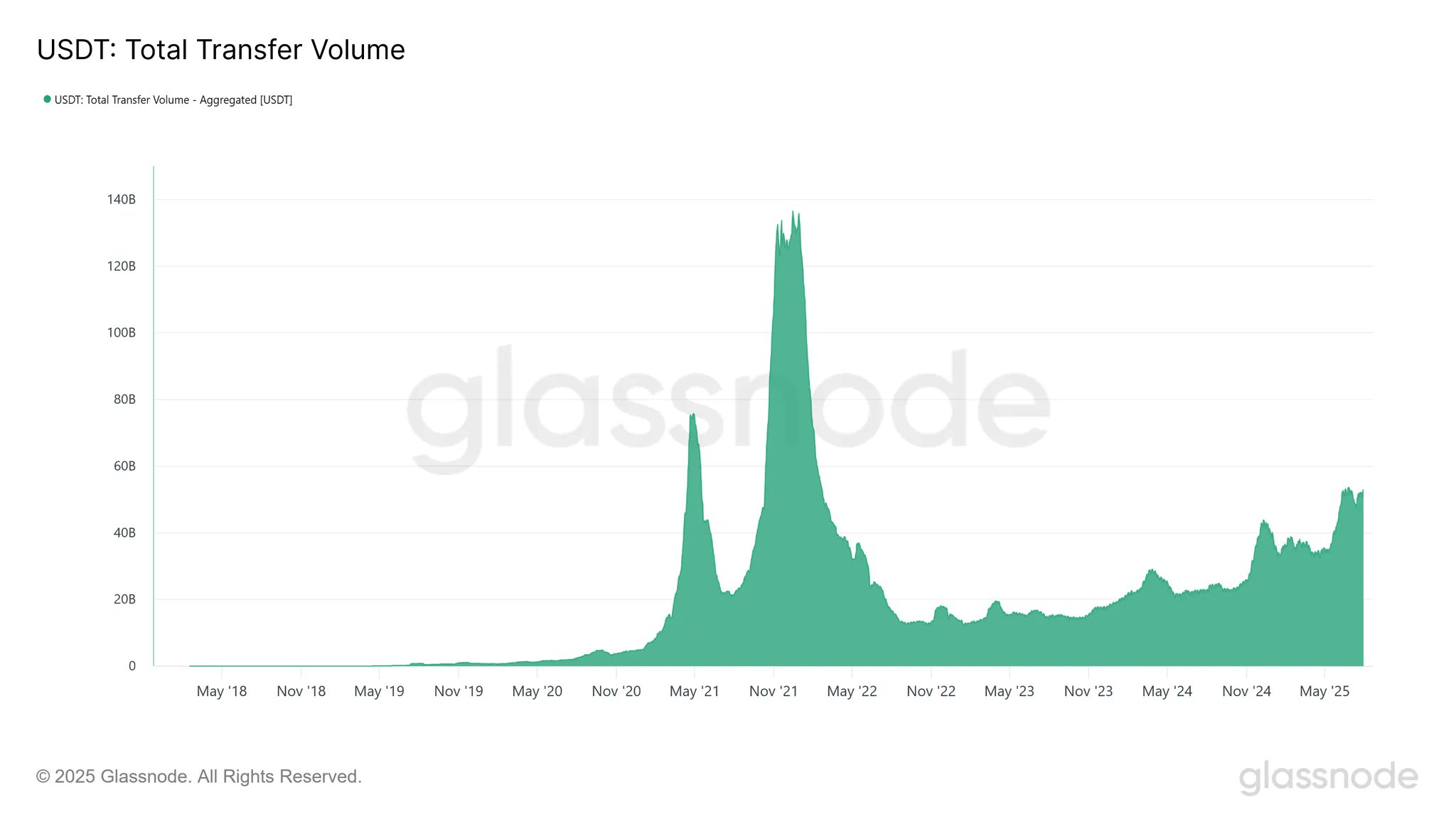

The trend in the USDT transfer volume over the last few years | Source: Glassnode on X

As displayed in the above graph, the 2022 accident has been recalling USDT transfer volume Stadley since the accident. “This gradual climb reflects a slope, but is involved in stabcoin velocity and market activation,” notes the glansode.

