Bitcoin (BTC) Mining Jugrant Mara Holdings today announced a successful completion of $ 950 million to offer zero-interest convertible senior notes. With a reminder allocated for the general corporate purpose, a portion of the procedures will submit the additional BTC.

Holdings killed to increase bitcoin exposure

Today, an annual, Florida -based bitcoin mining firm Mara Holdings said it has raised $ 950 million. It is worth noting that the deal was extended with an initial target of $ 850 million, Informed Last week.

No, the firm has provided a 13-day option to initial buyers to acquire $ 200 million in convertible senior notes. After accounting for the preliminary buyers exemption and commission, Mara found net procedures to the tune of $ 940 million.

Out of $ 940 million, about $ 18.3 million was used to dilute $ 19.4 million from future share conversions.

Remringing funds will be used for buying more BTCs and for other general objectives, such as strategic acquisition, working capital, extended to existing assets and repayment of counted loans.

To explain, zero-b-onion converted senior notes are loan securities that do not pay any interest, but can later be converted to the company’s shares. He is considered “senior” because he has a priority in repayment on other debates in the event of living life.

As CoyingcoMara currently holds 50,000 BTC, which costs about $ 5.9 billion on current market prices. It represents about 0.24% of the total circulating supply of bitcoin, which keeps it as a capital, with 37,230 BTC.

Today’s growth of $ 950 million is expected that Mara’s lead is more than twenty -one capital. However, the firm still fulfills Michael Siler’s strategy, dominating its blunt sheet with 607,770 BTC.

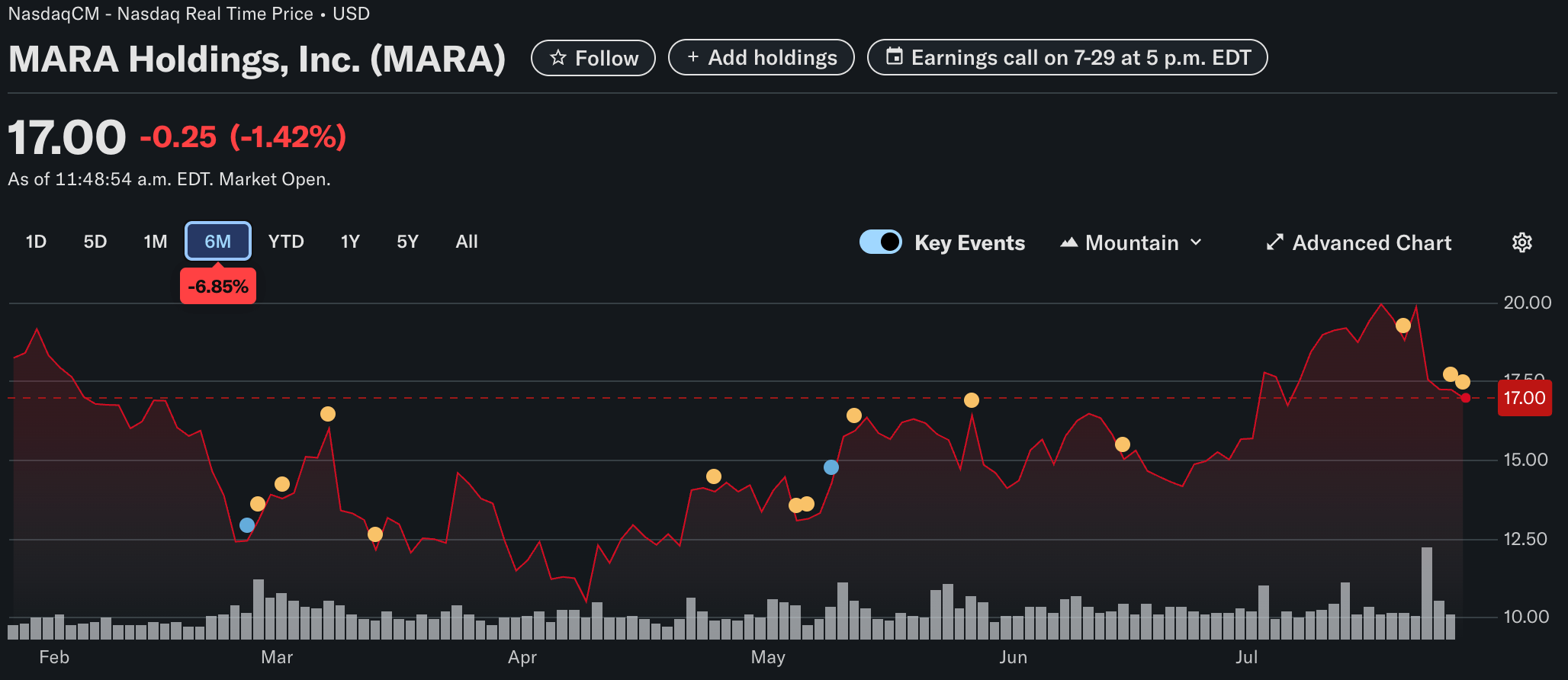

Shares of Mara Holdings recorded a minor pullback after the announcement, as they traded at $ 17 – 1.42% a day. No, NASDAQ-listed firm’s stock has declined by 6.85% in the last six months.

BTC French Corporates Corporates

Mara Holdings has had to increase its $ 850 million offer, showing a strong institutional interest in the world’s largest cryptocurrency by market cap. It underlines the recent trend of companies Allocation Important amount towards increasing their BTC holdings.

Earlier this month – 14 to 19 July – between 21 companies couple BTC of $ 810 million in his balance sheet. Some of the firms buying BTC, Metaplanet, ScientistAnd SequenceBetween Otthers.

The recent speed of bitcoin also helped this go ahead E-commerce giant Amazon in terms of total market cap. At the time time, BTC trades at $ 118,058, which is 0.6% below in the last 24 hours.

Image painted from Unsplash.com, Chart Yahoo! Finance from tardingview.com

Editorial process Focus on giving well, accurate and fair content for bitcoinists. We maintain strict sourcing standards, and each page undergoes hardworking review by our team of top technology experts and experienced editors. This process ensures the integration, relevance and value of our content for our readers.