Ethereum and Solana are the leading players for derivatives, which controls a finance RWA to create waves in space.

The StableCoin movement is indicating the continuity of the current rally.

Reshuffle

The world’s second largest exchange by trading volume is bybit Released its latest smart money report, which also focuses on the analysis of institutions and influential traders, as well as Their allocation strategies.

Account recent data, Eth ($ 3,559.66) has been made the crowd favorite, at a close place with Sol ($ 163.14), after exiting the depth of this bull run, exit. In addition, the rapidly popular trend of real-water assets (RWAS) is shaping the narratives of Defi.

The review has mentioned that Smart Money is organizing BTC ($ 114,594.00), ETH and first other ALT. The portfolio of the first mentioned people with Ondo ($ 0.93), UNI ($ 9.36), and WLD ($ 0.99) appear to be the main driver. Description of indication in a Boed range of conditions for both professional and everyday investors.

Major observation from the report that the atmosphere at the top of the holdings is the derivative, namely the stacked ath (LSETH) of the Liquid Collectorate, indicate matters of the organization’s confidence and its use in the asset.

Smart Money Token Balance. Source: Nansen

Smart Money Token Balance. Source: NansenOndo Finance (OOONTO) is paying dividends with close relations with Roy Market. With convergence of traditional finance (Tradfi) and decentralized finance (Defi), the token movement is receiving significant traction worldwide.

Uniswap (UNI) has quietly canceled an important presentation in the smart money portfolio, which has been reduced by just 40% in the last one month, according to the most recurrence of coinmarketcap. The increase of the indigenous tokens of Dex may indicate future protocol upgradation that is not publicly announced.

We can see equally integrated pictures in smart money trades.

Smart Money Token Movement. Source: Nansen

Smart Money Token Movement. Source: NansenIt can be seen that the Sol-related derivatives are taking the stage, the capital is slowly moving away from the ETH. The current is currently the main rival of Etharium with Solana

According to the data, meme coins appeared to grow again, with Bonak ($ 0.00) and Pengu ($ 0.04) favorite, each posting 90% and 170%, responsibility, in the past, according to data. Coinmarketcap.

Sky, first known as Mekarado, is a notable mention here, with the listing listing liquidity and investors on the major CX.

What about stablecoins?

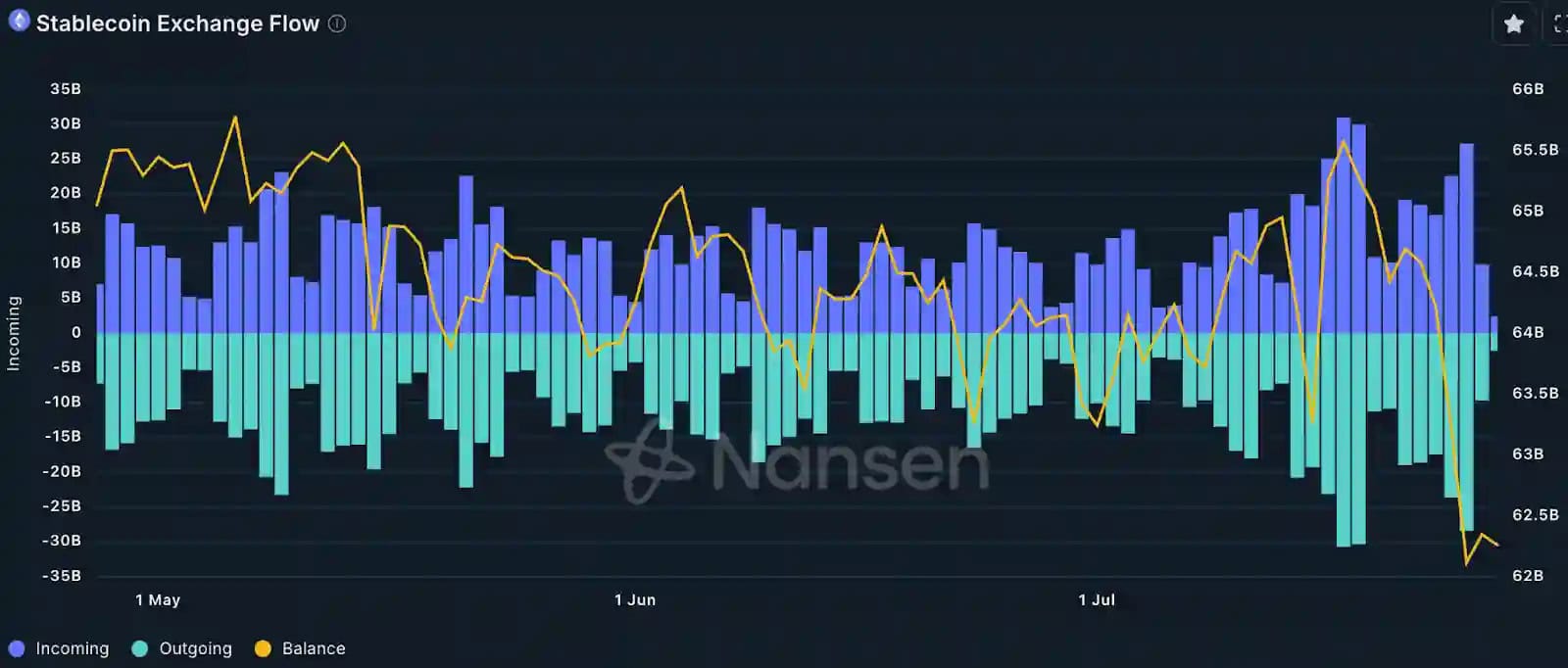

This chart by Intelligence platform Nansen can serve as a good guide to the health of Stabecrims at the University of Cryptocurrency.

Source: Nansen

Source: NansenAlthough we cannot consider it “bad”, we can assume that the major cryptocurrency exchange 3-minths are recorded at least a decrease in the level of stabeloin reserves.

We can interpret it as a “risk-on” sanite, as the decline in stabechoid levels on exchanges indicates an increase in accumulation of various assets rather than occupying capital.

The post flows into Smart Money Eth, SOL and RWAS, while the decline in stablecoins: Report appeared first on Cryptopotato.