Table of Contents

In Defi, Hyperlicid stands out due to its innovation. Coingcko data shows that publicity, its governance tokens, the most valuable dex coin, with a market cap more than twice Of Uniswap (Uni). Currently, Hyperlicid’s market cap is $ 13.4 billion, and in the last 24 hours, the volume has produced a hyp trading of over $ 244 million. While volume flulettes, interest in hyp tokens suggests that hyperlicids are monitored and it can become To find out the next crypto If it increases the market share.

discover: Best new cryptocurrency to invest in 2025

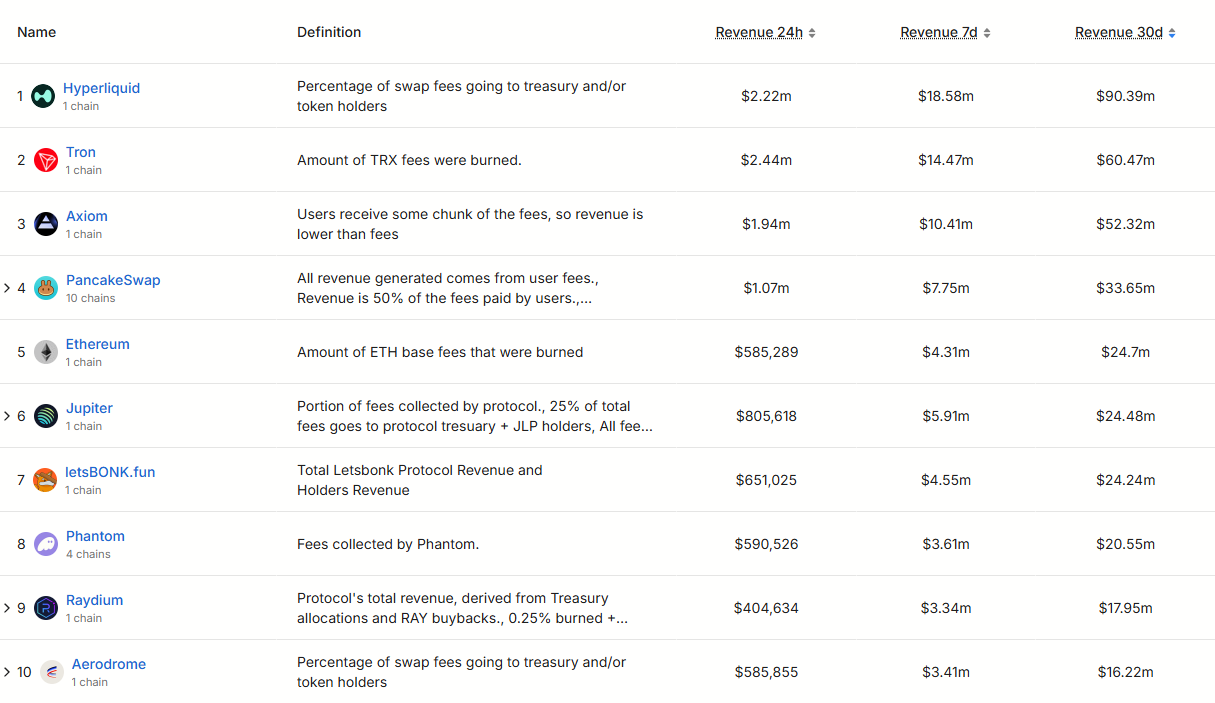

Hyperlicid generates revenue revenue

On X, an analyst notes that hyperlicid, decentralized always Crypto Exchange, may be one of the most competitive stories of Crypto. In the last month, Antist noticed that Hyperlicid produced more than $ 90 million in fee revenue.

(Source: Holosus on X)

At this stage, Hyperlicid improved Etreum, pump.fun, Ethena, Base, Ondo, and Solana, which collectively produced just $ 88 million in the past. For this reason, Anlyst is limited that it is like propaganda, which is underwelled in grams form on a $ 13.4 billion market cap.

