A large amount of bitcoin (BTC ($ 115,571.00)) and Ethereum (Ethereum ($ 3,673.65)) options are ending On August 1, 2025, stop the crypto market for instability.

Like the termination of monthly options, the weekly ONs can affect the price direction or cause value to pin near major strike levels because traders to hedge or unknown positions.

Bitcoin, Ethereum Option End in STKE with more than $ 7 billion

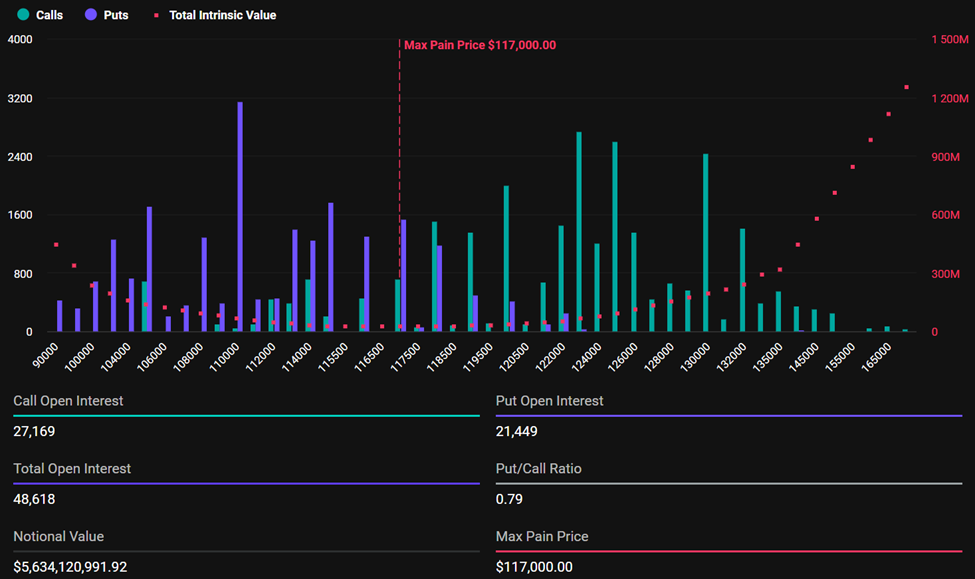

The data on Derbitit shows today’s end bitcoin options to show the maximum pain level or a strike price of $ 117,000, which is above the current price of $ 116,003.

Meanwhile, the total open interest, the sum of all puts (sales) and call (purse) options46,618Today is to end bitcoin options A notable value of $ 5.6 billion.

Depending on the current price, option traders have a bitcoin option for action 48,568.75 BTC tokens,

With a put-to-call ratio (PCR) of 0.79, the derbit data shows the prevalence of call options, suggests a common rapid syntulation.

Bitcoin expiry option. Source: Deribit

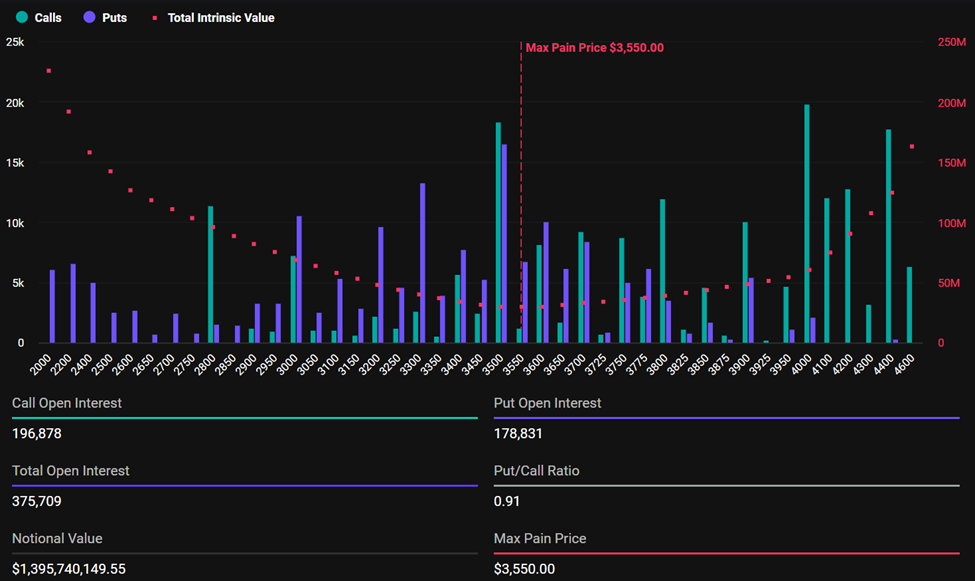

Bitcoin expiry option. Source: DeribitEleswere, Ethereum expiring option PCR of 0.91. This indicates a careful but optimistic approach in the market, except for sale orders.

Most traders will feel the most financial pain at the level of $ 3,550 maxom pain in today’s Etharium Exhiping Options. Unlike bitcoin, the price of Ethereum is above its strike price.

Meanwhile, the total open interest to eliminate ETH options is 375,709, indicating that ETH option is deployed more capital on contracts compared to BTC. It may also suggest that traders show more interest in the volatility of the close period of the atherium.

Another reason for more ethnic open interest than bitcoin is that atherium is more effective in derivatives markets between a delicious ETOR story. The data on Deribit shows a remarkable value for today’s Expring Eth option $ 1.39 billion.

Ethereum Expring options. Source: Deribit

Ethereum Expring options. Source: DeribitAs options near the expiration, prices move towards the level of their respective maximum pain, suggest a slight improvement for ETHs and a minor recovery for BTC. This is due to the action of smart money, who sell alternatives to retail traders, want to eliminate them waste.

Their action reduces payment on both calls and pin and pins prices near the maximum pain level.

No, this manipulation is not always interested. Sometimes, just hedging behavior causes natural gravity towards maximum pain.

However, when the liquidity is thin and the loop is made by keeping it, it may seem that the price is being stear.

“BTC posters are widespread, but the price is just above maximum pain. Derbit analysts said.

Corporate shopping provides delicate assistance

Eleswhere, Greeks.Live’s analysts point to a divided market position, exposing $ 116,000 as a significant support for bitcoin. Inverted, the pioneer crypto feature potential resistance around $ 118,000.

“… (there) disagreement is disagreeing on the fact that the Retent Dip represents a purchase operator or the beginning of a deep right,” the grade is written.

No, the price of bitcoin and the comprehensive crypto market were pulled back, there is a possibility of an improvement that the FOMC decision recently to keep the interest rates unchanged.

Despite the negative pressure on the market, Michael Sayler’s strategy cushes the bitcoin market from a long spiral for a long time.

“Strategy Corp shut down the $ 2.52B IPO and immediately bought 21,021 bitcoins at $ 117,256, reducing the important institutional purchase pressure,” Alallalsts in Alallsts said.

On the one hand, the translating support to increase the pressure to buy points indicates the support, which catalyze an inverted to the BTC value.

On the other hand, some people look at the purchase of strategy rental plans, which is in the form of provisional support around $ 114,000.

“The purchase does not make this purchase like the primary purchase support at 114 levels, which became clearly clear to reopen open interest. Easy can be 115 or less easily, highlighting the current dendens of the market on the corporate treasury flow,” Greeks said.

As today’s options near the expiration, traders must brace for instability, which count the cheerful value functions over the weekends.

However, the market may soon be stable

Posts of more than $ 7 billion bitcoins and atherium options are ending today: traders should be expected, first appeared on the beincrypto.