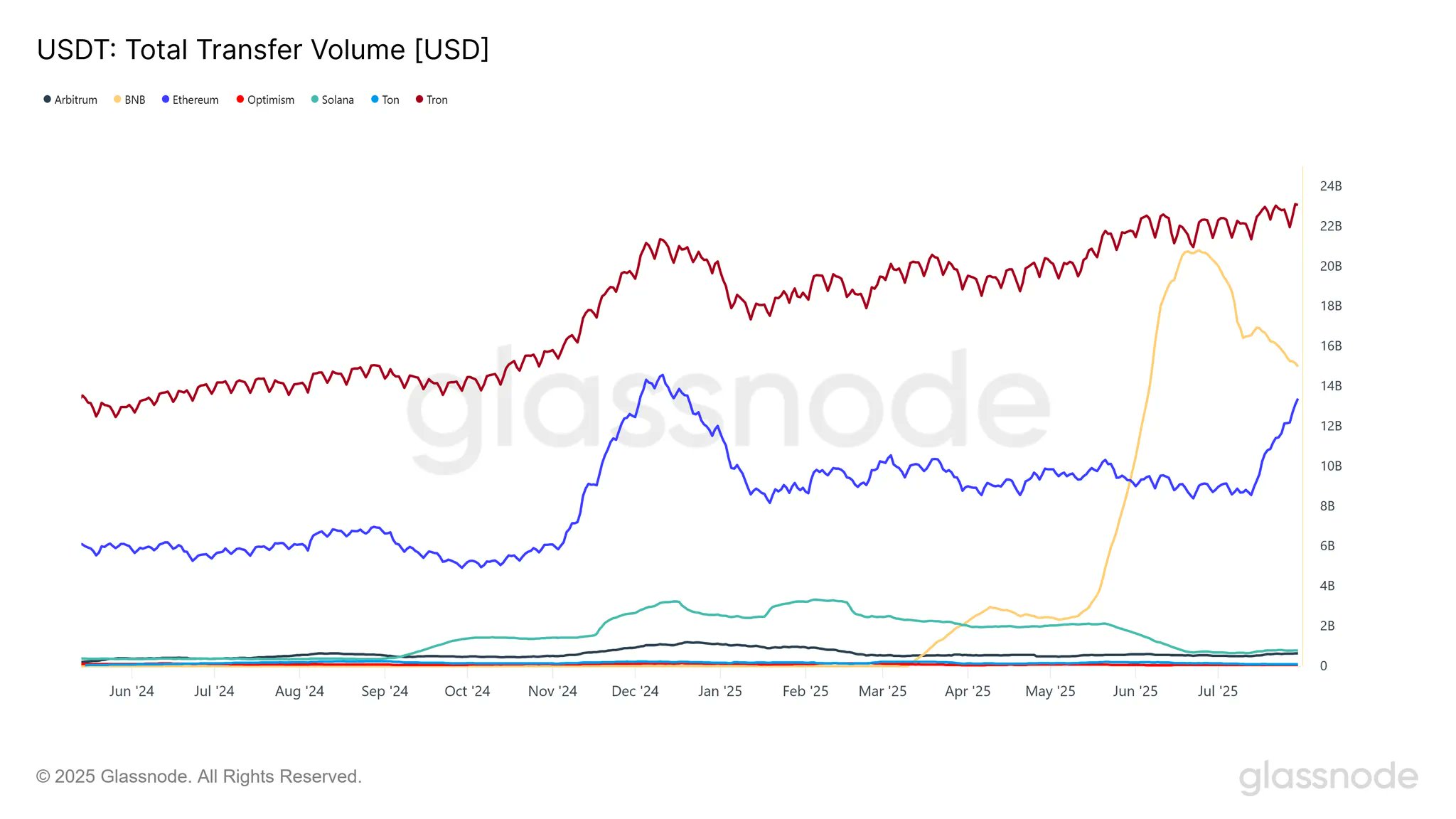

Interestingly, Ethereum has not been among the top two networks that share in the amount of stable.

The data of the USDT Transfer Volume across major networks | Source: Glassnode on X

Tron and BNB are two networks leading in USDT volumes, with metric $ 23 billion and $ 14.9 billion respectively.

Result price

At the time of writing, Etreum has been trading around $ 3,650 below 3.5% in the last 24 hours.

Looks like ETH has just taken a hit | Source: ETHUSDT on TradingView

Special image of chart from Dall-e, Glassnode.com, Intotheblock.com, TradingView.com

Editorial process Focus on giving well, accurate and fair content for bitcoinists. We maintain strict sourcing standards, and each page undergoes hardworking review by our team of top technology experts and experienced editors. This process ensures the integration, relevance and value of our content for our readers.