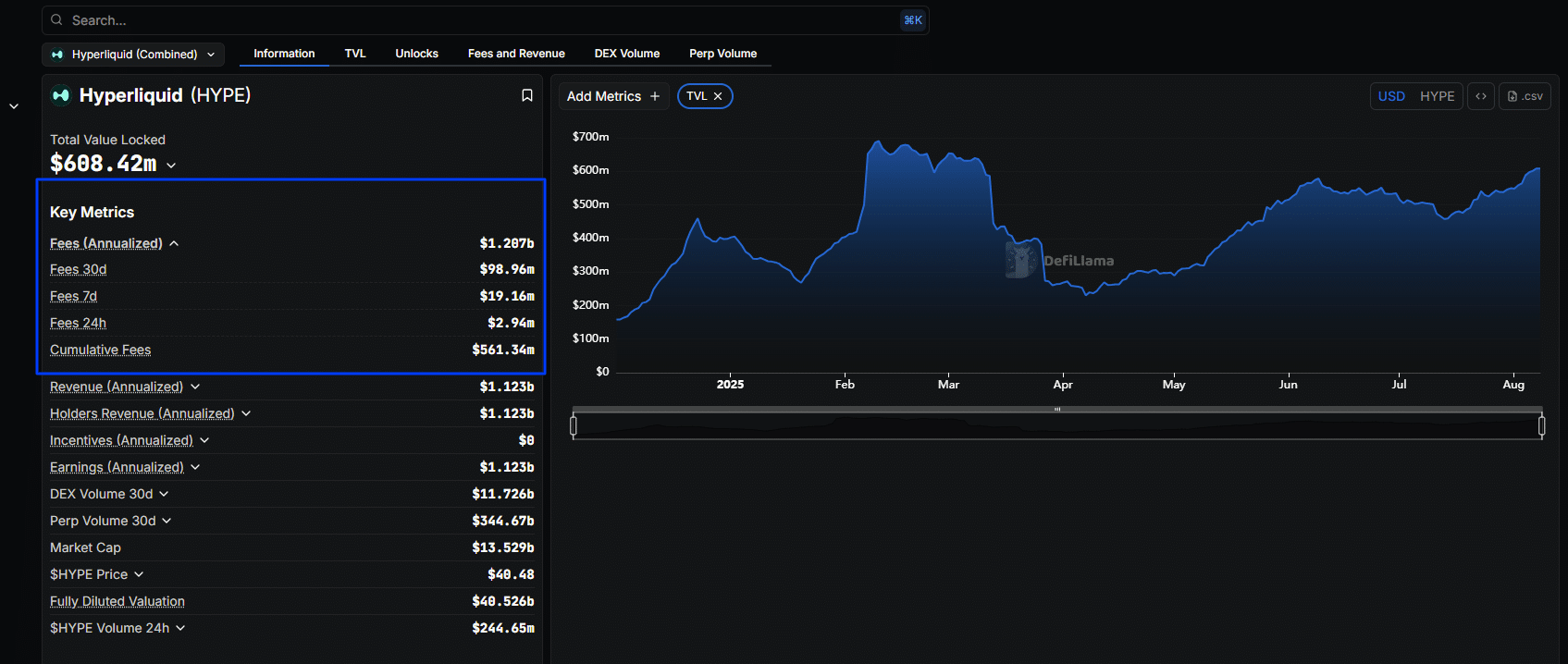

If additional, and current fee remains revenue, hyperlicid can easily be more than $ 1 billion annually, keeping it as a leader among the DEFI protocols. Kas for Difilama, Hyperlicid produced a fee of over $ 19 million in the previous week. Cumulatively, the protocol has generated more than $ 561 million fees.

