key takeaways

- Tesla missed the billions in potential profits by selling 75% of his bitcoin holdings.

- The company’s early bitcoins sold with challenges

Share this article

Tesla Count made Arabs, if it was held on Bitcoin (BTC) Insta, when prices crashed in 2022 to sell its wholesale.

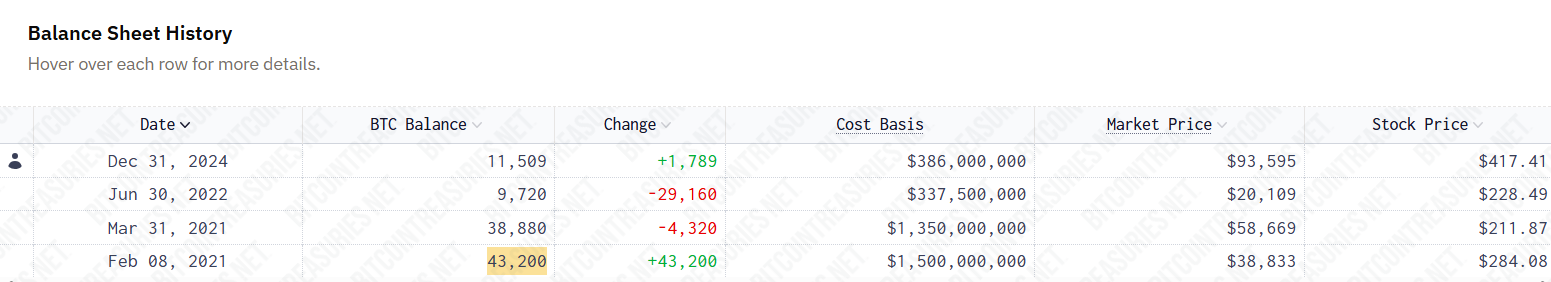

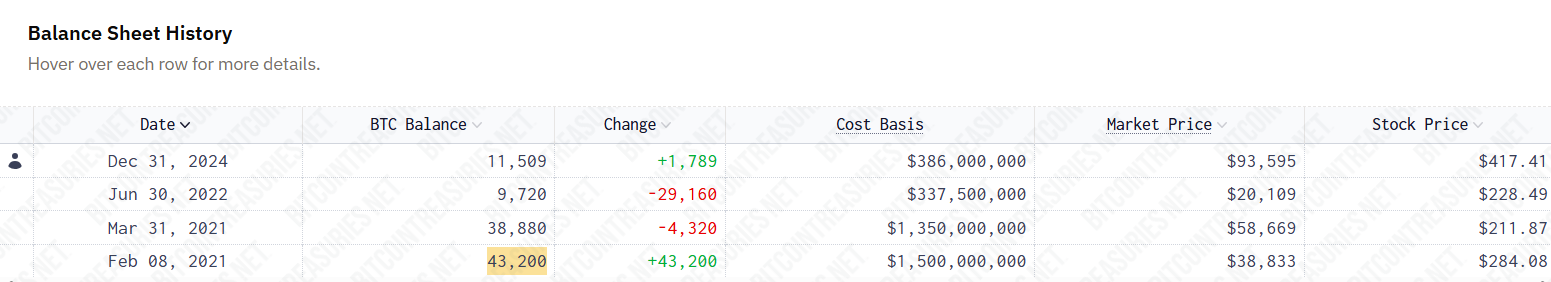

In early 2021, Tesla acquired $ 1.5 billion as part of its Treasury Diversification Strategy 43,200 bitcoins, data from Bitcoinitaries.Net shows.

Soon after, the company began to accept the property as payment for its cars, but then options due to environmental inclusion related to energy use of bitcoin mining.

In March of the year, Elon Musk’s electric vehicle company sold its first bitcoin, unloading 4,320 BTC when Bitcoin was trading above $ 58,000. During the 2021 cycle, Bitcoin reached a high of $ 61,500, so Tesla’s initial sales were not completely timely.

By the end of June 2022, Tesla had sold another 29,160 BTC, with 75% of the remaining holdings. At that time, Bitcoin was trading around $ 20,000 and later reduced to an annual year of $ 16,500.

However, the second lesson was favorable. This resulted in large -scale missed benefits.

Bitcoin has exploded since bitcoin, with prominent players such as Blackrock, Grassscale, and other fund managers to bring bitcoin in institutional investigation through ETFs. Spot Bitcoin Funds’ court victory for landmark debut of Bitcoin Funds in the US.

After that, bitcoin has overtaken the $ 20,000 level. Digital asset crossed $ 100,000 last December and increased its Rali to $ 122,000, its latest high.

Tesla’s initial holdings wounds for about 5 billion dollars, with bitcoin trading $ 116,300 during the day at the time of reporting. The BTC was offloaded, now a price of $ 3.5 billion.

Tesla now has a price of 11,509 BTC around $ 1.4 billion. The company has not accommodated its bitcoin portfolio since its final purchase.

Tesla’s auto revenue fell for the second consecutive quarter, and the company missed the projection of Wall Street. Stock declined by 8% on Thursday before bouncing 3.5% back on Friday. It is still more than 21% this year, according to Yahoo Finance.

Share this article