Table of Contents

Many American economic signals are in the pipeline this week, although not as a hot weight in the last week.

By completing the following events, traders and investors can buffer their portfolio against a sudden effect.

Initial Jobless Claims

This US economic signal, every Thursday, would indicate the number of citizens of the United States who have been filed for the first time for unemployment insurance.

Economists surveyed by Marketwatch expected a slight increase of 221,000 after a report of 218,000 in the week on 26 July.

Economist correspondent Nick Timiros indicated, “The initial clams for unemployed benefits (ended on 26 July) and running below their year level a year ago. Compared to a year ago.”

This American economic signal is particularly important because the labor market data progresses progressively as an important macro for bitcoin (BTC ($ 114,237.00)).

Unemployment claim will be data Follow the Nonform payroll (NFP) data released on 1 August.,

Data signaling with a diliative labor market, potential dollar volatility may push retail and institutional investors towards crypto in the long run.

If the unemployed claims of the previous week have continued to come up in high compared to the previous week or, except for worse, the weakness of the Perceraid labor market can be well for bitcoin as the inventors can pill against economic unwanted.

For perspective, an amazing increase in unemployed claims will indicate economic weakness, powerful supporting dysfunction political fed. Such a prefix will be rapid for a risky property like crypto.

ISM Services PMI

Beyond the labor market data, Crypto Markets will also be watching ISM Services PMI (Purchasing Manager Index).

This is derived from the monthly surveys of economic indicators, private sector companies, measuring commercial activity in areas such as new orders, inventory levels, production, supplier delivery and employment.

After readings of 50.8% in June, economists make a slight increase in July up to 51.1%. If the ISM services rise above the required 51.1%, it indicates strong economic activation and may reduce expectations for fed rate cuts. Such an outcom is potentially recession for bitcoin because tight liquidity persists.

However, a lower-China-procedure reading, less than 50, will suggest economic weakness and increase the expectations of monetary ease, possibly expected to increase the prices of crypto.

If data meets forecasts, markets can cause water, traders are waiting for more decisive indicators such as unemployed clam.

For this special American economic signal on Tuesday, the next step of bitcoin rests on wheat, which indicates overheating or recession to the major elements of Fed’s inflation and politics stance.

Bitcoin (BTC) Price Performance. Source: Beincrypto

Bitcoin (BTC) Price Performance. Source: BeincryptoAmerican productivity and unit labor cost

In addition, American productivity and unit labor costs will be important water, this week, Thursday, due to 7 August.

These data points indicate wage increase in the second quarter (Q2). In Q1, US productivity has declined by 1.5%, but now economists increase by 1.9%.

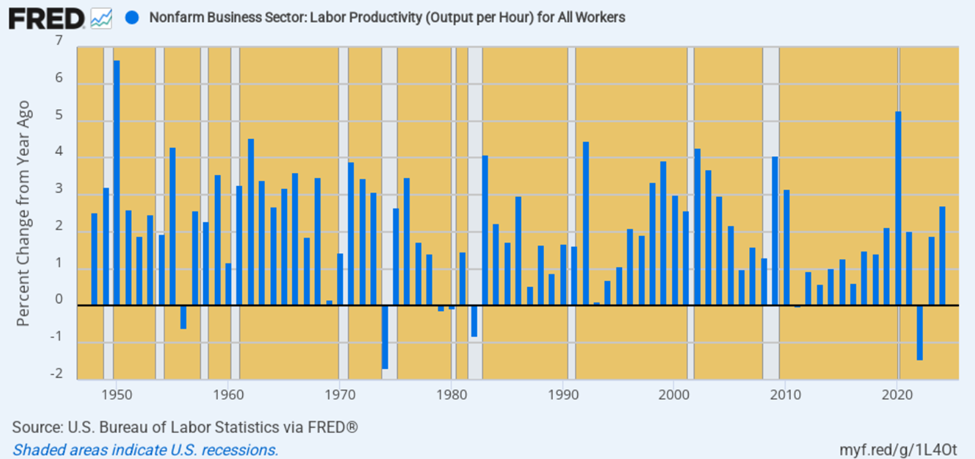

Annual US productivity growth, 1948 to 2024. Source: David Stockman on X

Annual US productivity growth, 1948 to 2024. Source: David Stockman on XMeanwhile, the American unit labor cost was 6.6% higher in the first quarter, but economists estimate a slight increase of 1.3% in Q2.

