The native tokens of the Hedera Hashgraph, Haber ($ 0.25), are facing the growing selling price below the $ 0.20 mark in the short term.

On-chain data shows a steady decline in the interest of futures traders and wearing accumulation on spot markets. This combination suggests that the processes of the month may have more negative side.

Habar’s futures cool as market vendors

On 27 July, on $ 0.3050, May, Rali of Haber has lost speed. The value of Altcoin has decreased by 11%, exchanging hands at $ 0.2427 as this writing.

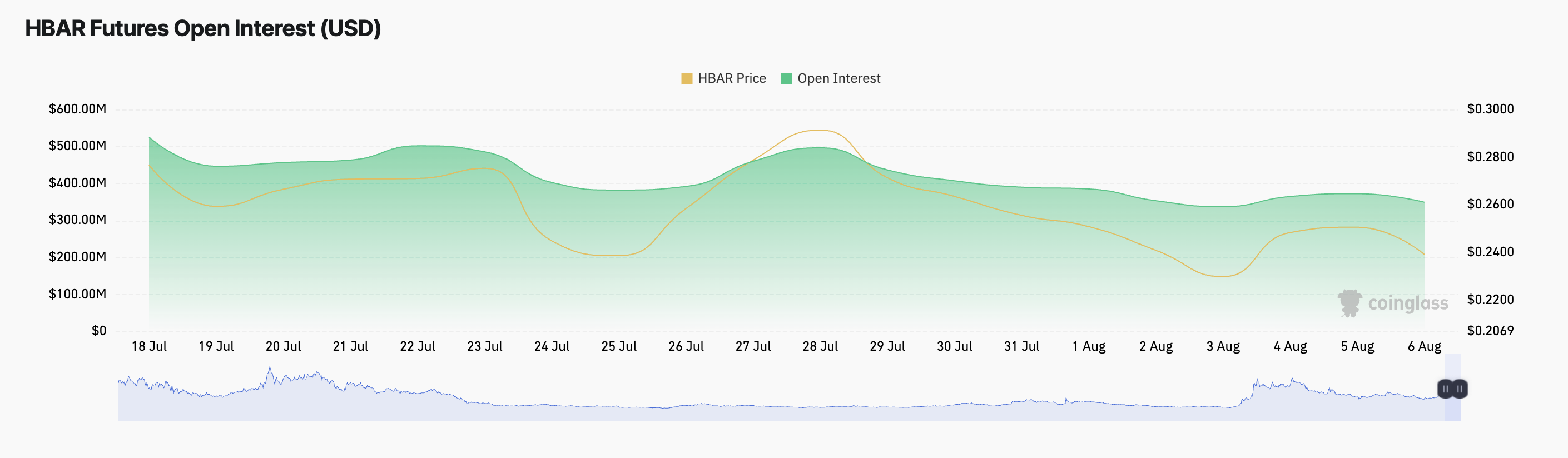

For coinglass, Habar’s open interest in its futures market is falling rapidly, indicating that derivative traders are getting away from the bolt. At the press time, it was 11% decline in the last seven days to $ 349.35 million.

Tokens for TA and Market updates: Want more tokens insight in this way? Sign up for the daily crypto newsletter of editor Harsh Notaria here.

Habbar Futures Open Interest. Source: Curring Class

Habbar Futures Open Interest. Source: Curring ClassThe open interest of a property tracks the total number of active futures or option contracts. When it arises, this glory indicates market participation, which indicates a fall that the property is closing and steps away from the market.

For Hubar, the recent fall in futures opened the interest of the Sindh, which is a clear of the menum among derivative traders. Low participants are betting on a close-term rebound, which shows a weak account trend in the spot markets.