,Source: Defilama,

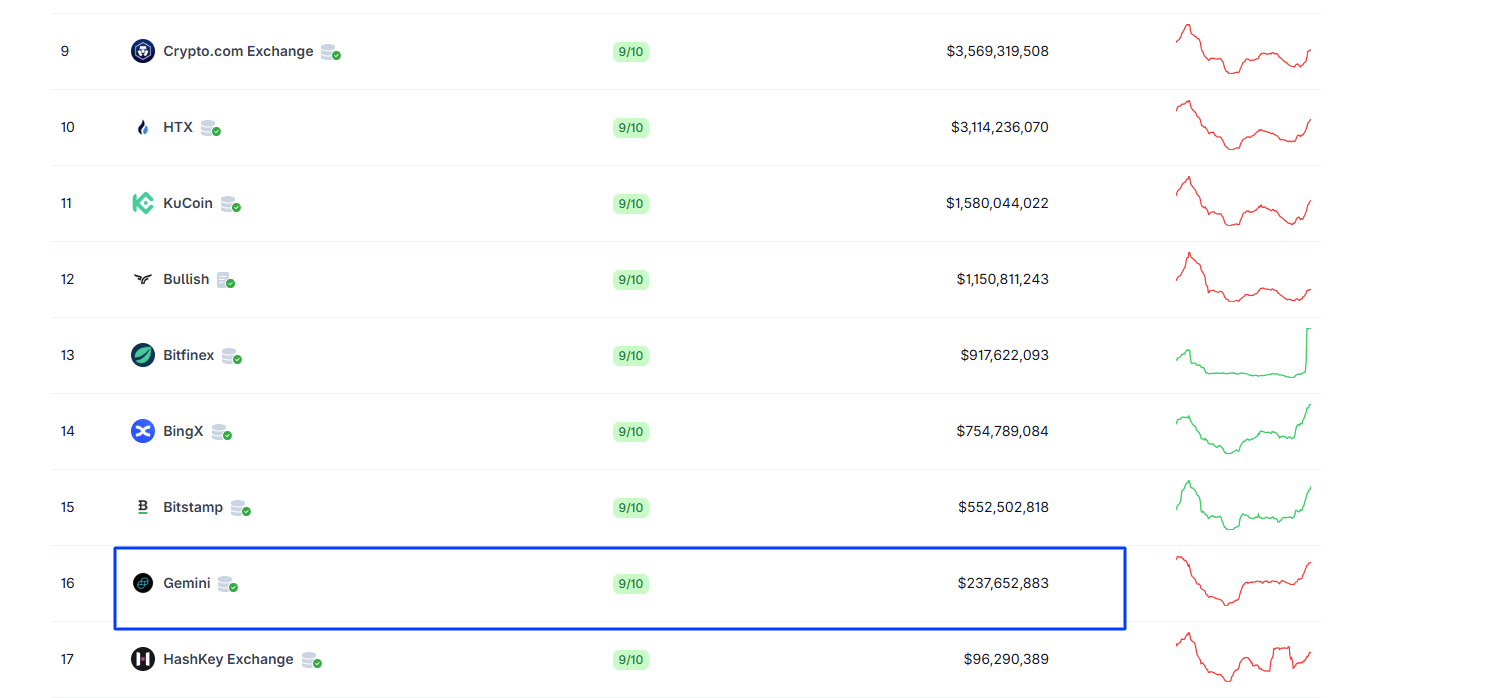

In terms of trading volume, the decentralized peritual exchange process over $ 11.7 billion in the last 30 days, $ 2.1 billion in the previous week and more than $ 296 million in the previous day. At this stage, Hyperlicid posted more than Gemini, which recorded around $ 237 million in the previous day.

,Source: Koingco Exchange,

This magnificent performance by hyperlikid is notable. It explains why the publicity was done in the eyes of optimistic antelsts, it started climbing. At spot rates, About 18% of about $ 50 blows its all -time high.

Despite the decline in July, the uptrend remains. Hype Crypto has a support of approximately $ 36. If buyers break above $ 40, there is a possibility of more increase, construction on profit from 2025 sprains. High of $ 50, almost $ 40 before it cools down.

discover: Next 1000x Crypto: 10+ Crypto tokens that can hit 1000x in 2025

Has Hype Crypto not evaluated?