Labor costs indicate rising vold sticky inflation without increasing productivity, which is expected to be positively sack for bitcoin.

More closely, Mismach Kuil met the expectations, known for response to dysinessflation or economic recession with Crypto.

However, if labor costs grow at the same speed of productivity, companies can pay more without increase in prices. This type of landscape will support the actual wage increase with triggering inflation. It is still a bulk to bitcoin as it promotes economic growth without tightening liquidity.

When the cost of labor falls during growing productivity, it is a highly disruptive and business-independent scannero. This is rapid for crypto because the possibility of cutting or liquidity support in the falling flow increases, in favor of the risk property.

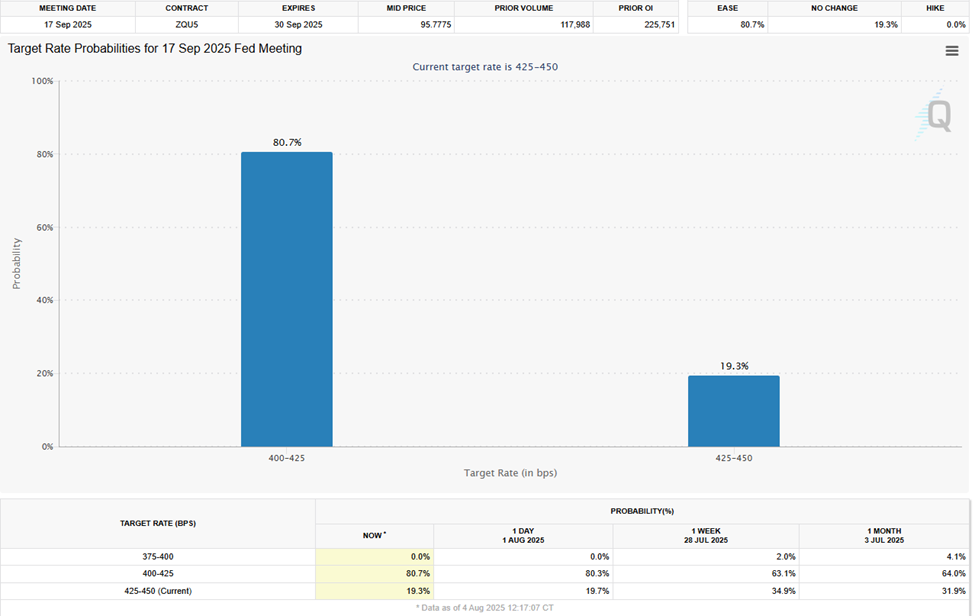

Possibility to cut fed interest rate. Source: CME Fedwatch Tool

Possibility to cut fed interest rate. Source: CME Fedwatch ToolDepending on the CME Fedwatch tool, the interest rate is 80.7% likely to the bookies that the Fed will cut interest rates in the September 17 meeting.

Atlanta Fed President Rafael Bstic Speech

Beyond the data points amidst US economic signals, traders and investors also monitor the comments from policy makers. This week, Rafael Bick, president of Atlanta Fed, will speak on Thursday, and will be eager to indicate the economic approach of market policy makers.

Rafael Bick, Chairman of Atlanta Fed, is known for bending on monetary policy, which is in favor of a spectacular approach to cut interest rate.

“If you are expecting rate cuts, don’t stop your breath. Atlanta Fed Chairman Rafael Bick recently said that he only supports the rate cut this year, highlighting the fed of the rejection fed due to tariffs,” the user recently said.

As one of Fede Politimers, the voices of inflation on inflation, rates, or balance sheet policy may speed up the market hopes.

If his comment had been Hawkish, it would have been a slowdown for bitcoin. However, a dowish trend will be faster, in eight if it is contrary to the tone of Powell.

Post 4 uses economic signs that can derail the recovery of bitcoin this week, first appeared on the beincrypto.