Ethereum is increasing increased instability after a local increase at a local high level of $ 3,360 at a local high level at a local high level. Prices have stringed the major resistance levels to retrieve, increasing the concerns between traders that a deep reform council is on the horizon. Market spirit is cautious because rapid speed is low and the atherium consoles in a tight color. Analysts have warned that failure to re -achieve important levels may soon trigger the future negative side in a short term.

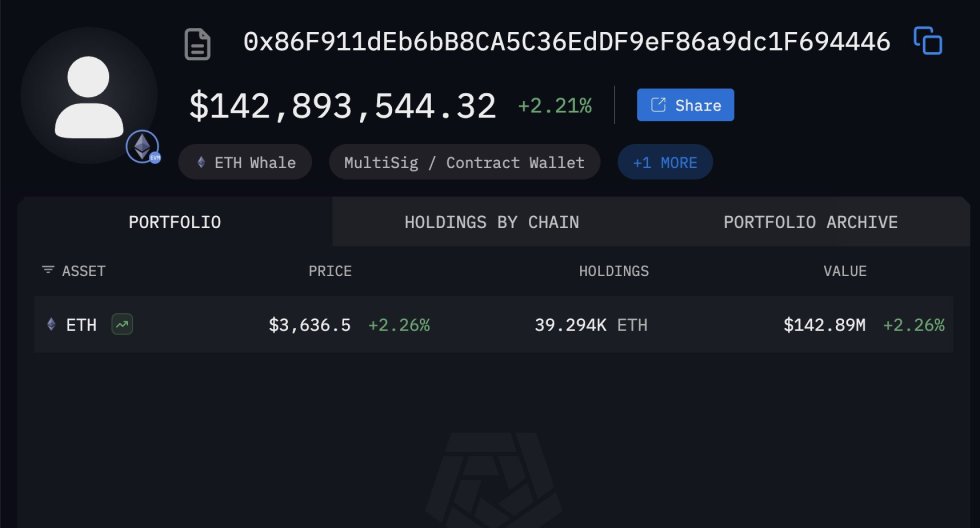

However, despite the weakness of the current value, whale activity remains strong. Arkham Intelligence, a major blockchain analytics platform – people and companies behind the blockchain wallet and transfusion, to accumulate a new big player ETH. This address has added a significant amount of atherium in the last fare days, which continues to accumulate in the latest right phase.

This cameo accumulation by institutional-grade investors adds a layer of optimism to the middle-to-time approach of the atherium. While the short -term value action looks unstable, strategic accumulation by the whale suggests a strong confederation in the basic principles of the atherium. Since ETH supply on exchanges is decreasing, many people believe that this improvement can make a healthy reset before the next leg.

Whale accumulation hints long -term confidence in atherium

Arkham Intelligence, Whale address 0x86F91111111F9EF8EDF8ADF8ADF86A9DC1F69DC1F69DC1F69DC1F69446 has been purchased by $ 141.6 million for ethnium days. Notable, Whoe is sitting on an unrealistic advantage of more than $ 1 million from these purchases, indicating both preview time and strong participation in the long -term capacity of Etrem.

This accumulation is as a clear indicator of traditional finance (Tradfi) capital, which flows into the ether, even a broad market is sent. The time of these purchases is essentially notable, as bitcoin is currently facing cooling menum, yet, large investors are actively placing them, suiting the atherium, they see the current value as an opportunity to make strategic holdings.

The trend of ongoing whale accumulation shows a broad market trust that the basic things of the atherium are solid. Institutional investors have been focusing on long -standing people such as the main role of Etharium in DEFI, Stabecrim infesticure, and RWA Tokanization, RWA Tokanarization, which are all receiving. Institutions.

While short -term value action can see volatility, aggressive accumulation from addresses such as 0x86F indicates that temporary improvements do not determine large players. Instead, they are preparing that they estimate the important reverse potinel in the coming months. This deviation between retail caution and whale accumulation often indicates decisive moments

Technical details: instability value action

Ethereum (Eth) is currently trading at $ 3,629, showing a sign of hesitation after a local re -turnbound near $ 3,360. The price is struggling to recover the 100-term SMA (Green Line) at $ 3,689, which has been served as dynamic resistance in recent sessions. The 50-term SMA (blue line) at $ 3,641 is providing some support, but the overlel Momentum Remeies Fragile, with low high, produces rejection at $ 3,860 resistance level with low higher.

The volume is remarkable during recovery attempt, indicating a lack of string bullish confession. This low-bouncing bouncing bounces that buyers are categories, and sellers can take advantage of any weakness to push ETH-Lower.

If Ethereum fails to break above $ 3,689 and recurs $ 3,700 zone, the recession landscape may be intense, re -looking at the $ 3,360 support area with the price target. Inverted, a clear breakout above $ 3,700 with the planrum cost the platform for another test of $ 3,860 resistance.

Specially displayed image from Dall-E, chart from tradingview

Editorial process Focus on giving well, accurate and fair content for bitcoinists. We maintain strict sourcing standards, and each page undergoes hardworking review by our team of top technology experts and experienced editors. This process ensures the integration, relevance and value of our content for our readers.