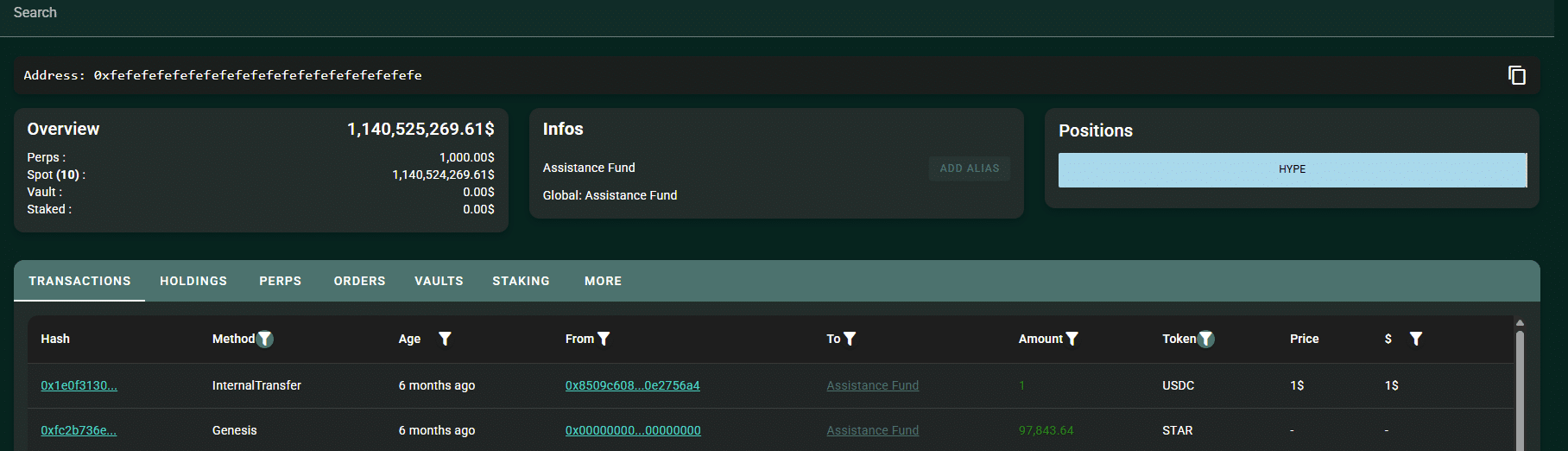

Traders estimate a supply shock in publicity. Hyperlicid uses 97% of its revenue to buy back from another market. At an annual rate of $ 1.1 billion, the decentralized peritual dex will use $ 950 million to obtain more promotion, which will reduce the circulating supplement and create continuous upward protection.

Currently, Hyperlicid Assistance Fund alone has promoted more than $ 1.1 billion through buyback.

,Source: Hipurcan,

At the current buyback rate, a speculation proved that this aggressive mechanism can see the dex Buy its entire circulating supply back Within four years.

This aggressive buyback mechanism is unfamiliar on the bank and far away, which is ultimately aimed at to reduce Its circulating ranges from 200 million to 100 million BNB.

discover: Top Solana Meme Coins to Buy 2025

Hyperlicids should further enhance their user base and increase their evergreen dex market share, the exchange may purchase a rapid back hype with the expectation of retailers. As AartitimisHyperlicid controlled more than 75% of all always dex trading volumes by July 2025. Compared to 13% of bitcoin.

Analysts say string performance, record revenue, and buyback programs align with the interests of traders and liquidity providers. Teogthe, they create a permanent and flexible model compared to traditional competitors such as Robinhood, making it attractive to investors.

Companies like Robinhood or Coinbase, Hyperlicid are lean. Teen allocation, copy PlateauI, less than 25% of the total support. These tokens are locking on 2027-2028, with 34% of the total support of 1 billion in circles. Mesari analysts say the structure gives hyperlicids to the “infinite” completely thin valuation (FDV), unlike the public companies serving the same customers.

discover: 9+ Best High-Risters to Buy in 2025, High-Wordy Crypto

Has Hyperlicid Hyp Crypto not been evaluated? Dex generating revenue

- Hype crypto can be evaluated

- More than $ 90 million hyperlicid has been generated in revenue in the last 90 days

- Hype Crypto prices can grow above $ 50

- Analysts point to the aggressive buyback scheme, which is a reason to live rapidly

The Post Dex generated a record revenue, which first appeared on 99bitcoins.