August has launched a difficult position for the crypto market, which is for ‘make’ coins. Trading activity has fallen as investors run to lock profits from a strong July. In the last week, the Global Crypto Market Capitalization has slipped up to 5%, indicating a decline in demand and a bridar market coldness.

Nevertheless, in the midst of this lulla, some ‘Make in USA’ are drawing attractions for their ability to deer to the token trend. Here three altcoins investors should place on their radar this month.

Omni network

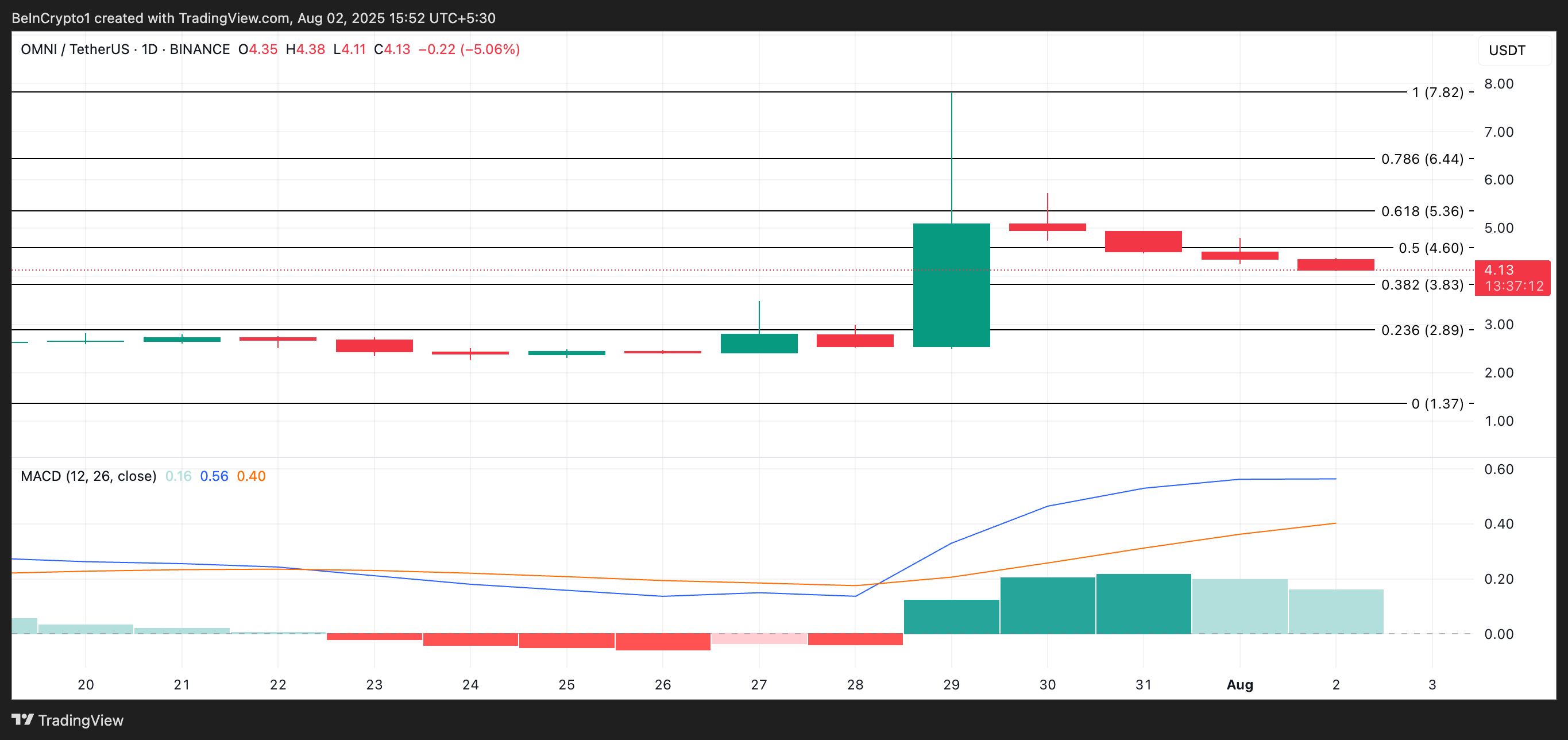

Omni is 72% above last week. It has recorded a decline in the broad market recorded in the last seven days. It makes it one of the-in-USA coins made to see as the first trading week of August.

The average convergence diversion (MACD) set of tokens of the moving average convergence diversion (MACD) on the daily chart confirms rapid bias towards AltCoin. At the time time, the MACD line (blue) of the Omni rests on the signal line (orange).

The MACD indicator identifies trends and speeds in its value movement. It helps in selling potential purchases or selling signals through crossovers between MACD and signal lines.

With OMNI, when the MACD line rests above the signal line, it indicates the speed of fast. Traders see this setup as a purchase signal.

If the accumulation persists, the token may break above $ 4.60.

Want more tokens insight by this way? Sign up for the daily crypto newsletter of editor Harsh Notaria here.

Omni price analysis. Source: TardingView

Omni price analysis. Source: TardingViewOn the other hand, if the counting of frequencies, tokens falls to $ 3.83.

Currently priced at $ 5.71, IP has climbed 24% compared to the last three weeks, which is another Med-in-USA coin to see in early August.

Reading from IP/USD One-Day chart suggests that Altcoin has been trading with a parallel parallel channel since 11 July. High levels of assets and high climbing, indicate a constant rapid tendency.

At the press time, IP is hovering near the lower line of Aarohi channel. If this support levels become levels and the accumulation increases, the altcoin rald can be, possibly reaching $ 6.46 in the short term.

IP price analysis. Source: TardingView

However, a decisive brake under the channel’s support line may invalve the rapid setup. This can trigger a stator fall in $ 4.92 zone.

The ZBCN is about 30% in the last seven days, making it one of the altcoins to see in the first week of August.

On the daily chart, the smart money index of the tokens has been seen as a stable optic, which highlights the continuous support of the key token holders. At the time of writing, it is at 1.

The SMI market of an asset tracks the activity of experienced or institutional investors by analyzing the market behavior Dagar and the first and last hour of trading. When it falls, it suggests selling activation from these holders, which indicates the expectations of a decline in value.

Conversely, with ZBCN, when the indicator increases, it indicates increased procurement activity. If the deceased continues to grow, the price of tokens may be above $ 0.0053.

Zebek Price Analysis. Source: TardingView

Zebek Price Analysis. Source: TardingViewOn the other hand, if the press flattens buy, the value of the token falls towards the couch $ 0.0047.

For the first week of August, a post 3, built in USA coins, appeared on Beincrypto for the first time.