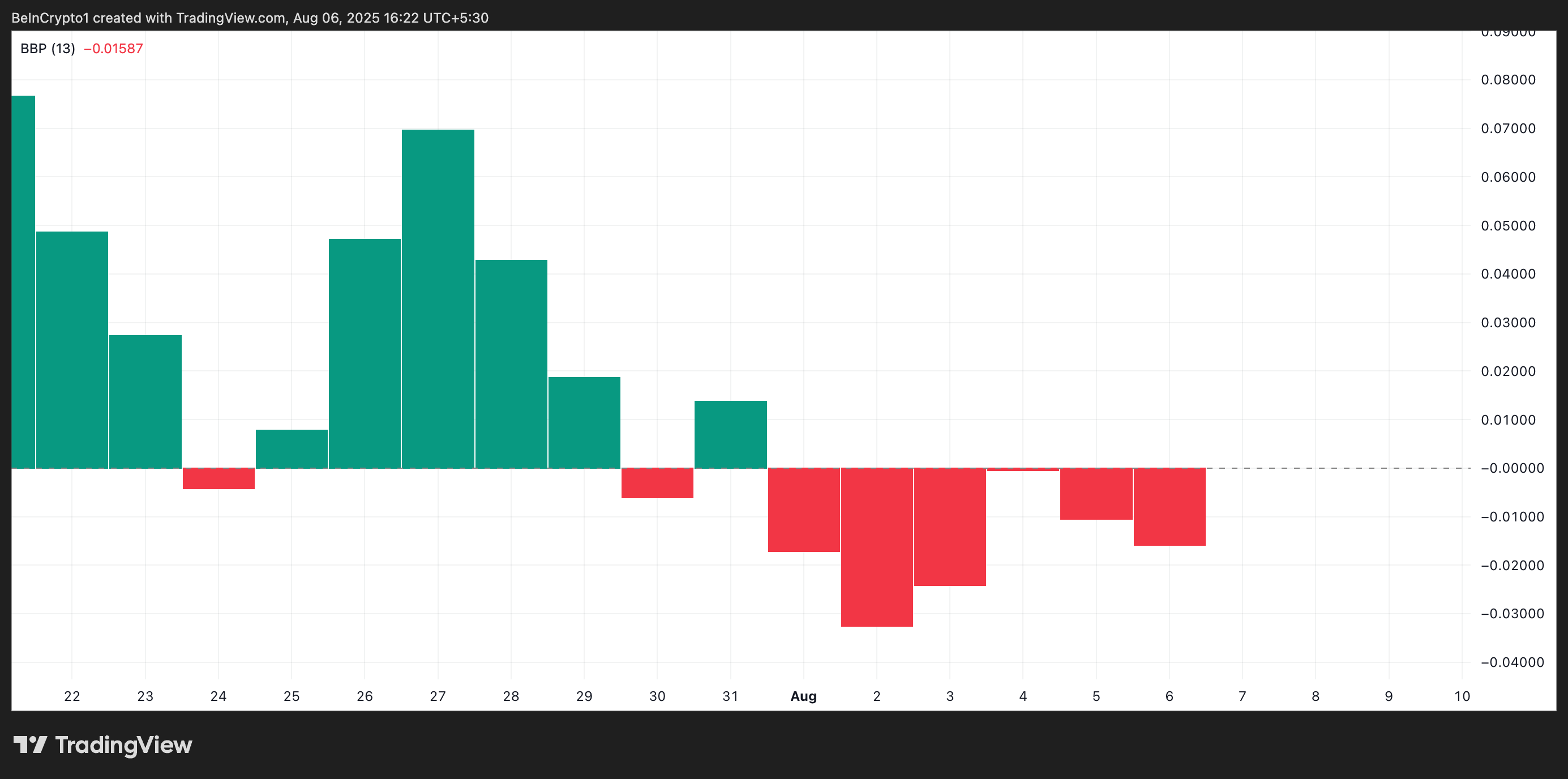

This weak accumulation tendency has also appeared in the Elder-Ray Index of HBAR, which has printed negative values for the last six consecutive trading sessions on the daily chart.

Haber Elder-Ray Index. Source: TardingView

Haber Elder-Ray Index. Source: TardingViewThis speed indicator measures the balance of purchasing and selling by reducing the price action against the moving average. Positive values suggest that buyers are under control, while negative readings indicate that vendors have the upper hand.

The recent stretch of the Red Histogram Bar indicated to sell dominance and fading speed in the Habar market.

Hedera support under pressure

At its current value, Hbar is above the support at $ 0.2366. If the demand falls further and this support floor becomes weakened, the price fall may be $ 0.2155. If this level also gives way, Hbar can trade at $ 0.1944

HBAR Price Analysis. Source: TardingView

HBAR Price Analysis. Source: TardingViewOn the other hand, if the accumulation starts again, this price may increase the profit towards $ 0.2667.

The Post Haber’s summer high feeds-sab-$ 0.20 risk looms appeared on Beincrypto earlier.