Table of Contents

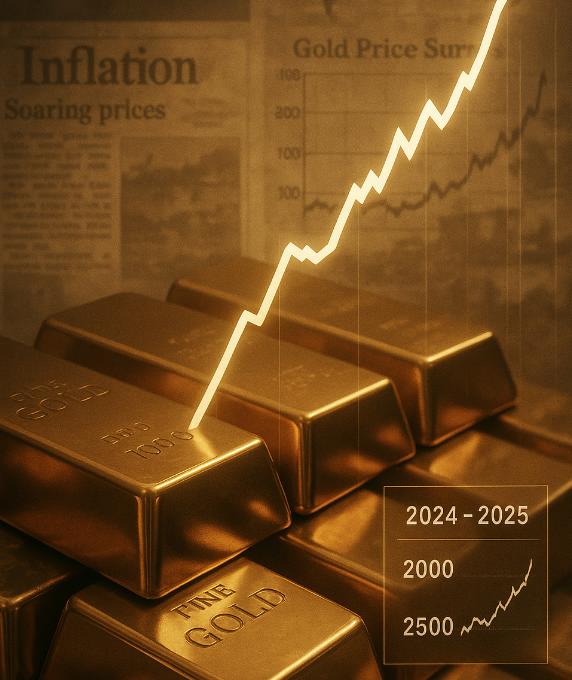

Gold prices have reached unprecedented level in 2025, with more than 20% increase from the beginning of the year according to trading data. This remarkable performance raises the question of how the current rally compare the previous price increase and the underlying factors distinguish today’s market conditions from the historical pattern. American Money Reserve, a major distributor Popular metals issued by the governmentTracking these events closely, informing how the current gold rally compare historical price movements.

Gold prices have reached unprecedented level in 2025, with more than 20% increase from the beginning of the year according to trading data. This remarkable performance raises the question of how the current rally compare the previous price increase and the underlying factors distinguish today’s market conditions from the historical pattern. American Money Reserve, a major distributor Popular metals issued by the governmentTracking these events closely, informing how the current gold rally compare historical price movements.

While Sona has experienced several notable rallies as the United States has abandoned the gold standard, which includes the 1970s inflation-powered surge and the financial crisis peak of 2008–2011, the current price trajectory displays different characteristics. Market analysts point to several factors running a recent rally, including enlarged geopolitical stress, transfer of monetary policies, and lack of fundamental supply.

World gold council Reports that gold prices have reached a high level 40 times during 2024, despite the decrease in quantity in some segments such as jewelry increase a sufficient price. The interconnection between the physical supply boundaries and increasing strategic demand has created the dynamics of the market not seen in the previous cycles.

Philip N., President of US Money Reserve and former director of US Mint. Diahal, identifying specific characteristics in the current environment: “Gold with high cost, new mining must draw a high price to justify its mining and processing,” they say. “It is increasing the long-term growth in gold prices-and will continue to do so every significant increase in gold will be more expensive. The political instability is a high-risk premium due to which miners are operated.”

This structural supply range has a deep implication for a long-term value approach of gold regardless of short-term market fluctuations. Unlike previous rallies, which may mainly be powered by monetary factors, the today’s value environment reflects complex supply-side obstacles with traditional demand drivers.

Geophysical and geological factor intensifies demand

Lack of supply in the current gold market and increased demand is characterized by a complex intersection of drivers. Unlike previous rallies, today’s value environment reflects both geological realities and geopolitical stresses, which makes a self-righteous value dynamic.

“Today, gold is rapidly becoming sour from some parts of the world which are often politically and economically unstable,” says Daihal. “This makes it hard and more expensive to find gold.”

These geo -political elements are particularly important in the 2025 market environment. Trade stress has intensified concern after the US presidential election of 2024 Gold prices rise for fresh records Earlier this year, the markets announced plans for an additional 25% tariffs on steel and aluminum imports.

Gold prices reached all time of more than $ 3,400/OZ. In April 2025, President Trump’s tariff policies, carved by several factors, including constant geopolitical stresses, and continued uncertainty around the federal reserve monetary policy.

The geological reality of gold mining represents another significant difference between the current rally and previous value cycles. Many of the most accessible gold deposits in the world have already been exploited, which requires more capital except for more challenging.

“Easy-to-rich gold-high quality veins-have been found all over the world,” Dihal is called. “That gold is largely out of the ground. On the supply, the big factor is just how difficult it is to find gold and then to Khan.”

Historical asset display reference

When comparing the performance of gold for other asset classes in economic cycles, separate patterns emerge that brighten its unique role in the financial ecosystem. Historical figures reveal the gold tendency to serve both as both Inflation hedge and a safe shelter During the period of economic uncertainty.

“Gold has a 2,500 -year -old track record; it is one of the few assets that not only have values, but also a medium of the exchange,” says Dedhal. “Gold is security in front of economic and political storms – and it is for generations.”

This historical perspective provides important reference to understand the current rally of Gold. Unlike purely speculative asset bubbles, the price of gold reflects its permanent value proposal in diverse economic environments. According to the analysis of macrotrands, the price of historic gold adjusted for inflation shows a significant value increase with the duration of economic stress.

The rally has firmness despite the option of competition to separate the 2024-2025 gold rally from the previous bull markets. Gold has maintained strong value performance despite high interest rates, which usually create opportunity costs to keep nonoveding assets. This deviation from the established correlation pattern suggests structural changes in the dynamics of the gold market.

The stable effect of gold in the portfolio is a consistent driver of demand in various market cycles including the current environment. “Gold often performs well during the period of strong economies,” Dedahl notes. “But it is a standout property in difficult times, during the period of recession and political instability. For this reason, gold is often used as money insurance to compensate for losses in other parts of a portfolio.”

Implications for portfolio strategy

While the current bull market can provide sufficient short -term growth ability to consider the allocation of precious metals, this asset class attraction is more firm in its long -term benefits. “Physical gold is traditionally a purchase-and-catch property,” Diehl explains. “People like you and me are not trying to take advantage of short -term price movements such as we want to do with stock or other items. Gold gets ballast in a portfolio; it provides an anchoring, stabilizing the effect.”

Another specific aspect of gold markets is a recycling component compared to other items. During the previous price rallies, high prices have sometimes increased secondary supply as holders liquid the existing positions.

“Sona is held somewhere in a vault or is used in jewelry,” Dihal explains. “When the time is difficult in a country, gold will often return to the market. During the 2008 financial crisis, there was a big flow of gold in the market. You see it in countries around the world when there is a political or economic crisis. Citizenship will sell gold to provide more financial resources immediately.”

But the existing rally is notable for relatively limited recycling activity despite significant value praise, suggests a strong punishment between existing holders. This low sales pressure represents another factor that separates the current market from the historical pattern.

The World Gold Council confirms the trend, given that while the consumption of gold jewelry declined by 11%, in 2024, it increased to 1,877 MT, the value of the purchase of gold jewelry actually increased by 9%, increased to $ 144 billion, both high prices, reflecting both high prices and continued global demand.

The specific features of the current gold rally have significant implications for portfolio manufacturing strategies. With the lack of supply of structural assistance to prices, the traditional role of gold as a portfolio variator leads to extra importance.

For portfolio holders considering allocation of precious metals, American currency reserved Provides comprehensive educational resources through its website. You can also call 833-845–1748 and talk with an account executive that can provide personal guidance based on your personal financial objectives.

Disclaimer: This is a paid advertisement