Table of Contents

Welcome to the Asia Pacific Morning Bref – your required digest of the overnight Crypto Development, which shapes the regional markets and global centers. This Monday version has been brought to you by Paul Kim. Hold a green tea and look at this place.

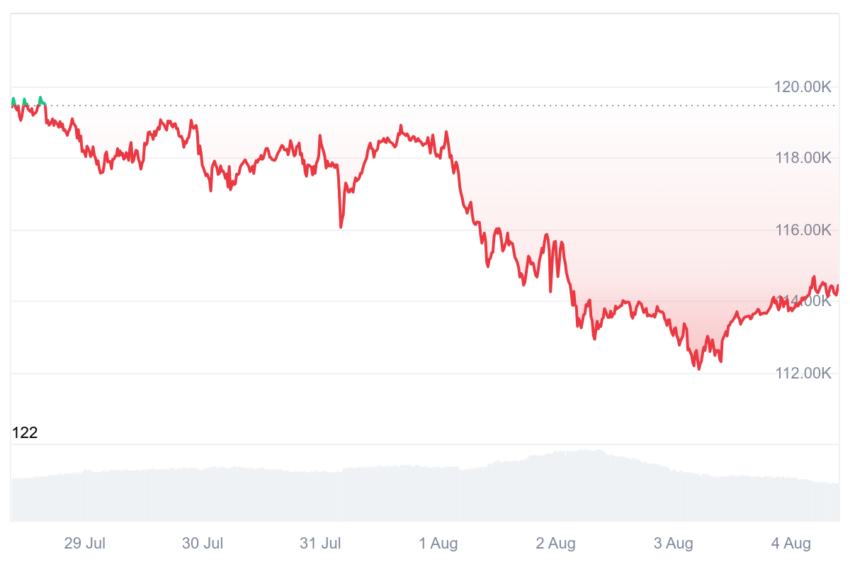

In August Crypto Bazaar is closed to start a challenge. Lastwek, bitcoin prices fell rapidly, broke the limit of $ 117,000 – $ 120,000 since 11 July, breaking the limit of $ 120,000.

First by Powell, second by NFP

The decline of last week came out in two main stages. One of the reasons was the comment of the Federal Reserve Chairing Zerome Poveling July Federal Open Market Committee (FOMC) meeting. The market was estimated in the market after a break in July in July, but electricity poured cold water on these experts.

Powell said that the possibility of cutting a September rate is still uncertain. During the accounting signals of a possible recession, he suggests that it is appropriate to keep the rati as the inflation effects of the tariff are to be confirmed.

He also emphasized that the labor market remains concrete and close balance, which urges to transfer inflation from employment to risk.

Interestingly, there was a strong internal opposition with Fed to this approach. Fed Governor Christopher Waller said that private sector employment growth has slipped a lot. Despite the surface-level health, data modifications reveal weakness, indicating calls for premit rate deduction.

For now, Powell’s perspective aligns with a majority with the fed, and the market has to visit its expectations for a September rate cut. Bitcoin prices increased to $ 115,800.

Price of bitcoin. Source: Coinmarketcap

Price of bitcoin. Source: CoinmarketcapNonform payroll (NFP) data was released on 1 August, resulting in a second decline. The July NFP was estimated at around 110,000 among the Wall Street analysts, but the actual figure came in 73,000. This paradox opposed Powell’s optimistic approach and indicates a significant decline in the American labor market.

More and more May and June data major Downward Revision was done by 258,000 jobs. The deliberately strong June NFP figure of 147,000 was mostly a statistical confusion. The US Bureau of Labor Statistics revised the June figure to 14,000 and May 19,000 – the lowest in five years.

The official unemployment rate corresponds to expectations at 4.2%, but a comprehensive U -6 unemployment rate was 7.9%, the highest since the Kovid -19 crisis. Long-tricum number of unemployed and people working for 27 weeks also deteriorated. These indicators of a sharp economic recession and the weakness of the labor market took a dip in the US stock market. Bitcoin also retreated to about $ 112,000 that day.

Macro downturn increases corporate procure

During the week, the major macroeconomic trends seized the crypto industry. In the Spot-Listed ETF, income which used to operate the prices of bitcoin and atherium, came down significantly in July after July 30 this year.

Ethereum-purchasing companies, which were the major driver behind the increase in the price of Ethereum, also stumbled. The week started positively: Sharplink Gaming confidently announced a purchase and stacking of $ 296 million with an additional $ 296 million, while Bittamine led by CEO Tom Lee claimed that Ethram’s intrigation is $ 60,000.

Standard Pathed bank estimated that atherium purchasing companies hold about 10% of the total support, not a strategic accumulation that has crossed the $ 10 billion-A 50 times increase.

However, these firms were powerless against the later price accident in the week. Ethereum fell 7.2%, with top ethereum-heolding companies Sharplink Gaming (-30.80%) and Bitmine (-23.16%) stocks also fall.

Given this situation, the recession was spread naturally. Bitmex founder Crypto Influencer Arthur Hayes predicted recession for major cryptocurrency. He predicted that bitcoin could fall to $ 100,000 and the atherium could be $ 3,000. Hayes quoted the upcoming American tariff law and global credit expansion as major factors.

In the weekend, on-chant data attracted attention with an observation atherium metric. Ethereum holder accumulation ratio dropped to 27.57% – the lowest in two months. This indicates that investors are not craving to increase their eth ($ 3,545.92) holdings aggressively.

American stock market is key

The hot menantum suddenly disappeared from July amid this sharp decline. What is next for Crypto prices this week? The key will be that the US stock market can retaliate with the shock of NFP data modification.

The American Employment Statistics Statistics Statistics has a history of modifying the annual nonform payroll data by more than 800,000 jobs last year, revealing that these jobs are not actually a really decoration reports for Previo. Year. However, even the revelation did not trigger the voltality of the important stock market.

Khadi drop final friederay was partly due to easily killing new heights due to retest US stock; Weak employment data provided a suitable trigger for corrective. If the US stock market recovers without further reforms, the crypto market also prefers to bounce back.

However, if further control stops, Powell’s comments refused to cut the September rate despite strong American employment, the economy. The fedwatch tool of the CME group estimates a three -rate deduction with Alidey Year.

No major macroeconomic issues are expected this week, but American employment is a significant focus. The conference board will release its employment trend index on Monday, and this data count will greatly affect the US stock markets.

We also want to invest successful to our readers this week too.

The “difference” post in American employment data declines. Is bitcoin ready for recovery? First appeared on the beincrypto.