Bitcoin is showing symptoms of gathering strength after a week of movement in side, with two key on-chain indicators indicate on a photo.

Summary

- The MVRV ratio of bitcoin is moving towards its 365-day MA, a pattern rallies after history.

- The futures market shows signs of cooling, suggests a healthy, low speculative BTC Rali.

- Technical indicators show consolidation near support with a powerful breakout browing.

31 July In Anlisis, the cryptoctive contributor indicates the coincidence for a clear price ratio for the market value, which currently sits at 2.2 and is turning towards its 365-day moving averages. Historically, such a period of convergence often occurs before the bitcoin (BTC) rallies, as the metric 3.7 climbs towards the overvival zone.

Setups, coincidence notes, are similar to how the stock does not hover around long lasting average for Longor.

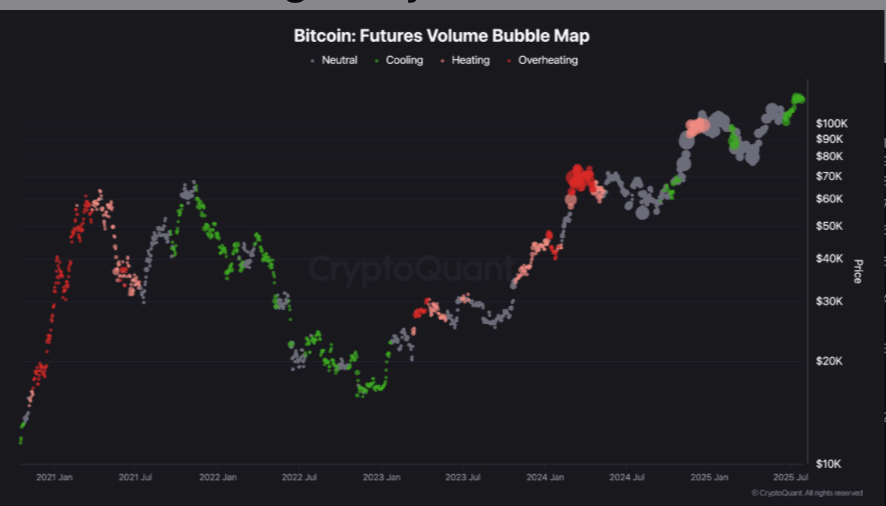

Bitcoin futures market cools

A separate July 30 analysis by Cryptoctive analyst Shainmarkets highlighted a cooling trend in the bitcoin futures market. Recently, despite BTC trading near $ 123,000, the volume bubble map shows a change in neutral and cooling areas more than the overdated red zone.

In a stable climb and speculative activity of bitcoin above $ 100,000, it indicates the market more than natural demand in the market, which knows the way for a fresh bulush bullshot trend.

With a seven-day ration of $ 115,184- $ 119,568, trading at $ 118,313 at the time of bitcoin writing, up to 0.1% for the day. Although it is still below its 14-time high of $ 122,838 below 3.7%, it is 10% above the previous month, indicating flexibility.

Bitcoin technical analysis

On the daily chart, Bitcoin is embracing the 20-day Bollinger band middle line, currently around $ 118,327, indicating moderate bullish pressure. They have compressed the bands in renovated sessions, which reflects the possibility of low voltality and breakout because compression often occurs before detail.

The relative power index is neutral at 59.32. Although it is not yet in the overbott area, it still shows some rapid mentum. The next step of bitcoin may depend on its ability to cross $ 119,900, which is the upper edge of its bowlinger band.

If this level is clear, it can be a channel for a fresh Rali and can be a thick for about $ 123,000. On the other hand, a breakdown below $ 116,700, the lower band border, the current will invaluate the faster the structure and open the door for a dehpar improvement.